- Analytics

- News and Tools

- Market News

- EUR/USD well supported above 1.1300 in subdued, holiday-thinned trading conditions

EUR/USD well supported above 1.1300 in subdued, holiday-thinned trading conditions

- EUR/USD is trading in subdued fashion though remains well supported to the north of the 1.1300 level.

- The pair has formed an ascending triangle in recent sessions but is likely to remain within recent ranges into 2022.

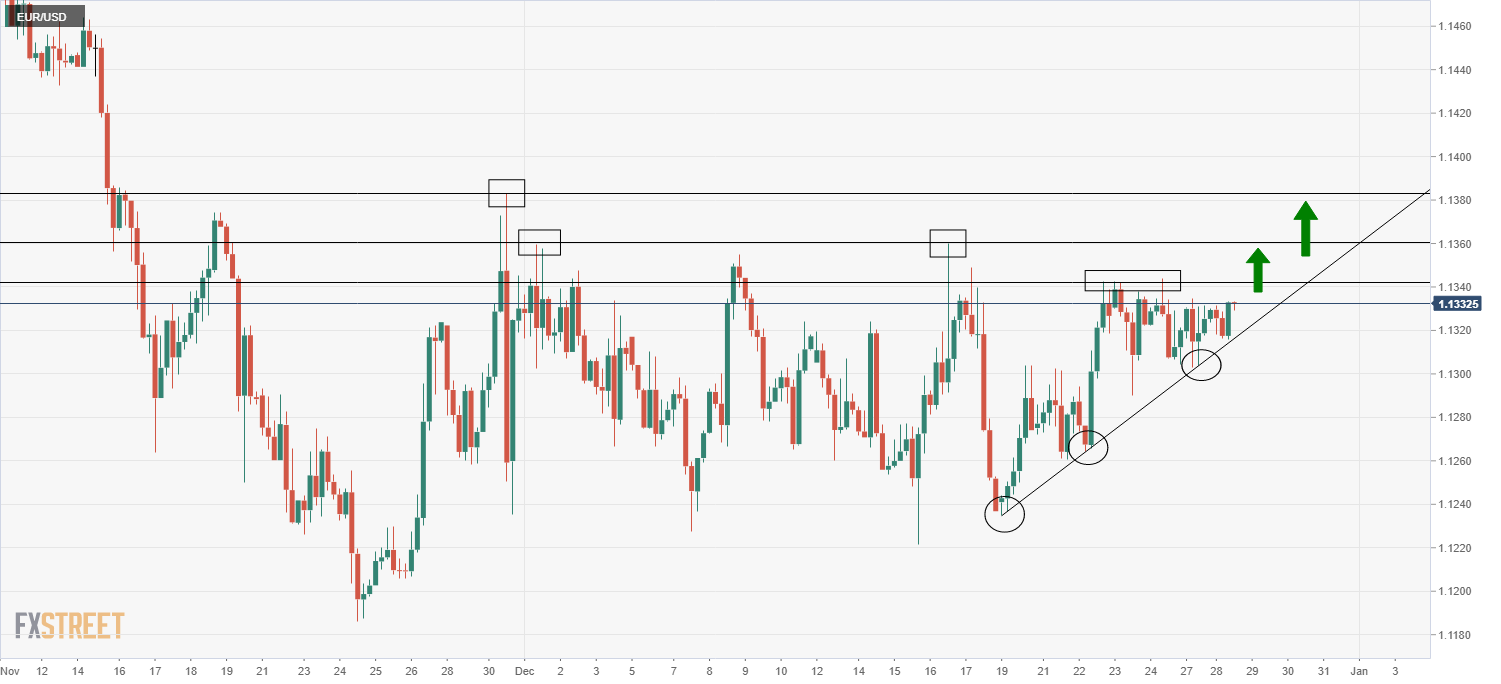

EUR/USD is currently trading just below highs of the week in the 1.1330 area, amid subdued, holiday-thinned trading conditions. The pair has traded with a modestly positive trading bias this week amid broadly risk-on conditions (stocks and commodities have been moving higher), which seems to have weighed slightly on the buck and looks set to remain well supported above 1.1300. Indeed, this is where the 21-day moving average currently sits, with the moving average having offered good support in recent sessions.

As strategists had been expecting, EUR/USD continues to trade well within the 1.1240-1.1360ish range that has prevailed for most of the month. This range is likely to hold until 2022 gets underway and market participants return and volumes go back to normal. Indeed, the first week of January will be a big one with the release of the December US jobs report and ISM manufacturing and services PMI surveys all due. This week there is very little US data of note aside from the usual weekly jobless claims report on Thursday. The Eurozone economic calendar is a little more interesting with the preliminary estimate of December HICP scheduled for release on Thursday.

Looking at EUR/USD from a technical standpoint, the pair is eyeing a test of last week’s highs in the 1.1340s, a break above which would bring in focus a test of December highs in the 1.1360s-80s area. Indeed, the pair does appear to have formed an ascending triangle in the latter stages of the month, which often is indicative that a bullish break is in the offing. Should the recent upwards trendline be broken to the downside, this would be a bearish sign that EUR/USD may be headed back under the 1.1300 level.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.