- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Bulls making little progress, 0.6800 opens 0.6850

NZD/USD Price Analysis: Bulls making little progress, 0.6800 opens 0.6850

- NZSD/USD bull's grit is being tested by the pullback.

- Bulls looking for a breakout of accumulation for the sessions ahead.

NZD/USD has been pressured in recent trade and is making hard work of the recovery into the 0.68 area. The bears are taking control to the lows of the session, so far, near 0.6787. However, 0.6770 would be expected to hold if, indeed, the bird is going to correct higher from a phase of accumulation.

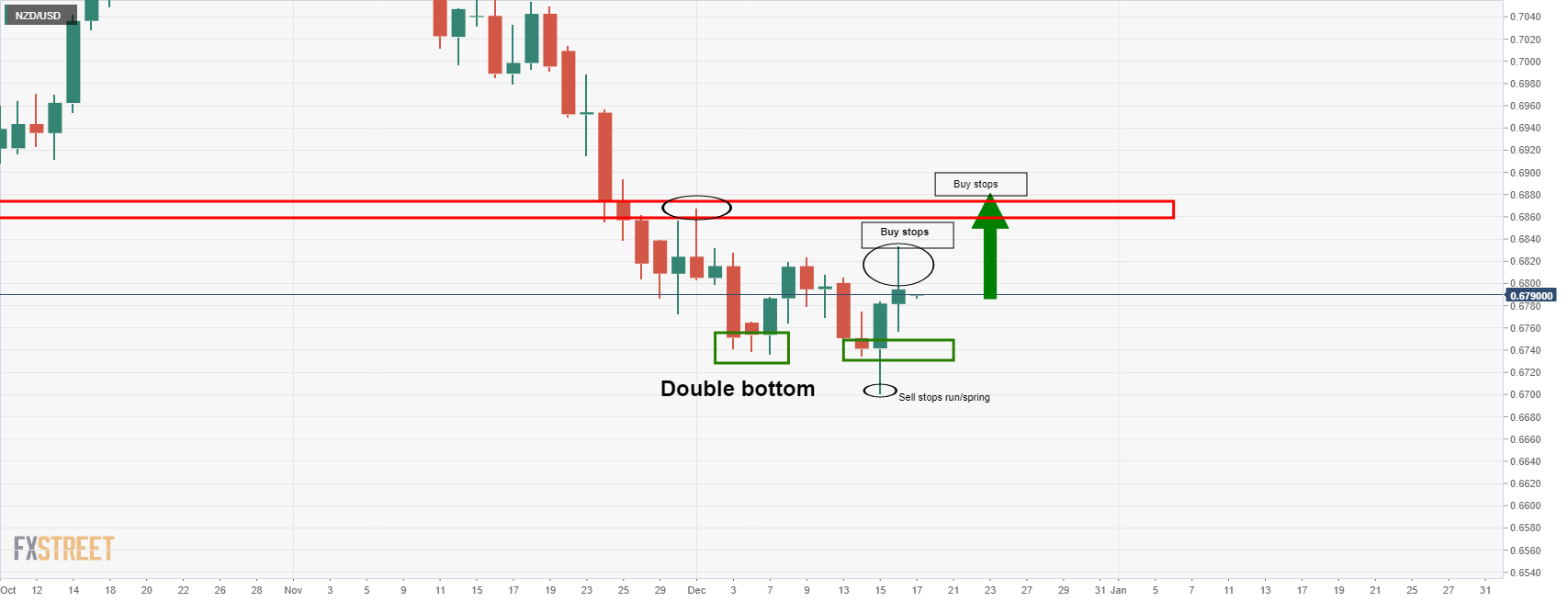

The following illustrates the market structure and the potential for a return to the upside once sell stop liquidity is seized by firmer bullish hands. These bulls were looking for a discount to test higher prices before the week is out.

NZD/USD daily chart

As per the daily chart, we can see what is going on under the hood from the price action. The price has left a double bottom on the chart and we can see the liquidity run, triggering the sell stops. In Wycoff terminology, aka the ''spring''. This gave firmer buyers sellers to buy from and led to a continuation of higher prices as more longs were accumulated at better prices.

The buyers would now be looking to find liquidity around the highs of the recent price action, namely, buy stops, where shorts are unwilling to take any more drawdown in losing positions. This gives rise to the potential for a move higher at this juncture which can be monitored from an hourly perspective as follows:

NZD/USD H1 chart

As illustrated, the price is on the verge of a retest of the support where buyer's stops will be located given the prior resistance and the 61.8% Fibonacci level. This is regarded as a deep retracement area where the pain of holding onto a losing position becomes too stressful for most to bear. Nevertheless, should the price hold in the vicinity of 0.6770/80, then there is a higher probability that buyers will engage and take the price higher. In doing so, there are prospects of a breakout as per the hourly accumulation as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.