- Analytics

- News and Tools

- Market News

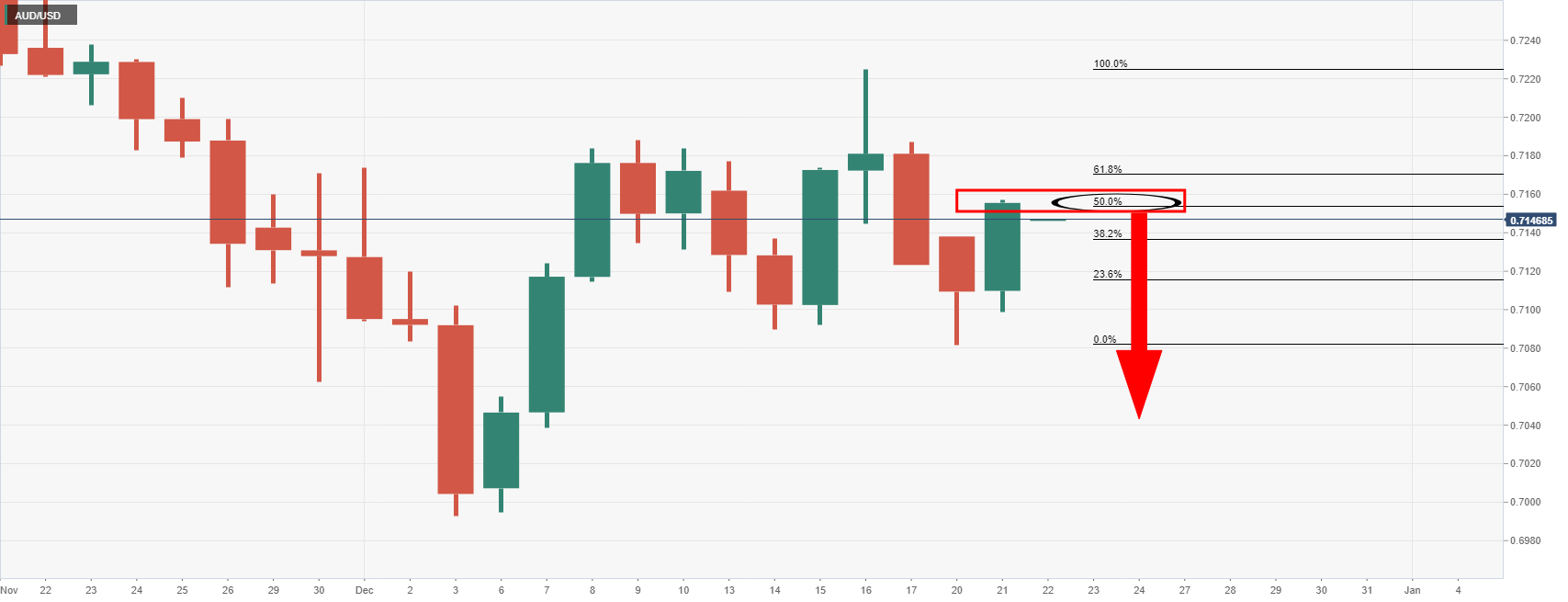

- AUD/USD bulls throw in the towel, so far unable to break 50% mean reversion

AUD/USD bulls throw in the towel, so far unable to break 50% mean reversion

- AUD/USD is pulling back into support in Asia.

- The bulls could be looking for a discount at this juncture, with 0.7180 eyed.

Despite bullish equities in Asia, following the lead from overnight and strong performances on both European bourses and Wall Street stocks, AUD/USD is under pressure.

At the time of writing, AUD/USD is down some 0.1% after sliding from the overnight highs of 0.7154 to a low of 0.7143 so far. The US dollar is firming after a modest down day while risk-on sentiment favoured the high beta forex currencies with the kiwi topping the leader board and the Aussie in tow close behind.

The Chinese are helping to elevate the Aussie with their efforts to provide liquidity onshore. The Peoples Bank of China also arrived recently with a loan prime rate cut) to support the domestic economy. Additionally, iron ore has been making a comeback due to the Chinese possibly decreasing the restrictions in the steel industry which is likely to aid the Aussie.

Meanwhile, the Omicron variant is a wild card for forex and the US dollar which has a tendency to stay offered at this time of year, looking back over recent years at least. If new restrictions are implemented in the UK and US, this could be a catalyst for a stronger dollar and weigh on stocks and high-beta currencies, such as the Aussie.

For the day ahead, ''markets will focus on US data (GDP revisions, consumer confidence, existing home sales) along with COVID developments on Wednesday,'' analysts at TD Securities said.

AUD/USD technical analysis

AUD/USD Price Analysis: Bulls step up to target 0.7180

The bulls have been unable to break the 50% mean reversion of the prior daily bearish impulse as follows:

However, if the 50% breaks, then the bulls will be back in play:

AUD/USD H1 chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.