- Analytics

- News and Tools

- Market News

- AUD/USD slams into weekly support ahead of critical NFPs

AUD/USD slams into weekly support ahead of critical NFPs

- AUD/USD take on critical weekly support and stall.

- Fed and RBA divergence is running the show, contrary to seasonality. NFP next in line.

Around 0.7160, AUD/USD ended the day down some 0.80% on Thursday after falling from a high of 0.7222 to a low of 0.7145 in a technical move that has pierced important daily trendline support. The hawkishness at the Federal Reserve is driving sentiment and has resulted in an offer in the Aussie, to the contrary to the usual bullish seasonal factor.

Over several years, the start of the year has been typically bullish for the commodity sector and high beta currencies, such as the Aussie. However, the caveat for the seasonal bullishness was always going to be how hawkish the Fed comminuted at the start of the year. That came sooner than the market had expected in Wednesday's Federal Open Market Committee minutes.

First off, “Participants generally noted that, given their individual outlooks for the economy, the labour market, and inflation, it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.”

Additionally, the Fed has shown to markets that it is already thinking two steps ahead in discussing balance sheet runoff, as "Almost all participants agreed that it would likely be appropriate to initiate balance sheet runoff at some point after the first increase in the target range for the federal funds rate. However, participants judged that the appropriate timing of balance sheet runoff would likely be closer to that of policy rate liftoff than in the Committee’s previous experience."

as such, the divergence between the Reserve bank of Australia and the Fed is playing out in the price action of AUD/USD and couples up with the prior technical analysis as follows:

AUD/USD technical analysis

AUD/USD Price Analysis: Bears are moving in, a case building for longer-term downside

