- Analytics

- News and Tools

- Market News

- GBP/USD bears making their mark to start 2022, test of 1.3500 imminent

GBP/USD bears making their mark to start 2022, test of 1.3500 imminent

- GBP/USD bears step on the gas at the start of the week into test near to 1.35 the figure.

- US events, Brexit, Covid and central banks outlooks to be the driving forces this week.

GBP/USD is on the back foot to start the week, -0.15% at the time of writing. Cable is sinking from 1.3535 to a low of 1.3507 so far, technically bound for further downside to come for the forthcoming sessions, see below.

Meanwhile, the volumes in forex and markets, in general, are not going to arrive until nations such as Japan, Australia and the UK return from holidays. However, while there is little in the way of domestic data from the Uk, the week will quickly move into gear with a busy US schedule on the calendar.

The main event will likely come at the end of the week from the US jobs market with the US Nonfarm Payrolls report. ''The late-December COVID surge likely came too late to prevent a pickup in US payrolls after the gain in November (210k) appeared to be held down by an overly aggressive seasonal factor,'' analysts at TD Securities explained.

US ISMs on the 4th will also be key. The levels should remain high according to analysts at TD securities. ''We expect the services index to decline more markedly following November's eye-popping jump to 69.1—an all-time high—and given the likely initial impact from Omicron. The MFG index probably fell below the 60 mark for the first time in four months. Anything over 60 is exceptionally strong.''

The other main event will come with the Federal Open Market Committee minutes. These are following the FOMC's decision to double the pace of QE tapering and the projection of a significantly more hawkish dot plot will be the focus before then. ''Focus will now turn to the elements that led to the evolution of views among policymakers (including on "maximum employment") after the November meeting,'' analysts at TD Securities said.

Domestic risks for GBP

As for the pound, the surprise rate hike by the Bank of England at its December meeting gave the currency some time-limited support. The fast spread of the Omicron variant in the UK has been a weight since in particular as the government may opt to impose some new restrictions following the holidays. Brexit is also likely to snap back and make for political turmoil that may also weigh on GBP as markets attempt to re-assess the Brexit policy.

GBP/USD technical analysis

The hourly chart shows prospects of a price running into support near 1.35 the figure and correcting back to the upside for a higher high for the coming sessions.

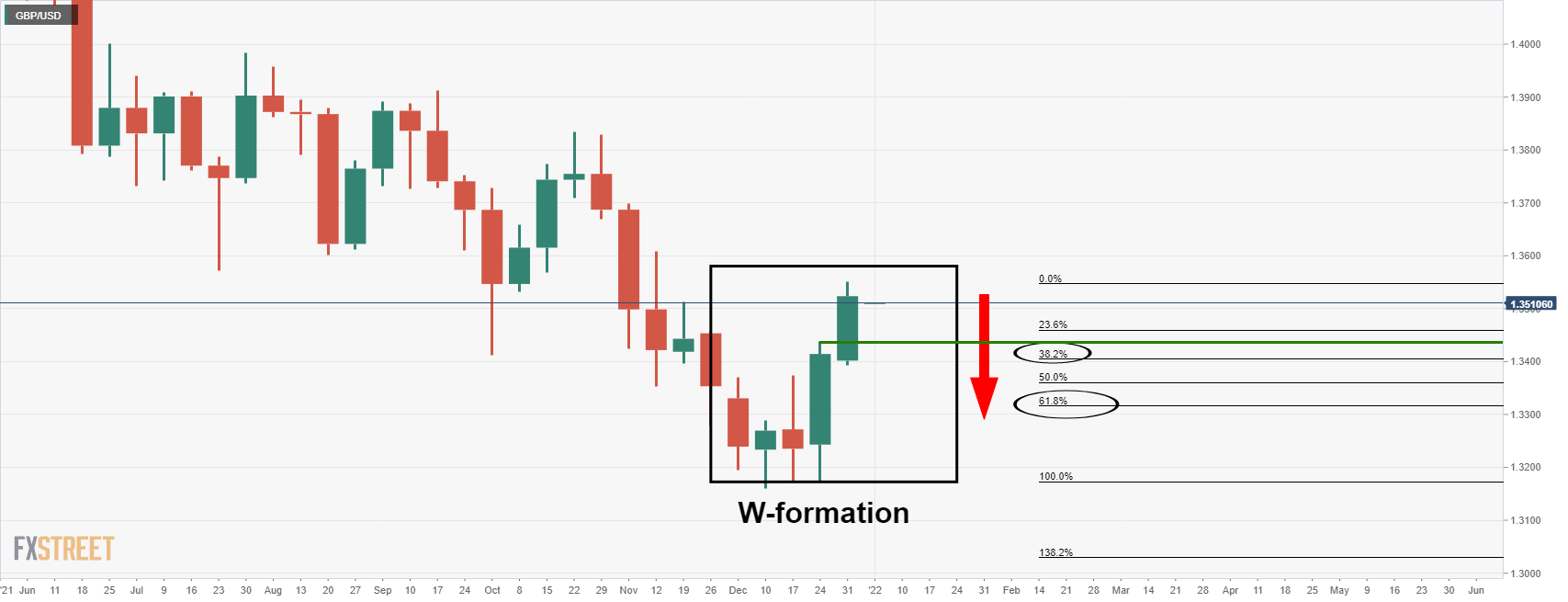

For the weekly chart, we see a W-formation:

While there are prospects of a shallow correction as per the hourly analysis, the weekly perspective is far more bearish. The W-formation is a reversion pattern that has a high completion rate, in that the price would be expected to be drawn to the neckline of the pattern. The neckline comes in at around a 61.8% Fibonacci retracement near to 1.3320.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.