- Analytics

- News and Tools

- Market News

- Fed's Daly: Sees rate increases as early as March

Fed's Daly: Sees rate increases as early as March

The President and CEO of the Federal Reserve Bank of San Francisco Mary Daly has stated that the Fed does not want to get too far ahead on calling a number of rate increases.

She explained that they definitely see rate increases as early as March because inflation is uncomfortably high.

She explained that it is time to start removing some accommodation and that she sees prices moderating as supply imbalances ease.

Market implications

Fed speakers will enter blackout on communications this weekend and the markets are already expecting a rate increase as soon as the end of this quarter. The Fed has guided that rates can start to go up as soon as March.

''We agree with that assessment and expect that the Fed will hike 25bps in March (once they’ve halted further asset purchases), delivering a total of five hikes over 2022. Capping inflation is the Fed’s key priority for 2022,'' analysts at ANZ Bank explained.

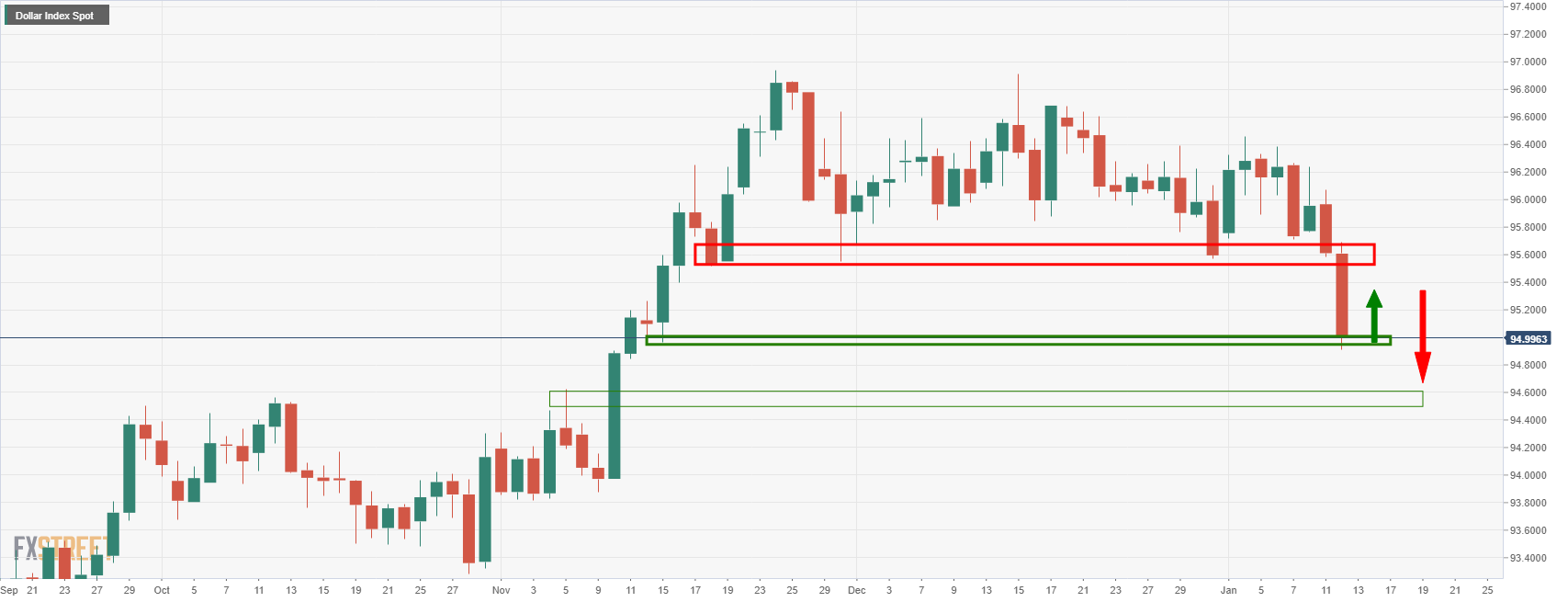

Meanwhile, the US dollar, as measured by the DXY index, has moved in on a critical level of daily support and would now be expected to correct higher as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.