- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD eyes $1,765 on 200-DMA break, firmer yields

Gold Price Forecast: XAU/USD eyes $1,765 on 200-DMA break, firmer yields

- Gold consolidates recent losses after consecutive two-day declines.

- Omicron woes escalate as WHO, Imperial College of London and US CDC support market fears.

- Deadlock over US President Biden’s BBB, US-China tussles and Fed’s rate-hike concerns also favor risk-off mood.

Gold (XAU/USD) licks its wounds near $1,790 during Tuesday’s Asian session, after declining from two consecutive days from the monthly high.

The yellow metal’s latest weakness could be linked to the market’s fresh fears over the South African covid variant, dubbed as Omicron. Adding to the risk-aversion are the chatters surrounding the US Federal Reserve’s (Fed) rate hike, deadlock over US President Joe Biden’s Build Back Better (BBB) plan and the Sino-American tussles.

After an initial rejection of the Omicron fears, global leaders are all worried over the COVID-19 variant that pushes some of the leading economics, like the UK and Europe, to recall strict activity restrictions during the holiday season.

The fears of Omicron were recently backed by the World Health Organization (WHO) while saying, “The Omicron variant of the coronavirus is spreading faster than the Delta variant and is causing infections in people already vaccinated or who have recovered from the COVID-19 disease,” per Reuters. On the same line were the Researchers at Imperial College London and the US Centers for Disease Control and Prevention (CDC). The UK scientists said, per Reuters, Infections caused by the Omicron variant of the coronavirus do not appear to be less severe than infections from Delta. On the other hand, Reuters said that Omicron is now the most common coronavirus variant in the US, accounting for nearly three-quarters of COVID-19 cases, per US CDC.

US President Joe Biden’s much-awaited BBB stimulus plan gets a rejection from Senator Joe Manchin, making it hard to cross the House considering the Republicans’ readiness to avoid favoring the plan and Democrats’ wafer-thin majority. Even so, House Speaker Nancy Pelosi and US President Biden stay hopeful of getting the aid package through during early 2022.

Adding to the risk-off catalysts are the US-China tussles that escalated of late. On Monday, Chinese foreign minister Wang Yi said, per Reuters, "If there is confrontation, then (China) will not fear it, and will fight to the finish." China’s Wang Yi adds, "There is no harm in competition but it should be ‘positive’”. On the same line were fears of the Fed rate-hike, backed by Fed Board of Governors member Christopher Waller

Against this backdrop, the US Treasury yields posted 2.3 basis points (bps) of an upside to 1.42% after declining to the monthly lows. Further, the Wall Street benchmarks also posted losses but the S&P 500 Future print mild gains by the press time.

Looking forward, a light calendar will restrict gold’s short-term moves but risk catalysts can keep the bears hopeful until the yields keep the latest rebound.

Technical analysis

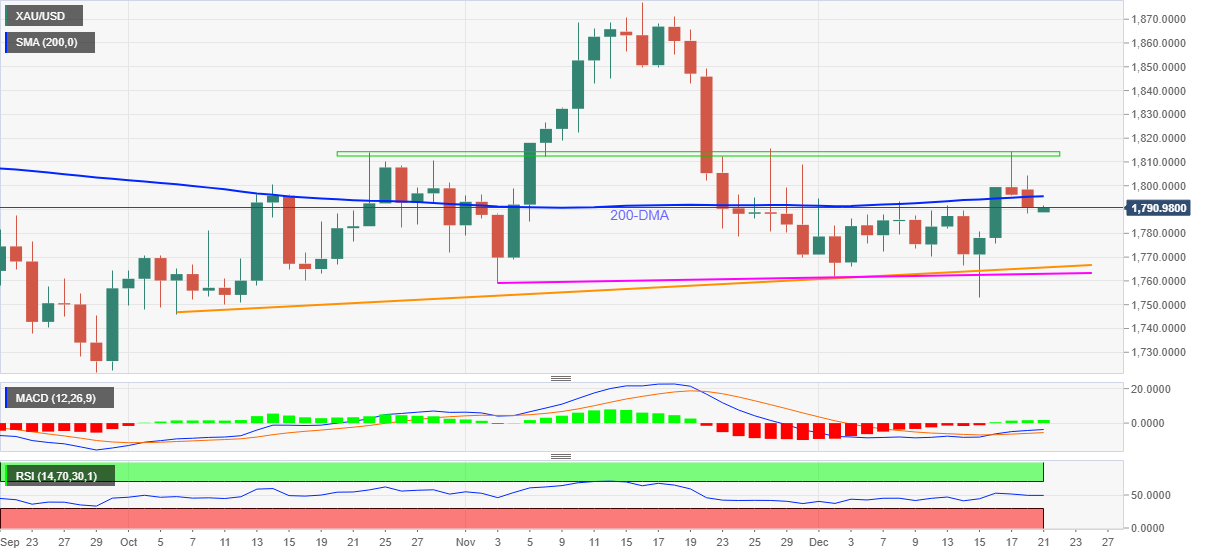

Failures to cross a two-month-old horizontal resistance area precede the metal’s latest break of the 200-DMA, around $1,795, to keep gold sellers hopeful.

That said, an ascending support line from early October, close to $1,765 will be challenging the bears, a break of which will have another support line from early November, near $1,760, to challenge the gold bears.

In a case where the gold prices decline below $1,760, September’s bottom surrounding $1,721 should become their favorite.

On the contrary, a clear upside break of the stated horizontal hurdle around $1,813-15, will aim for tops marked during July and September near $1,834 and then to multiple lows marked during mid-November close to $1,845.

In a case where gold buyers successfully cross the $1,845 resistance, November’s peak of $1,877 and the $1,900 round figure will be in focus.

Gold: Daily chart

Trend: Further weakness expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.