- Analytics

- News and Tools

- Market News

- US Dollar Index remains under pressure, challenges 96.00

US Dollar Index remains under pressure, challenges 96.00

- DXY trades on the defensive near the 96.00 mark.

- The US ADP report surprised to the upside in December.

- Investors’ attention now shifts to the FOMC Minutes.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rivals, trades on the defensive and close to the 96.00 neighbourhood on Wednesday.

US Dollar Index now looks to FOMC

The index remains unable to reverse the resurgence of the selling pressure so far and navigates in the lower end of the daily range and at shouting distance from the key 96.00 yardstick.

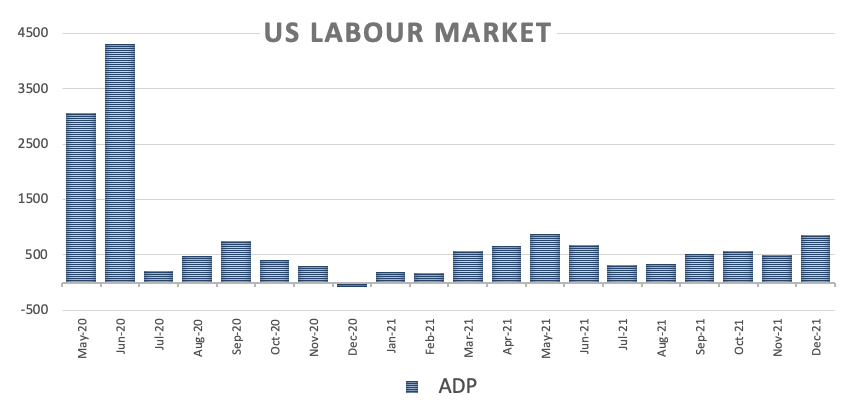

The lack of conviction in US yields amidst mixed performance across the curve and the investors’ bias towards the risk complex keep the buck under scrutiny despite the auspicious results from the ADP report in December.

Indeed, the US private sector added 807K jobs during last month, crushing estimates for a 400K gain and up from November’s 505K.

Later in the session, Markit will release its final Services PMI for the month of December and the FOMC will publish its Minutes of the last meeting.

US Dollar Index relevant levels

Now, the index is retreating 0.30% at 95.99 and a break above 96.46 (weekly top Jan.4) would open the door to 96.90 (weekly high Dec.15) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 95.57 (monthly low Dec.31) followed by 95.51 (weekly low Nov.30) and then 94.96 (weekly low Nov.15).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.