- Analytics

- News and Tools

- Market News

- Breaking: Aussie CPI comes in hotter and lifts AUD over 26 pips off the bat

Breaking: Aussie CPI comes in hotter and lifts AUD over 26 pips off the bat

Australia’s fourth-quarter Consumer Price Index has been published as follows:

Australia Core Inflation 2.6% YoY vs the expected 2.4%.

- CPI (YoY) Q4: 3.5% (est 3.2%, prev 3.0%).

- CPI Trimmed Mean (QoQ) Q4: 1.0% (est 0.7%, prev 0.7%).

In terms of key drivers, dwelling purchase prices, auto fuel and food will have played an important role in this release, analysts at Westpac explained in a note ahead of the event.

Meanwhile, this data will mean a lot for markets. ''Most immediately for the Reserve Bank of Australia, which may need to acknowledge that a rate hike in 2022 is no longer completely out of the question, analysts at ANZ Bank said. ''It could also have political implications, with the cost of living shaping up as a key issue for the upcoming Federal election.''

AUD/USD has moved higher on the data as follows:

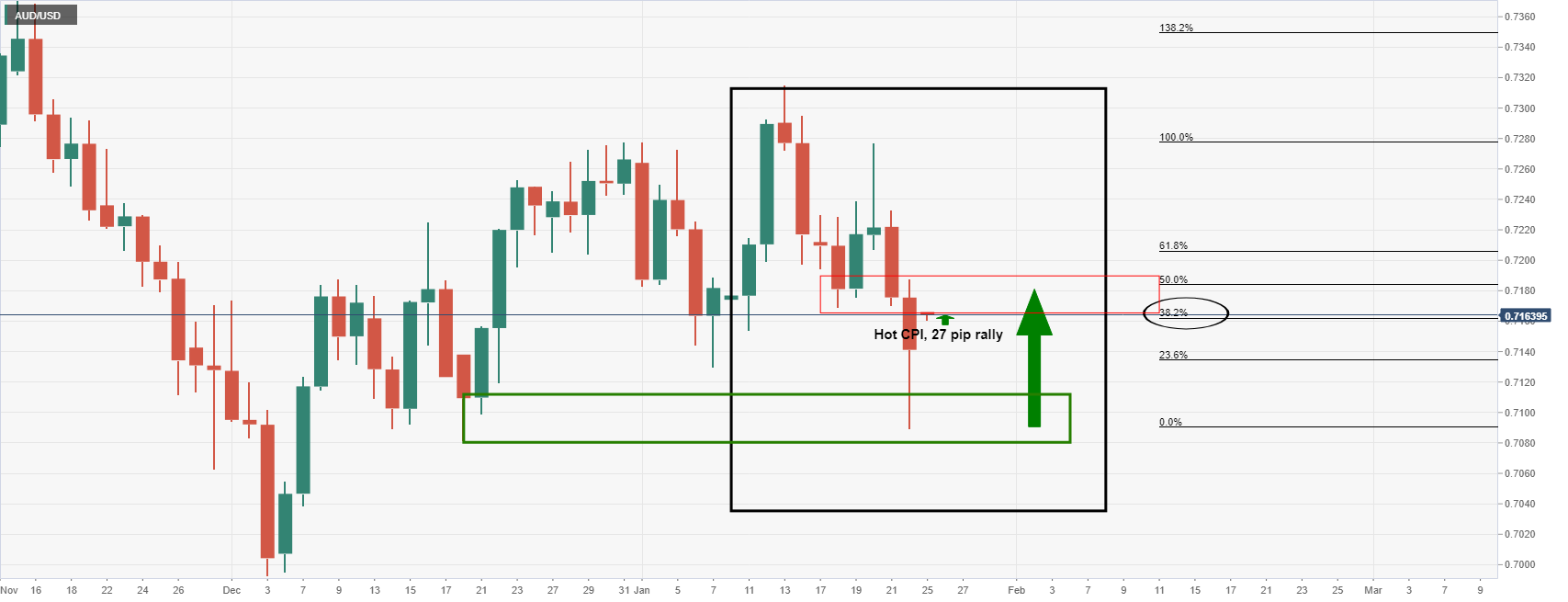

(15-min chart)

The move falls in line with prior analysis for a test of the M-formation's neckline:

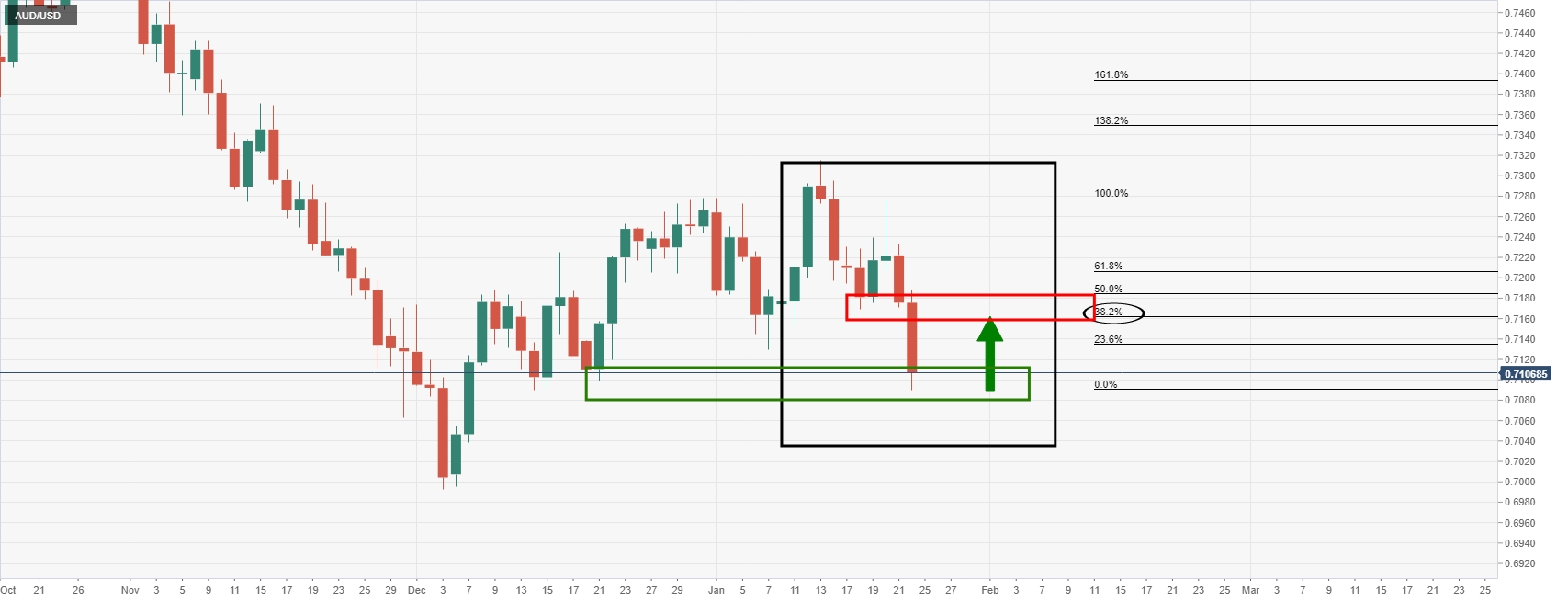

(Daily charts)

AUD/USD prior analysis

It was stated overnight in a prior article that ''AUD/USD's M-formation on the daily chart is a compelling chart pattern for the week ahead. A reversion towards 0.7150/60 would be expected...''

About Consumer Price Index (CPI)

It is published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.