- Analytics

- News and Tools

- Market News

- Aussie Unemployment Rate big beat supports AUD/USD

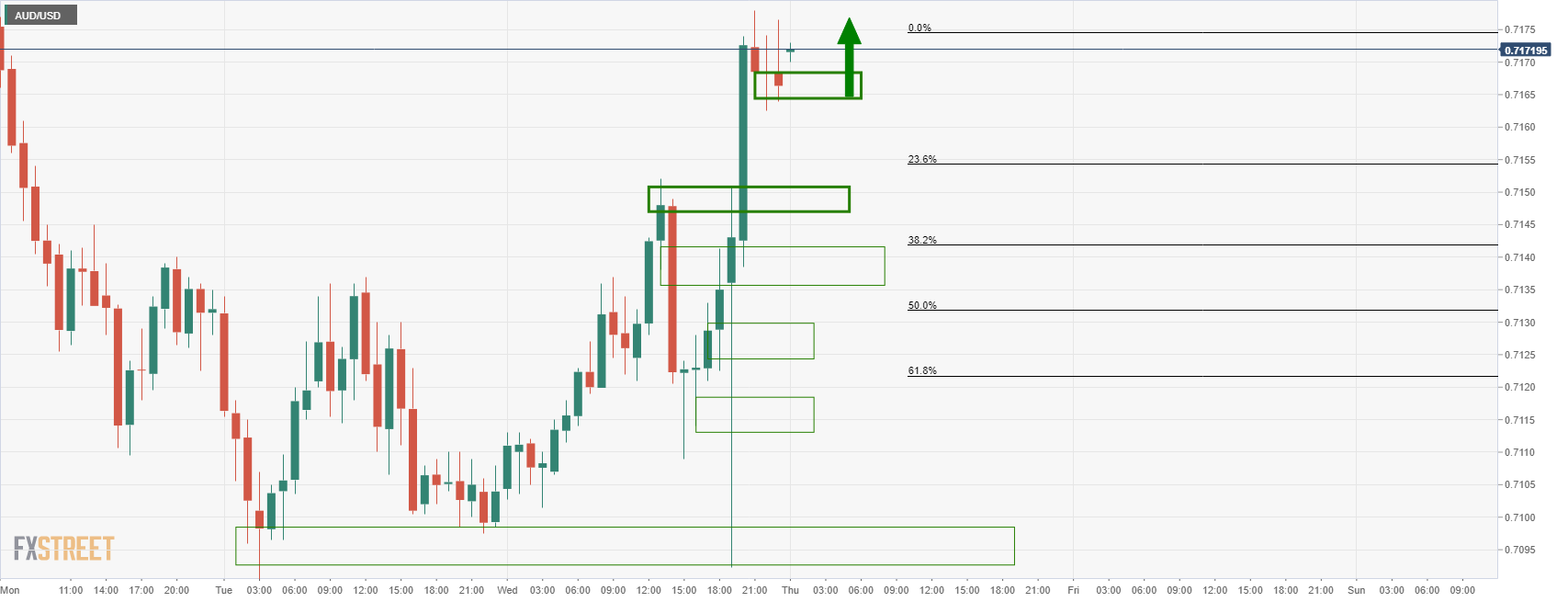

Aussie Unemployment Rate big beat supports AUD/USD

Australia’s November labour force survey has been released as follows:

- Australian Unemployment Rate Nov: 4.6% (exp 5.0%; prev 5.2%). This is a huge beat.

- Employment Change Nov: 366.1K (exp 200.0K; prev -46.3K). This is also very impressive.

- Participation Rate Nov: 66.1% (exp 65.5%; prev 64.7%).

AUD/USD reaction

Prior to the data release, the price was undergoing a post-Fed-volatility correction to the downside. However, the data is positive for an otherwise dubious bid in the Aussie.

The sentiment prior to the data was that a solid post-lockdown momentum through October, as indicated by the lift in payrolls, suggested a robust gain for employment. Nevertheless, the data is very encouraging for the AUD, at least in the meantime. The participation rate was higher so the Unemployment Rate is impressive.

The Reserve Bank of Australia sees the economy as likely to return to its pre-Delta path in the first half of 2022, but there will not be any rate rises next year which leaves the divergence between the Federal Reserve and the RBA a negative factor for AUD in the medium term.

About the Unemployment Rate

The Unemployment Rate released by the Australian Bureau of Statistics is the number of unemployed workers divided by the total civilian labour force. If the rate hikes indicates a lack of expansion within the Australian labour market. As a result, a rise leads to weakening the Australian economy. A decrease of the figure is seen as positive (or bullish) for the AUD, while an increase is seen as negative (or bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.