- Analytics

- News and Tools

- Market News

- USD/TRY looks firm, challenges weekly highs just below 14.0000

USD/TRY looks firm, challenges weekly highs just below 14.0000

- USD/TRY extends the march north near the 14.00 mark.

- The lira drops further after N.Nebati comments midweek.

- Investors’ attention remains on the CBRT event on January 20.

Another day, another drop in the lira. This time, the depreciation of the Turkish currency lifts USD/TRY to the vicinity of the 14.00 level, challenging at the same time the area of YTD tops.

USD/TRY up on stronger US yields, lira weakness

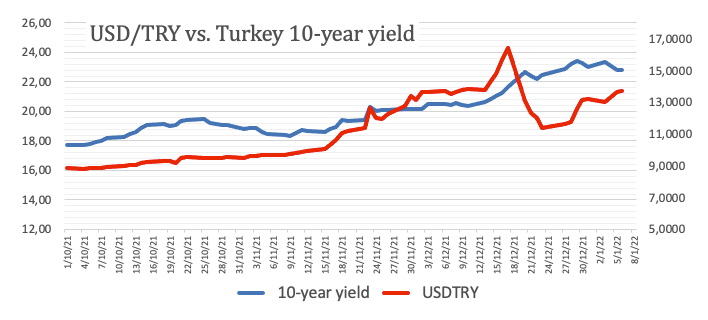

USD/TRY advances since Tuesday on the back of the move higher in US yields and increasing depreciation of the domestic currency, which has particularly exacerbated its losses following the 19-year high in Turkey’s inflation figures. It is worth recalling that consumer prices tracked by the CPI rose past 36% in December vs. the same month of 2020.

An extra hit to the lira (as if needed) came after Finance Minister N.Nebati said on Wednesday that the country will now abandon orthodox policies when it comes to tackle the rampant inflation, shifting instead to “heterodox policies” (or whatever that means), as the country will now chart its own course (?).

Further news from agency Reuters cited President Erdogan saying that “From now on, it is time to reap the benefits of our efforts, to show our people that we are approaching our goals”… (which would be…)

In the meantime, the lira shed nearly 45% in 2021 vs. the US dollar, making it one of the worst performers during the past year. Furthermore, since the Turkish central bank (CBRT) started its easing cycle back in mid/late September, TRY lost around 33%.

What to look for around TRY

The lira resumed the downtrend while market participants continue to digest the recent inflation figures and the government scheme to protect deposits in the domestic currency. The reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the lira under intense pressure for the time being, That said, another visit to the all-time high north of the 18.00 mark in USD/TRY should not be ruled out just yet.

Eminent issues on the back boiler: Progress (or lack of it) of the new scheme oriented to support the lira. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges.

USD/TRY key levels

So far, the pair is gaining 0.91% at 13.7531 and a drop below 12.7523 (weekly low Jan.3) would pave the way for a test of 11.8918 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.8967 (YTD high Jan.3) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.