- Analytics

- News and Tools

- Market News

- USD/JPY bulls stay in charge during Santa Claus rally

USD/JPY bulls stay in charge during Santa Claus rally

- USD/JPY bulls are in charge in the final days of the year.

- The risk-on sentiment has damaged the yen as investors cheer the COVID headlines.

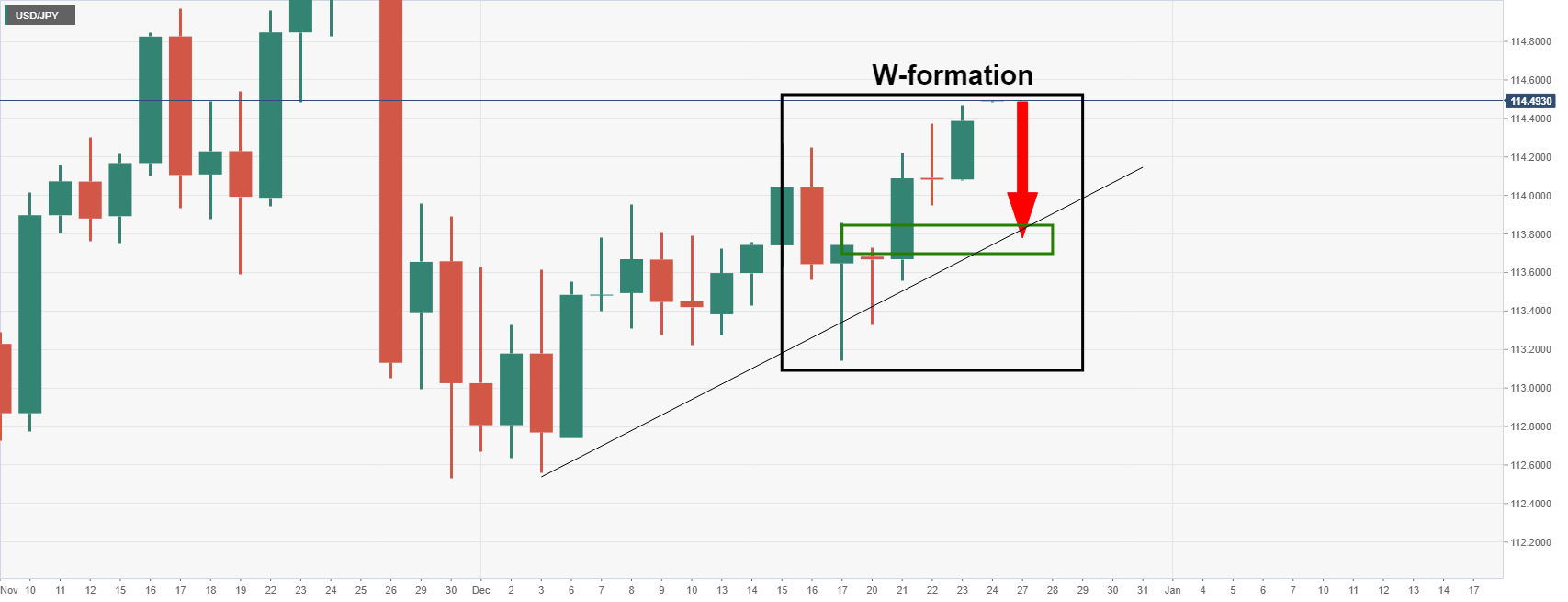

USD/JPY is perched in bullish territory although the W-formation on the daily chart could be troublesome for the bulls in the next few days. At the time of writing, the pair is trading at 114.45 and has moved between a low of 114.32 and a high of 114.47.

Risk sentiment improved this week due to a stream of cautiously positive headlines which have been weighing on the greenback and the yen. Investors are expecting that COVID variants will not disrupt global development after all and this has given the bulls on Wall Street good reason to get on board the Santa Claus rally.

AstraZeneca (AZN) said its Evusheld preventive antibody retained its neutralizing activity against the omicron variant in clinical trials conducted by Oxford University in the UK and the University of Washington in the US.

Santa Claus rally took off to fresh highs

The recent covid-variant news is a breath of fresh air for investors that have otherwise been concerned by a combination of virus fears, tighter policy, and a bleak outlook for US fiscal stimulus.

Closing at all-time closing highs, the S&P rose 0.6% to 4,725.78, up 2.3% in the holiday-shortened week marking three straight daily gains. The Nasdaq Composite advanced 0.9% to 15,653.37 and the Dow Jones Industrial Average gained 0.6% to 35,950.63, but those indices remained below record highs set in November.

As for the bond markets, the 10-year US Treasury yield rose to 1.50% on the last full day of trade in the bonds and stocks before Xmas Eve, (the bond market was to close at 2 pm ET ahead of a market holiday Friday, while the stock market was slated to remain open until 4 as usual but it seems it will be closed in observation of Xmas day that falls on a Saturday).

The greenback, as measured by the DXY, ended the New York session down some 0.11% and printed a low of 95.99. The index fell from a high of 96.277 within the sideways channel/daily wedge formation:

DXY daily index

Meanwhile, in recent trade, the Japan National CPI (YoY) in November came in at 0.6% (exp 0.5%; prev 0.1%). The National CPI Ex Fresh Food (YoY) for November arrived at 0.5% (exp 0.4%; prev 0.1%) The National CPI Ex Fresh Food, Energy (YoY) for the same month came in at -0.6% (exp -0.6%; -0.7%).

US data in focus

In US data, the US Initial Jobless Claims totalled 205,000 during the week ended December 18, in line with market expectations. Personal Consumption Expenditure Inflation added 0.6% on a monthly basis in November and 5.7% annually, in line with expectations. However, excluding volatile food and energy costs, the measure was up 4.7% year-over-year, the most since 1989 which have helped to keep yield elevated and the US dollar supported.

Additionally, personal income rose 0.4% in November versus market expectations for a gain of 0.5%, while spending grew 0.6% in line with estimates. While there is no data on Frdua, the usual University of Michigan Consumer Sentiment Index was brought forward and it was revised up slightly Thursday to a reading of 70.6 for December from the 70.4 preliminary estimates.

USD/JPY daily chart

The W-formation is a reversion pattern and the neckline of the pattern would be expected to act as support on a retest near 113.85.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.