- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD under pressure as US dollar stabilizes

Gold Price Forecast: XAU/USD under pressure as US dollar stabilizes

- Gold is under pressure as the greenback attempts to correct ahead of Retail Sales.

- XAU/USD bears eye a run to $1,800 if $1,810 breaks.

The price of gold in Asia is under pressure as the US dollar stabilises following a series of down days for the greenback. XAU/USD is trading around $1,820 and down some 0.1% while the DXY index attempts to correct from the depths of the late December to YTD sell-off.

The US dollar, as measured by the DXY index, sold off from 96.90 to a recent low of 94.66. In as many weeks, XAU/USD has climbed over 4%. However, in what could be more of a technical move, the yellow metal had failed to capitalise on the fall of US yields and the greenback on Thursday.

DXY dropped 0.4% and the US 10-year yield was down 2.5bps at 1.718%. ''Sustained weakness in the US dollar failed to push gold prices higher, as investors look concerned about Fed’s hawkish move to contain inflation,'' analysts at ANZ Bank argued.

However, this would not explain why the greenback and yields keep falling. Instead, the bond market appears to be repricing the pace of the Fed's balance sheet run-off following less hawkish rhetoric from Fed members, Jerome Powell, the chairman, and Philly Fed President Patrick Harker.

On Thursday, Harker said he sees the Fed starting to shrink its balance sheet “in late 2022 or early 2023” after the central bank has raised its target rate sufficiently, to around 1 per cent from near zero. The comments echoed that of Powell who said the Fed could start to shrink its balance sheet later this year at his confirmation hearing before the Senate Banking Committee.

"At some point, perhaps later this year, we will start to allow the balance sheet to run off, and that's just the road to normalising policy," he said, adding the US economy "no longer needs or wants" the Fed's very highly accommodative policies.

These comments come in contrast to that of other more hawkish officials, such as the Atlanta Fed President Raphael Bostic. "There is a risk inflation is likely to be elevated for an extended period of time and we need to respond directly, clearly and aggressively," Bostic told Reuters in an interview on Monday.

Bostic explained that the central bank should be aggressive with regards to the balance sheet as well, allowing its holdings to decline by at least $100 billion a month, and with plans to quickly pull at least $1.5 trillion out of financial markets that he considers pure "excess liquidity."

The day ahead

For the day ahead, we will hear from Fed's New York president, John Williams. Then, the Fed will move into its blackout period until the next interest rate decision later this month. This leaves US data in focus. In this regard, Retail Sales will be of interest today.

Analysts at TD Securities explained that Retail Sales probably fell in December, even with higher prices boosting nominal values. ''Spending was likely held down by the fading of fiscal stimulus, payback for earlier-than-usual holiday shopping, and Omicron. We look for a notable 1.4% MoM decline in total sales (consensus: -0.1%) and a larger 2.0% retreat for the control group (consensus: flat). Real as well as nominal spending was likely still up solidly on QoQ basis and strongly on a YoY basis.''

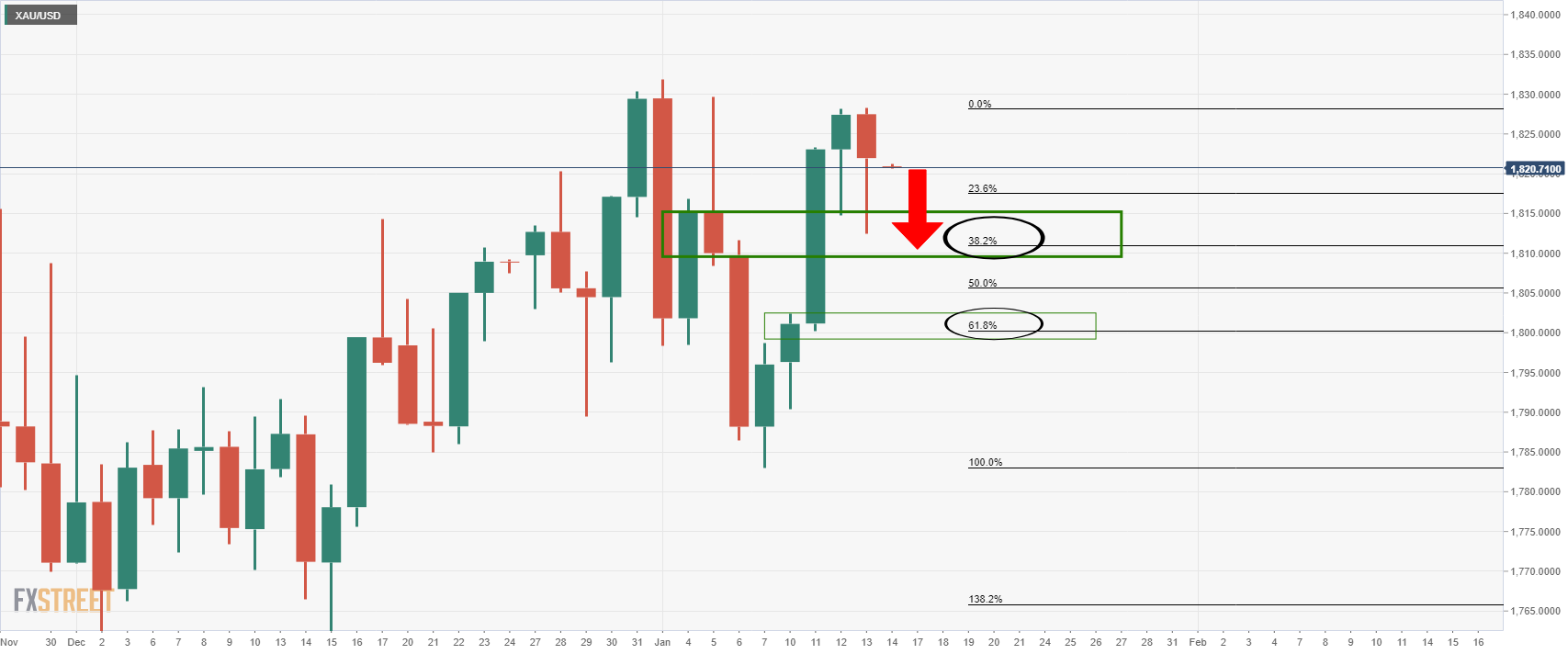

Gold technical analysis

If the US dollar rebounds from here, gold would be expected to be pressured towards critical support as follows:

The 38.2% Fibo near $1,810 guards $1,800 and the 61.8% Fibo.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.