- Analytics

- News and Tools

- Market News

- EUR/USD bears shift into gear on hawkish Fed Powell

EUR/USD bears shift into gear on hawkish Fed Powell

- EUR/USD is under pressure as the Fed chair's hawkish comments send Wa;l Street lower and USD higher.

- Fed's chair, has stated in the presser that they could move faster and sooner than they did the last time.

EUR/USD is down 0.5% on the day following a sell-off on the back of a hawkish turn of events during the Federal Reserve event today, Despite a relatively dovish statement, as per the more hawkish of market expectations, the US dollar and yields have soared on the back of a pivot during the Federal Reserve's chairman's press conference.

Jerome Powell, the Fed's chair, has stated in the presser that they could move faster and sooner than they did the last time which has helped the US dollar to extend on pre presser gains:

Additionally, the Fed's chair stated that they could hike rates at every meeting and that they are in the mind to raise rates in March.

Fed's Powell's key comments, so far

- We are of a mind to raise rates at March meeting’.

- The current economy means we can move sooner, perhaps faster than we did last time.

- Next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room’ to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

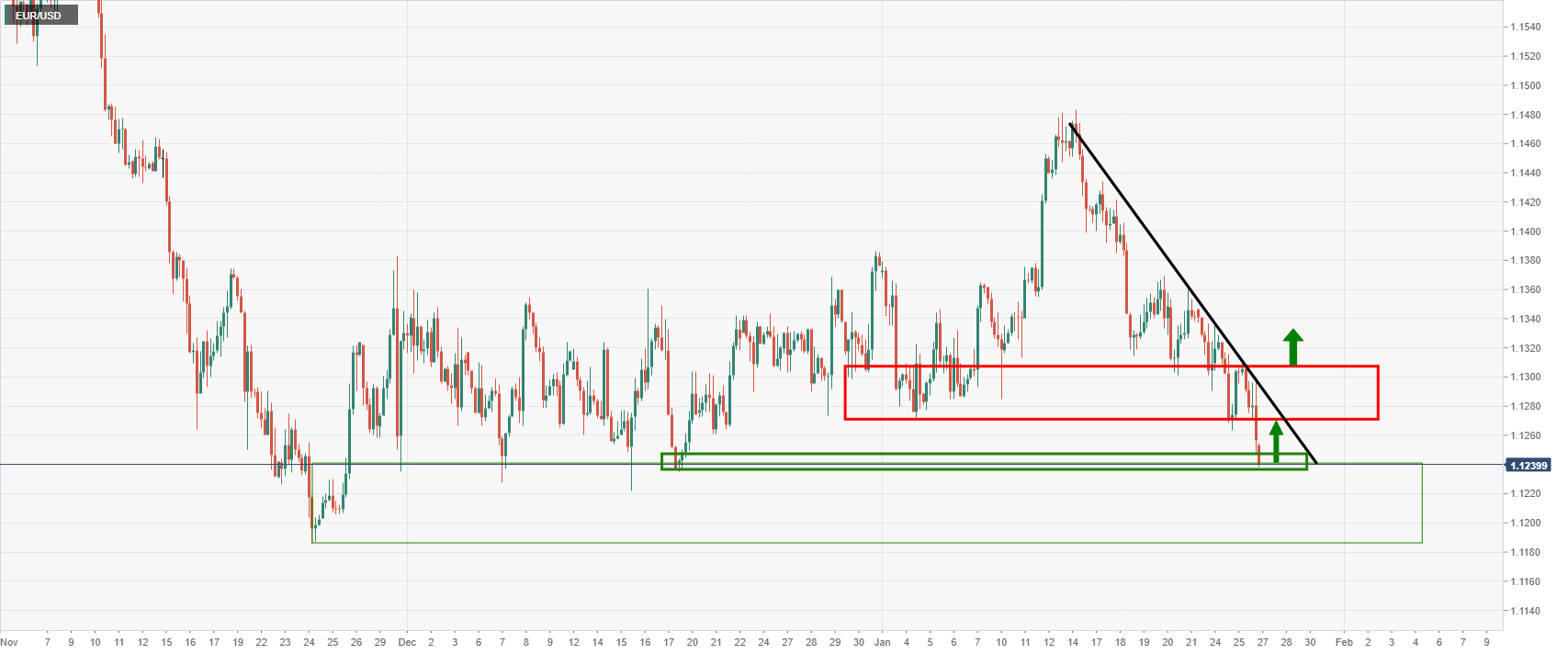

EUR/USD technical analysis

As a consequence, US equities are down and EUR/USD has dropped below a key technical level on the charts, losing the 1.13 area and printing a fresh low of 1.1240:

On the wider time frames, such as the H4 chart, the price is seen testing the next critical level of support:

Bulls will need to get back above 1.1310 to be in the clear at this juncture.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.