- Analytics

- News and Tools

- Market News

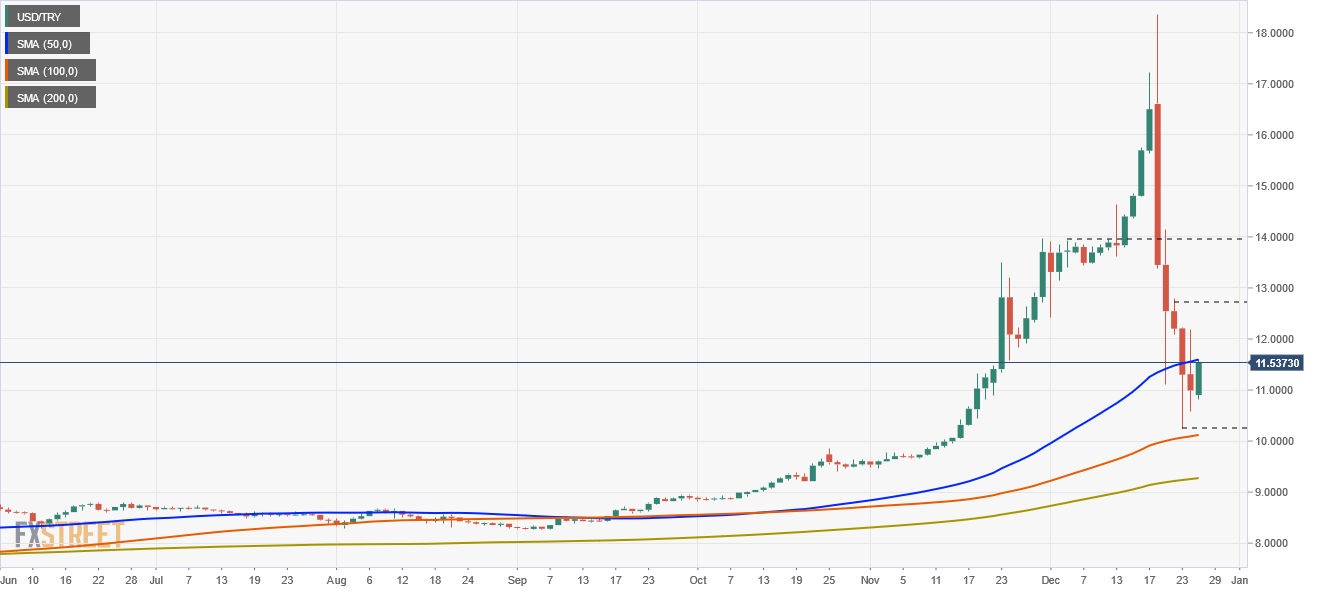

- USD/TRY seesaws around the 50-DMA at 11.5360s amid a risk-on market mood

USD/TRY seesaws around the 50-DMA at 11.5360s amid a risk-on market mood

- The Turkish lira weakens some 5.11% against the greenback amid thin liquidity markets.

- USD/TRY Price Forecast: It has an upward bias, though a break above the 50-DMA is needed, to resume any moves towards 13.8000s.

The Turkish lira weakens through the day, trading at 11.4100 during the New York session at the time of writing. The market sentiment remains upbeat, with the S&P 500 printing all-time highs, despite the ongoing Omicron strain spread worldwide.

The US Dollar Index, which measures the greenback’s performance against a basket of rivals, edges up some 0.08%, sitting at 96.09.

In the meantime, Turkey’s banking watchdog filed criminal complaints against individuals who commented on the lira, including two former central bank governors. Furthermore, the regulator said that commentators attempted to manipulate exchange rate movements, violating an article of the banking law, according to Bloomberg

Doing a recap of the last week, President Recep Tayyip Erdogan announced extraordinary measures on December 20 to contain the Turkish lira’s losses against the greenback. Erdogan’s effort spurred a downward move from 18.2600 down to 13.0900.

USD/TRY Price Forecast: Technical outlook

The USD/TRY has an upward bias, despite the recent fall of 500-pips on measures implemented to stop the fall of the Turkish lira. The downward move was capped near the 100-day moving average (DMA) at 10.0890, bouncing off that level towards 11.3669, to then seesawed around the 50-DMA, unable of breaking to the upside.

To the upside, the USD/TRY first resistance level would be the 50-day moving average (DMA) at 11.5486. A breach of the latter would expose the December 24 daily high at 12.0550, followed by the December 22 high at 12.6800, and then the December 3 daily high at 13.8723.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.