- Analytics

- News and Tools

- Market News

- EUR/USD remains under pressure and breaches 1.1200

EUR/USD remains under pressure and breaches 1.1200

- EUR/USD extends the selloff and breaks below 1.1200.

- The greenback gains extra steam following the FOMC event.

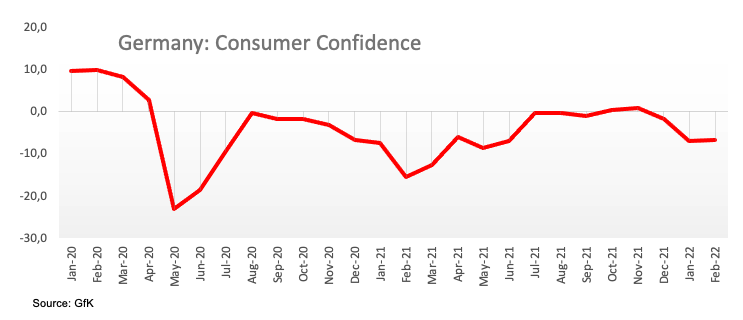

- Germany GfK Consumer Confidence improved to -6.7 in February.

Sellers remain well in control of the sentiment around the European currency and drag EUR/USD to fresh YTD lows near 1.1190 on Thursday.

EUR/USD weaker post-FOMC

EUR/USD loses ground for the fourth session in a row on Thursday and approaches the area of the 2021 lows in the 1.1190/85 band, always in response to the firmer tone in the US dollar.

Indeed, the demand for the greenback quickly picked up pace in the wake of the press conference by Chief Powell at the FOMC event on Wednesday.

Indeed, inflows into the buck accelerated after Powell suggested a rate hike in March and left the door open to further hikes at the subsequent meetings this year. It seems to be a matter of how many rate hikes and by how much that investors are expected to be discussing in the next months, putting the debate around the reduction of the balance sheet on the back burner for the time being.

Locally, the German Consumer Confidence measured by GfK improved a tad to -6.7 for the month of February.

Across the Atlantic, Durable Goods Orders, Pending Home Sales and the flash Q4 GDP figures are due later in the NA session.

What to look for around EUR

EUR/USD sold off and broke below the 1.1200 support for the first time since late December following the hawkish message from Chair Powell on Wednesday. Moving forward, dark clouds seem to be piling up when it comes to the outlook for the pair, particularly in light of the Fed’s imminent start of the tightening cycle vs. the accommodative-for-longer stance in the ECB, despite the high inflation in the euro area is not giving any things of cooling down for the time being. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: Germany GfK Consumer Confidence (Thursday) – Germany Advanced Q4 GDP, EMU Final Consumer Confidence (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch

So far, spot is losing 0.39% at 1.1197 and faces the next up barrier at 1.1314 (55-day SMA) seconded by 1.1369 (high Jan.20) and finally 1.1457 (100-day SMA). On the other hand, a break below 1.1193 (2022 low Jan.27) would target 1.1186 (2021 low Nov.24) en route to 1.1168 (low Jun.11 2020).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.