- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD rises above $1,813 key support amid USD pullback – Confluence Detector

Gold Price Forecast: XAU/USD rises above $1,813 key support amid USD pullback – Confluence Detector

- Gold snaps two-day downtrend, refreshes intraday high at the latest.

- DXY fades bounce off early November lows during US bank holidays.

- Virus woes, Fed rate hike concerns remain on the table but China tries to stay positive.

- $1,821 acts as an immediate hurdle, bears have a bumpy road to return.

Gold (XAU/USD) renews intraday high around $1,820, up 0.20% on a day heading into Monday’s European session. In doing so, the yellow metal cheers US dollar weakness, as well as mixed sentiment in the markets, to keep the bounce off the key support confluence.

That said, the US Dollar Index (DXY) fails to extend the previous day’s U-turn from the lowest levels since November 10, down 0.02% intraday to refresh daily lows at 95.14 by the press time. The greenback gauge cheered hints of faster rate-hikes, mainly due to virus-led negative impacts on inflation, on Friday. Federal Reserve Bank of San Francisco President Mary Daly said that the latest Omicron wave will extend the period that inflation will remain high. Fed’s Daly also signaled that officials are “going to have to adjust policy”. On the same line, Federal Reserve Bank of New York President John Williams said Fed is approaching a decision to begin raising interest rates.

Elsewhere, China’s Beijing tightens the rule for entry into the capital city after a jump in the covid cases while Japan also discusses heightened virus-led restrictions for Tokyo on witnessing more than 20,000 daily infections for the third consecutive day.

It should, however, be noted that firmer China Q4 GDP and hopes of faster economic recovery, as conveyed by the National Bureau of Statistics (NBS) Head Ning Jizhe seems to challenge the bears. On the same line could be the recently easing virus numbers from Australia, the UK and the US.

It’s worth noting that an off for the US banks limits Treasury bond moves and allows markets to consolidate Friday’s performance. However, Omicron woes and Fed rate-hike concerns may keep the gold prices pressured, even as technical confluence signals otherwise.

Read: Gold Weekly Forecast: Bulls to take action with a break above $1,830

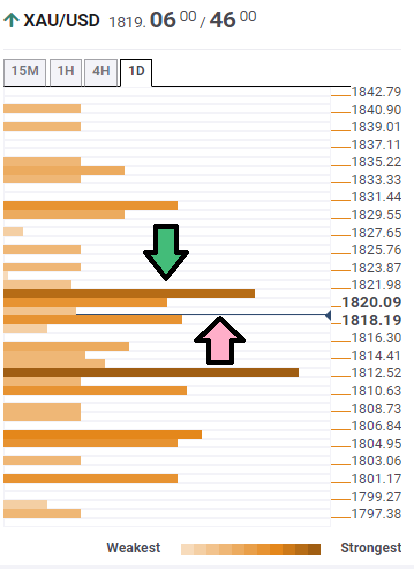

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price stays firmer past $1,813 key support comprising Bollinger Band one-hour lower, 23.6% Fibo. on monthly and Bollinger Band four-hour lower.

However, a middle band of the Bollinger Band four-hour joins Fibonacci 38.2% one-day and SMA 10 on the four-hour chart to guard the quote’s immediate upside around $1,821.

Following that, a smooth run-up towards the $1,831 hurdle can’t be ruled out. The stated resistance includes the previous monthly high.

Meanwhile, a downside break of the $1,813 support will direct gold sellers towards the $1,810 mark including SMA 50 on 4H, SMA 200 on 1H and SMA on 1D.

In a case where the gold prices remain downbeat past $1,810, Fibonacci 61.8% one-week and Pivot Point one-day support 2 will act as an additional downside filter around $1,805 before directing the quote to $1,800 threshold, also including 38.2% Fibo. one-month.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.