- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Greenback slides and offsets rising US yields

Gold Price Forecast: Greenback slides and offsets rising US yields

- Gold is flat and sideways in consolidating markets awaiting a catalyst.

- US CPI and central banks are in focus while the greenback disconnects with US yields.

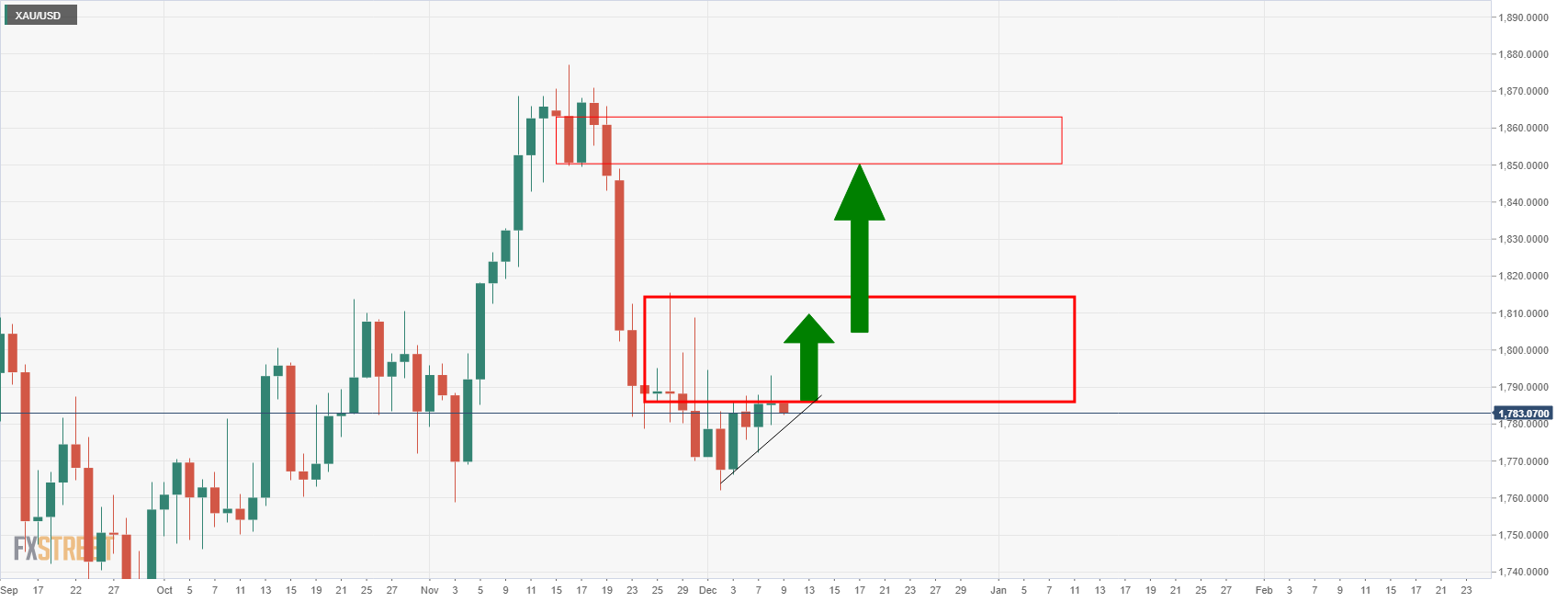

Gold, XAU/USD, is consolidating in the $1,779 and $1,793 range with markets trying to assess the outlook with regards to inflation, central banks and the uncertainty surrounding the Covid-19 variant.

In the Federal Reserve's blackout period, gold prices were little changed on Wednesday while the US dollar slid and offset firmer US Treasury yields ahead of this week's US Consumer Price Index. Investors are likely squaring their positions in the run-up to the key data.

''We expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validating in the near term,'' analysts at TD Securities said.

''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

The data will be important for traders as the monitor for an acceleration in the pace of tapering by the Federal Reserve, potentially to start as soon as this month.

Hawks may call for a March hike if US November inflation data comes in higher than expected on Friday. Clues as to the probability of a March hike will then be provided by the Fed next week (Dec. 15), when it is expected to announce an accelerated tapering of its bond purchases. Meanwhile, the benchmark US Treasury yields climbed, dimming gold's appeal with the narrative shifting back to central banks' tightening policy, which was likely to boost the US dollar.

''With inflation prints expected to remain elevated in the early months of the year, the market's pricing for Fed hikes could still become more aggressive, but we expect that it will ultimately prove to be far too hawkish,'' analysts at TD securities argued.

''In fact, with both an accelerated taper and more than three rate hikes already priced in for 2022, the balance of risks for gold positioning remains to the upside, as geopolitical risks and virus risk could catalyze a positioning reshuffling.''

Gold technical analysis

The price of gold is stuck in familiar territory and the monthly chart illustrates that space is running out for the bulls. A break of the symmetrical triangle opens the risk of a breakout to the downside which could be potentially significant if $1,700 gives out.

From a daily perspective, the price needs to break beyond the $1,810 level for space to $1,850.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.