- Analytics

- News and Tools

- Market News

- US Dollar Index recedes from tops, back near 96.20 ahead of data

US Dollar Index recedes from tops, back near 96.20 ahead of data

- DXY retreats modestly and retests the 96.20 area midweek.

- The US ADP report will be the salient event later in the NA session.

- The FOMC will publish its Minutes of the December meeting.

The greenback, in terms of the US Dollar Index (DXY), gives away part of the recent gains and retreats to the 96.20 zone on Wednesday.

US Dollar Index looks to data, FOMC

After two consecutive daily advances, the index meets some selling pressure and recedes from Tuesday’s peaks near 96.50 to revisit the 96.20 region on Wednesday.

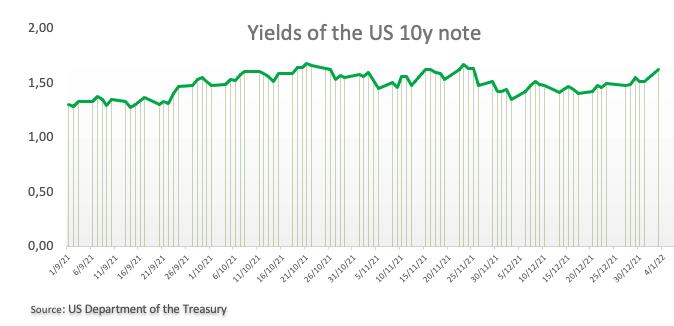

The corrective downside in the buck appears in contrast to the firm note in yields in the US cash markets, where the short-term note flirts with 22-month peaks near 0.80% and the key10y reference approaches the 1.70% mark for the first time since later November.

Further pressure around the greenback comes from the improvement in the risk complex, where the Dow Jones clinched new all-time highs on Tuesday and European reference stock indices opened on an upbeat note on Wednesday.

In the US docket, MBA Mortgage Applications in the week to December 31 are due seconded by the more relevant ADP report for the month of December. Later in the session, the FOMC will release the Minutes of the December’s meeting.

What to look for around USD

The index managed to regain the 96.00 barrier and above at the beginning of the new year, almost exclusively on the back of the move higher in US yields. As markets slowly return to normality, the dollar is forecast to remain bolstered by the Fed’s intentions to hike the interest rates later in the year amidst persevering elevated inflation, supportive Fedspeak, higher yields and the solid performance of the US economy.

Key events in the US this week: ADP Report, FOMC Minutes (Wednesday) - Initial Claims, ISM Non-Manufacturing, Factory Orders (Thursday) - Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Start of the Fed’s tightening cycle. US-China trade conflict under the Biden’s administration. Debt ceiling issue. Potential geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is retreating 0.16% at 96.12 and a break above 96.46 (weekly top Jan.4) would open the door to 96.90 (weekly high Dec.15) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 95.57 (monthly low Dec.31) followed by 95.51 (weekly low Nov.30) and then 94.96 (weekly low Nov.15).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.