- Analytics

- News and Tools

- Market News

- GBP/USD Price Analysis: Recovers early lost ground, bulls await a move beyond 1.3500 mark

GBP/USD Price Analysis: Recovers early lost ground, bulls await a move beyond 1.3500 mark

- GBP/USD attracted some dip-buying on Thursday and recovered the early lost ground.

- The technical setup favours bullish trades and supports prospects for additional gains.

- A sustained break below the 1.3400 round figure is needed to negate the positive bias.

The GBP/USD pair recovered intraday losses and was last seen trading in the neutral territory, just below the key 1.3500 psychological mark, or the monthly high touched earlier this Thursday.

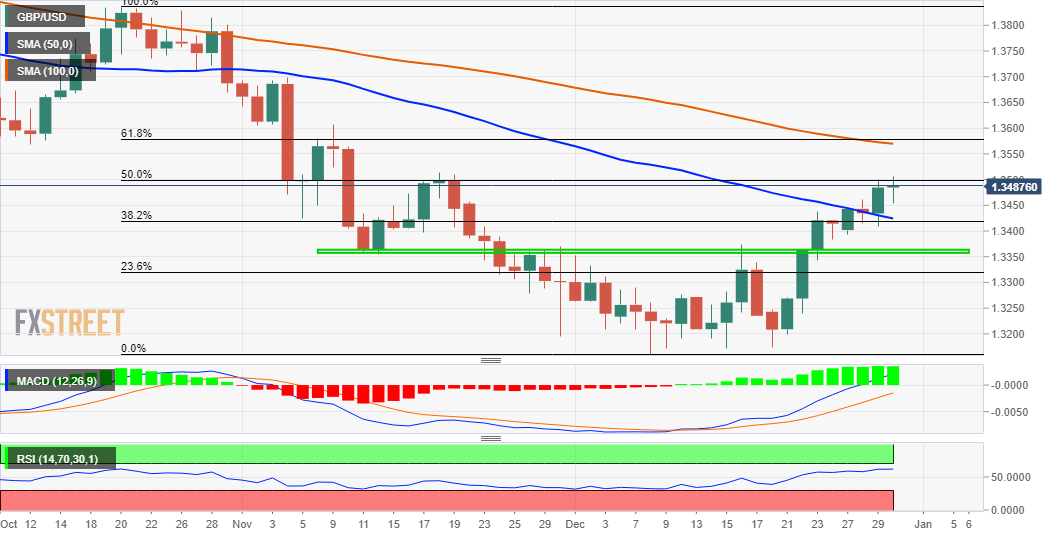

Looking at the broader picture, the recent strong recovery move from the YTD low paused near a hurdle marked by the 50% Fibonacci level of the 1.3834-1.3161 downfall. This coincides with the November 19 swing high and should act as a key pivotal point for short-term traders.

Given the recent move beyond the 1.3375-80 barrier, the overnight sustained breakthrough the 38.2% Fibo. and the 50-day SMA confluence favours bullish traders. This along with positive oscillators supports prospects for a further near-term appreciating move for the GBP/USD pair.

Hence, a subsequent strength towards the next relevant resistance, near the 1.3565 region, remains a distinct possibility. The mentioned area comprises 61.8% Fibo. level and the 100-day SMA, which if cleared decisively would be seen as a fresh trigger for bullish traders.

On the flip side, the daily swing low, around the 1.3455-50 region, now seems to protect the immediate downside. Any subsequent decline could be seen as a buying opportunity near the 38.2% Fibo. level/50-DMA confluence resistance breakpoint and remain limited near the 1.3400 mark.

Failure to defend the mentioned support levels, leading to a further slide below the 1.3385-75 region might shift the bias back in favour of bearish traders. The GBP/USD pair could then accelerate the fall towards testing the 23.6% Fibo. level, around the 1.3320 area.

GBP/USD daily chart

Levels to watch

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.