- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD moves lower in a technical test of critical support

Gold Price Forecast: XAU/USD moves lower in a technical test of critical support

- The Fed could be priced too hawkish according to the recent moves in US yields and the greenback.

- Gold drops despite softness in the greenback in a technical test of key support.

- Gold is trying to stabilise and is headed for a test of 4-hour resistance towards $1,830.

Gold, (XAU/USD), has been under pressure on Thursday and despite the sell-off in the US dollar which has marked a fresh low to 94.660 as per DXY. At the time of writing, gold is trading at $1,820,33 and is down some 0.32% after sliding from a high of $1,828.18 to a low of $1,812.42.

The price of the US dollar has been undermined by some less hawkish comments of late, including both the Federal Reserve chair, Jerome Powell, and Philly Fed President Patrick Harker.

On Thursday, Harker said he sees the Fed starting to shrink its balance sheet “in late 2022 or early 2023” after the central bank has raised its target rate sufficiently, to around 1 per cent from near zero. The comments echoed that of Powell who said the Fed could start to shrink its balance sheet later this year.

''We're going to end our asset purchases in March, meaning we'll be raising rates over the course of the year," Powell said on Tuesday at his confirmation hearing before the Senate Banking Committee.

"At some point, perhaps later this year, we will start to allow the balance sheet to run off, and that's just the road to normalising policy," he said, adding the US economy "no longer needs or wants" the Fed's very highly accommodative policies.

These comments come in contrast to that of other more hawkish officials, such as the Atlanta Fed President Raphael Bostic. "There is a risk inflation is likely to be elevated for an extended period of time and we need to respond directly, clearly and aggressively," Bostic told Reuters in an interview on Monday.

Bostic explained that the central bank should be aggressive with regards to the balance sheet as well, allowing its holdings to decline by at least $100 billion a month, and with plans to quickly pull at least $1.5 trillion out of financial markets that he considers pure "excess liquidity."

Gold has otherwise been on the backfoot due to such a hawkish outlook at the Fed. However. The varied responses in the markets to the Fed could play into the hands of the gold bugs in time to come.

Initially, the US dollar was on the front foot along with US yields. The 10-year yield rallied to 1.8080% but it has since fallen to 1.7110%. Today, the yield is steeply lower again but above yesterday's aforementioned low.

Despite this, gold has fallen on the day but this could be more of a technical shakeout than anything else. Rates markets have already pencilled in 89bps of rate hikes, with 90% odds of lift-off in March, analysts at TD Securities explained.

''The rates shock appears to be baked into the cake in gold particularly with quantitative tightening still months away,'' the analysts added.

''In this context, gold prices could remain supported in coming trading sessions but are unlikely to follow through to significantly higher prices as markets will ultimately remain intensely focused on the Fed's exit.''

Gold technical analysis

As mentioned, despite the softness in the US dollar, gold is down, but this could be more of a technical move on the day than anything other.

This was forecasted in the following analysis from the prior session as follows:

