- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Firmer Bund yields, bearish technicals test XAU/EUR rebound ahead of Eurozone inflation

Gold Price Forecast: Firmer Bund yields, bearish technicals test XAU/EUR rebound ahead of Eurozone inflation

- Gold prices in Euro consolidate the biggest fall in five weeks.

- 32-month high German Bund yields, clear break of €1,590 key level keeps bears hopeful.

- Euro hawks aim for firmer inflation, US NFP can challenge gold buyers.

Gold (XAU/EUR) prints mild gains around €1,585 as sellers take a breather near a three-week low heading into Friday’s European session.

The latest corrective pullback in gold prices could be linked to the cautious mood ahead of the Eurozone Consumer Price Index (CPI) for December and the US jobs report for the said month. Additionally, escalating covid woes and the US-China tussles, recently over trade and human rights, also favored gold buyers of late.

The bullion prices in Euro dropped the most since November 30 the previous day as the 10-year German Bund yields jumped to the highest since May 2019. Behind the moves could be Germany’s inflation gauge, namely the Harmonized Index of Consumer Prices (HICP), which eased in December while matching downbeat forecasts. On the same line were fears of tighter monetary policies at the European Central Bank (ECB) as Latvian central bank governor and ECB governing council member Martins Kazaks said earlier in the week that the ECB is ready to raise rates and cut stimulus if needed.

On the other hand, the US 10-year Treasury rallied to a nine-month high, retreating to 1.72% of late, while cheering hawkish Fedspeak that justifies Wednesday’s FOMC Minutes. That said, St. Louis Fed President James Bullard pushed for a March rate hike whereas Federal Reserve Bank of San Francisco President and an FOMC member Mary C. Daly marked the need to raise interest rates to keep the economy in balance.

Against this backdrop, the US 10-year Treasury yields consolidate recent gains around a nine-month high while the S&P 500 Futures and EuroStoxx Future print mild gains.

Moving on, Eurozone CPI, expected to ease to 4.7% from 4.9% YoY may allow XAU/EUR bears to retake controls ahead of the US jobs report. Following that, the US jobs report will be important to watch amid hawkish hopes from the Fed, which in turn may weigh on the EUR due to the Fed v/s ECB battle.

Technical analysis

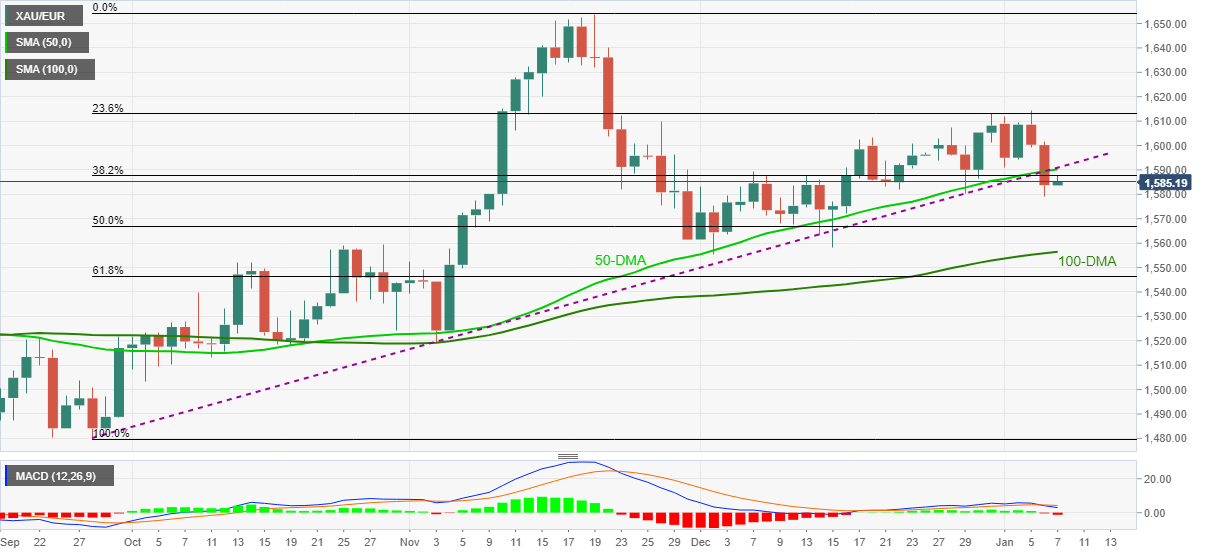

Gold (XAU/EUR) slumped to a three-week low on breaking an upward sloping support line from September and the 50-DMA, around €1,590, the previous day. The downside also gains support from the recently bearish MACD signals.

As a result, the corrective pullback remains elusive until the quote rises back beyond the €1,590 level.

Even if the gold prices in Euro rise beyond the €1,590 hurdle, the 23.6% Fibonacci retracement (Fibo.) of September-November upside, near €1,613, will challenge the commodity buyers.

Meanwhile, gold’s downside towards the 50% Fibo. level of €1,567 becomes imminent while the 100-SMA level of €1,556 can challenge the metal sellers afterward.

Overall, gold prices are likely to portray further downside even as the latest move challenges the bears.

XAU/EUR: Daily chart

Trend: Further weakness expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.