- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD near monthly lows, Fed meeting to challenge current range

Gold Price Forecast: XAU/USD near monthly lows, Fed meeting to challenge current range

- Gold is moving sideways with a bearish bias ahead of the FOMC.

- Volatility likely to jump around Fed’s statement.

- XAU/USD looking at December lows, all can change dramatically.

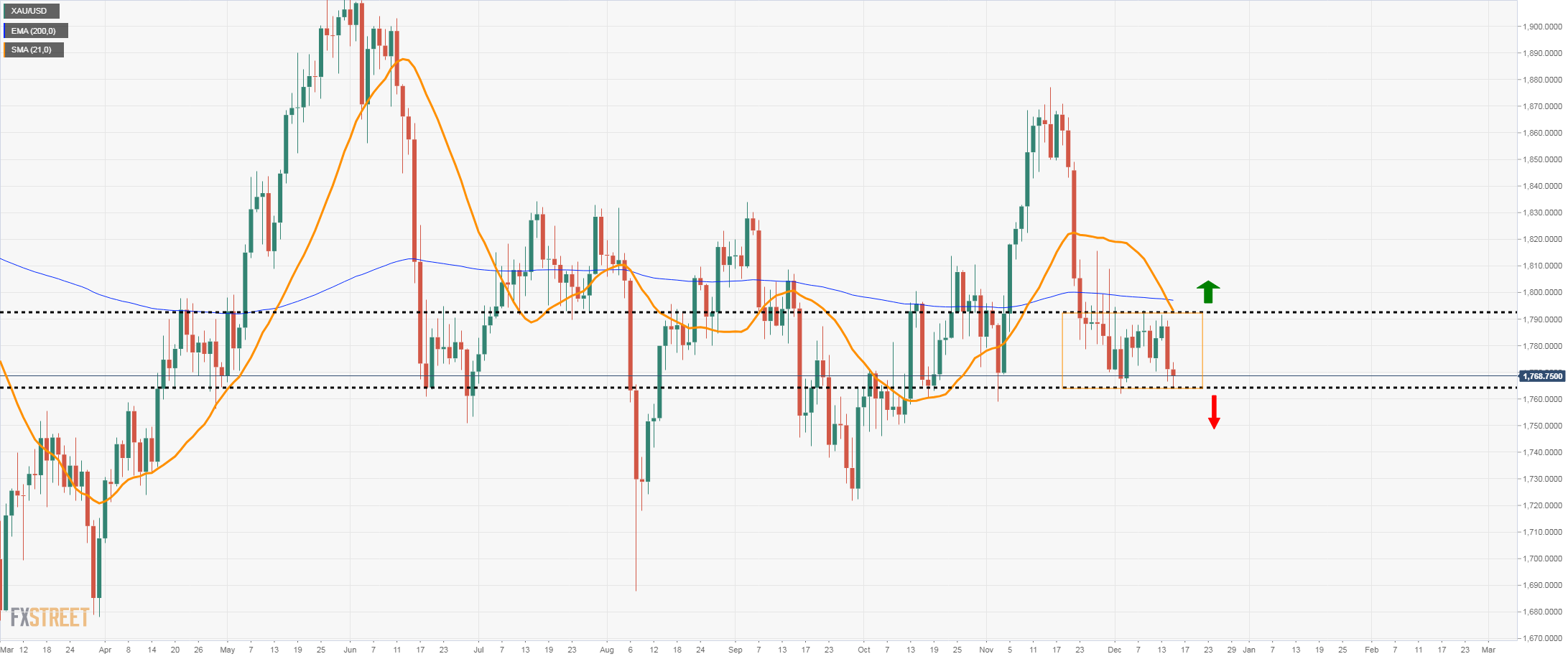

Gold is falling on Wednesday, before the decision of the Federal Reserve. Recently it bottomed at $1763m the lowest since December 3 and then rebounded toward $1770. Price is moving sideways with a bearish bias.

The US November retail sales report came in below expectations and boosted gold for a few minutes. After reaching $1774, it turned to the downside amid a stronger US dollar during the American session.

The risk aversion environment kept US yields under control and offered some support to gold. What the Fed decides and what Powell says will have a large impact on the Treasury market, hence in gold prices. The statement will be released at 19:00 GMT, including the projections of FOMC members.

Levels to look for after Fed

Gold had been moving sideways since December and is has established to critical levels. On the upside is the area around $1790/95, a horizontal line, and also near the 20 and 200-day moving averages. A firm break above and a confirmation should clear the way to more gains above $1800.

On the flip side, $1765 is a key level that should lead to more losses if broken on a sustained basis, targeting $1745/50. Below the next support stands at $1730.

Volatility and exaggerated moves are likely during the FOMC announcement and later during Powell’s press conference.

Technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.