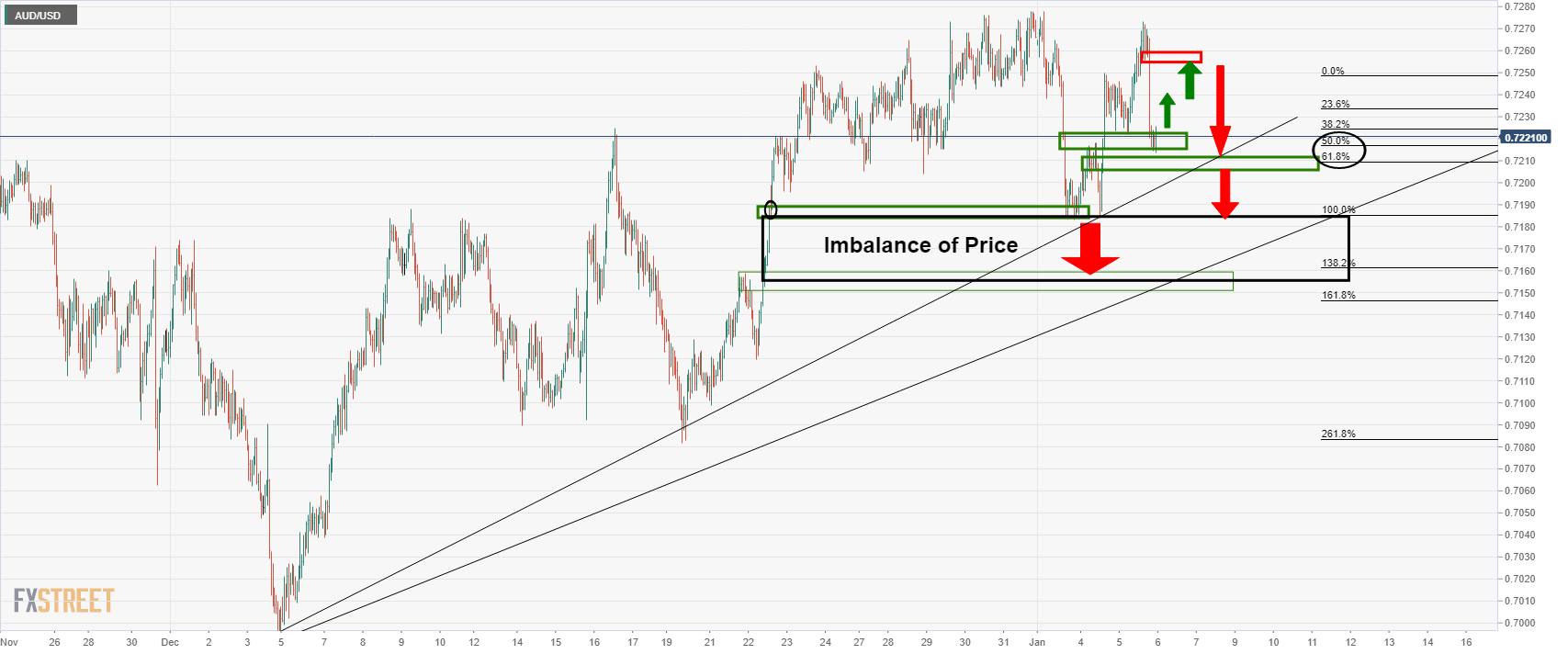

On this occasion, the price did not revisit the inefficiency of the Fed drop yesterday and instead moved in on the imbalance of price below support as follows:

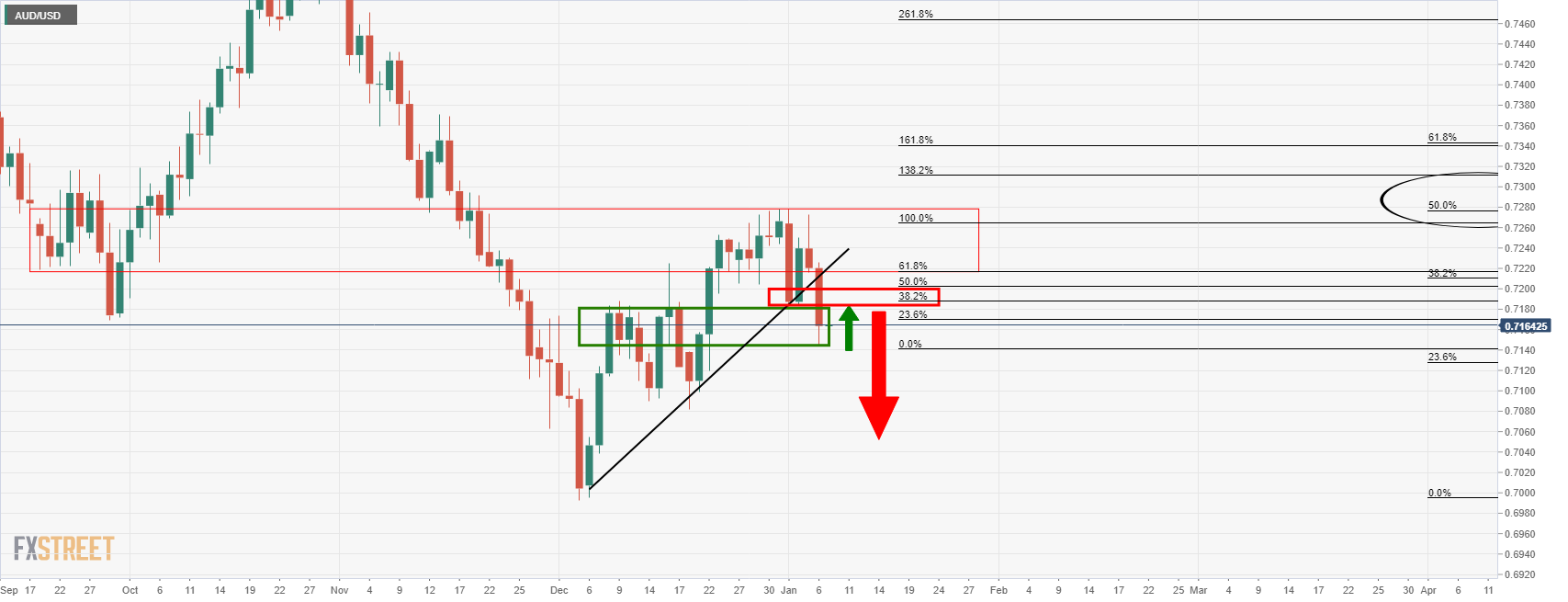

The Fed's communication meant that there will be a much quicker timeline between rate hikes and balance sheet runoff than the last time, as such, it is full steam ahead with respect to the central bank divergences. Overall, that spells a lower Aussie for the weeks ahead which leaves the weekly technical outlook intact as follows:

On a break of weekly support, near 0.7150, the prospect of a downside continuation will be in play. Meanwhile, there is room for a correction to the old daily support near 0.72 the figure.

Nonfarm Payrolls is next in line for prospects of another shakeup in financial markets. However, anything outside of what is expected and a shock is unlikely to move the needle. ''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities explained.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.