Gold Price Forecast: XAU/USD bears move in, $1,810 eyed before $1,850

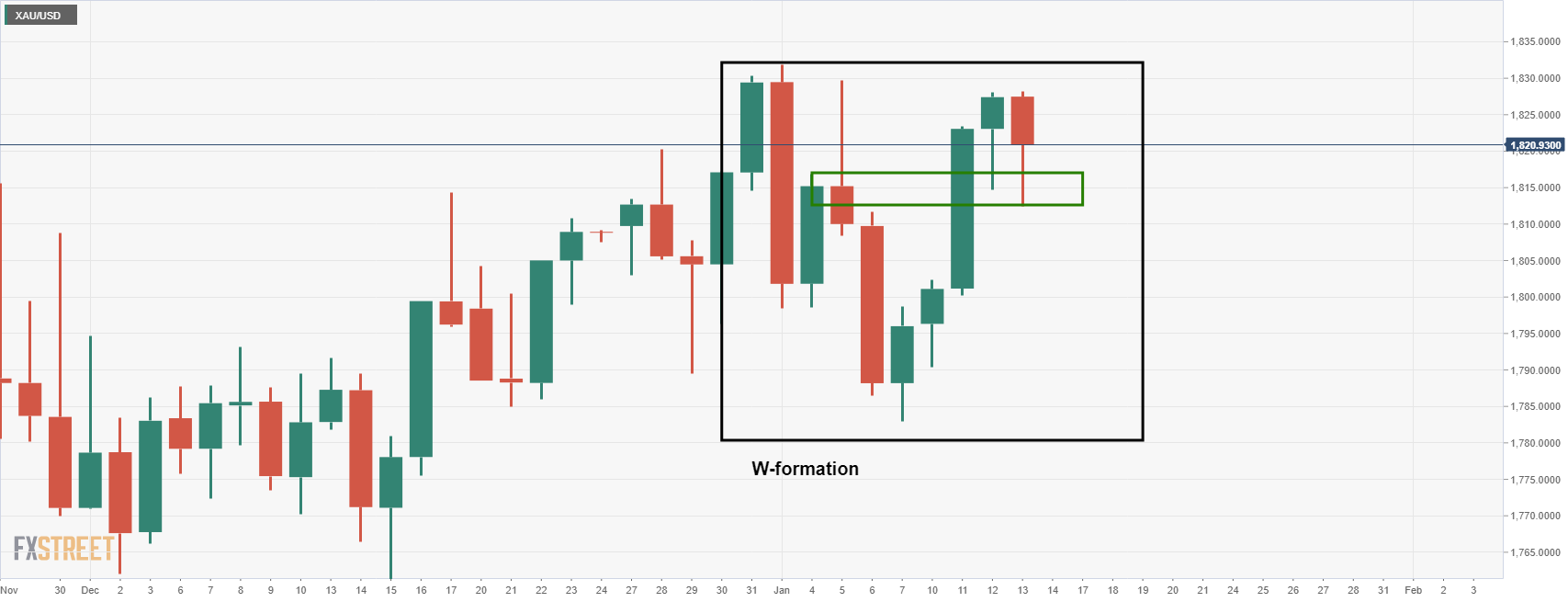

As illustrated, the price has moved lower in a W-formation, as forecasted, and is now making tracks back to the upside on the 4-hour time frame:

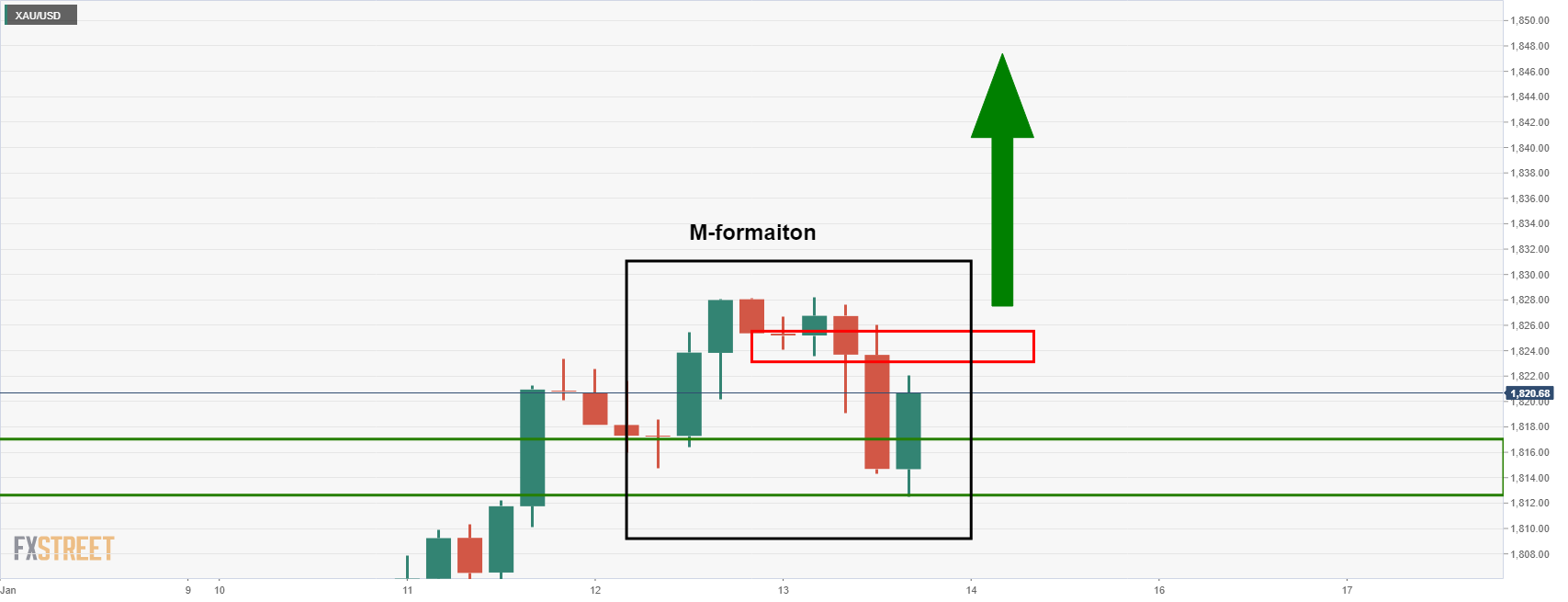

A move higher opens the risk of a break of the M-formation's neckline that could be one of the last major defences for a run towards the $1,850 target.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.