- Analytics

- News and Tools

- Market News

- USD/TRY Price Analysis: Monthly support tests further downside around $13.50

USD/TRY Price Analysis: Monthly support tests further downside around $13.50

- USD/TRY licks its wounds near early December lows after the biggest daily slump on record.

- Erdogan unveiled series of measures to stop further dollarization, around $1.0 billion was sold after announcement.

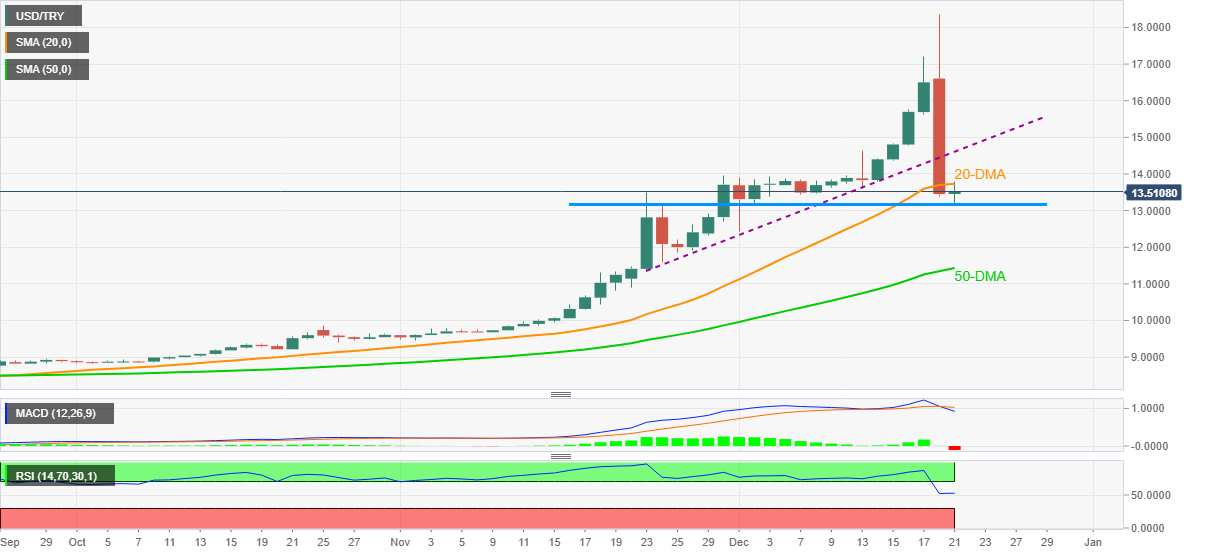

- Steady RSI suggests further consolidation of losses, 21-DMA guards immediate upside.

- 50-DMA acts as additional downside filter, bulls need clear break of $14.65 for confirmation.

USD/TRY pares the heaviest daily fall on record while taking rounds to $13.50, up 0.40% intraday, during early Tuesday.

The Turkish lira (TRY) pair’s downpour could be linked to a clear break of an ascending support line from November, in addition to the fundamental moves by Turkish President Recep Tayyip Erdogan.

“Speaking after a Cabinet meeting, Erdogan said the measures would ensure citizens would not have to convert their lira into foreign currency over the lira crash, including a deposit guarantee promise,” per Reuters. The news also quotes the head of the Turkish Banks Association while saying, “Around $1 billion was sold in markets after Erdogan unveiled the measures.”

Even so, one-month-old horizontal support around $13.20-15 restricts the quote’s further downside.

Although the MACD signals do favor bears, a clear downside break of $13.15 becomes necessary for the USD/TRY sellers to keep reins.

In doing so, the 50-DMA level of $11.43 and the $10.00 psychological magnet should become their favorites.

Alternatively, steady RSI and failures to conquer the immediate support can favor USD/TRY bulls if the quote rises past the 20-DMA hurdle surrounding $13.75.

Following that, the $14.00 round figure and previous support line near $14.60 will test the pair buyers before resuming the run-up to aim for the $20.00 round figure. During the rise, the $15.70 and the latest all-time high of $18.36 will be important to watch.

USD/TRY: Daily chart

Trend: Further recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.