- Analytics

- News and Tools

- Market News

- EUR/USD bulls keep the pace up, eye 1.1300

EUR/USD bulls keep the pace up, eye 1.1300

- EUR/USD is attempting to move higher despite the bearish prospects on the hourly chart.

- Risk-on themes are making their way through to Asian markets on Wednesday.

The greenback in sliding in Asia and the euro has extended gains on a strong hourly impulse that started in the early hours of the Nother American session on Tuesday. Concerns over the severity of the omicron virus strain continued to fade which supported riskier asset classes. China also announced measures to boost economic growth which lifted stocks and fed through into the forex space.

At the time of writing, the single currency is on the front foot vs the greenback, printing a fresh corrective high in Tokyo of 1.1277. The US dollar index is down on the day and extending its losses from overnight despite the Federal Reserve Chair Jerome Powell's hawkish stance.

Meanwhile, US stocks rallied the most in nine months, with major averages rising at least 2% on hopes that the omicron variant will not derail global growth. Consequently, US treasuries fell, causing two-year yields to reach their highest level since March 2020. The CBOE volatility index also fell five points to 22 as the risks of the covid variant abate.

In terms of data, the US trade deficit shrank, while third-quarter productivity fell. Private consumption was the most important driver of the eurozone's most recent economic expansion. In the eurozone, Industrial Production in Germany outperformed in October gaining 2.8% MoM. However, the ZEW Survey of Expectations for December weakened from the previous month but was stronger than expected.

US CPI eyed

Looking ahead for the week, the US Consumer Price Index will be key. ''We expect inflation to slow significantly as fiscal stimulus fades and supply constraints ease, but we don't expect the data to be validating in the near term,'' analysts at TD Securities explained. ''The CPI likely surged in Nov, with a drop in oil coming too late to avert another large gain in gasoline and core prices boosted by rapidly rising used vehicle prices and post-Delta strengthening in airfares and lodging.''

EUR/USD technical analysis

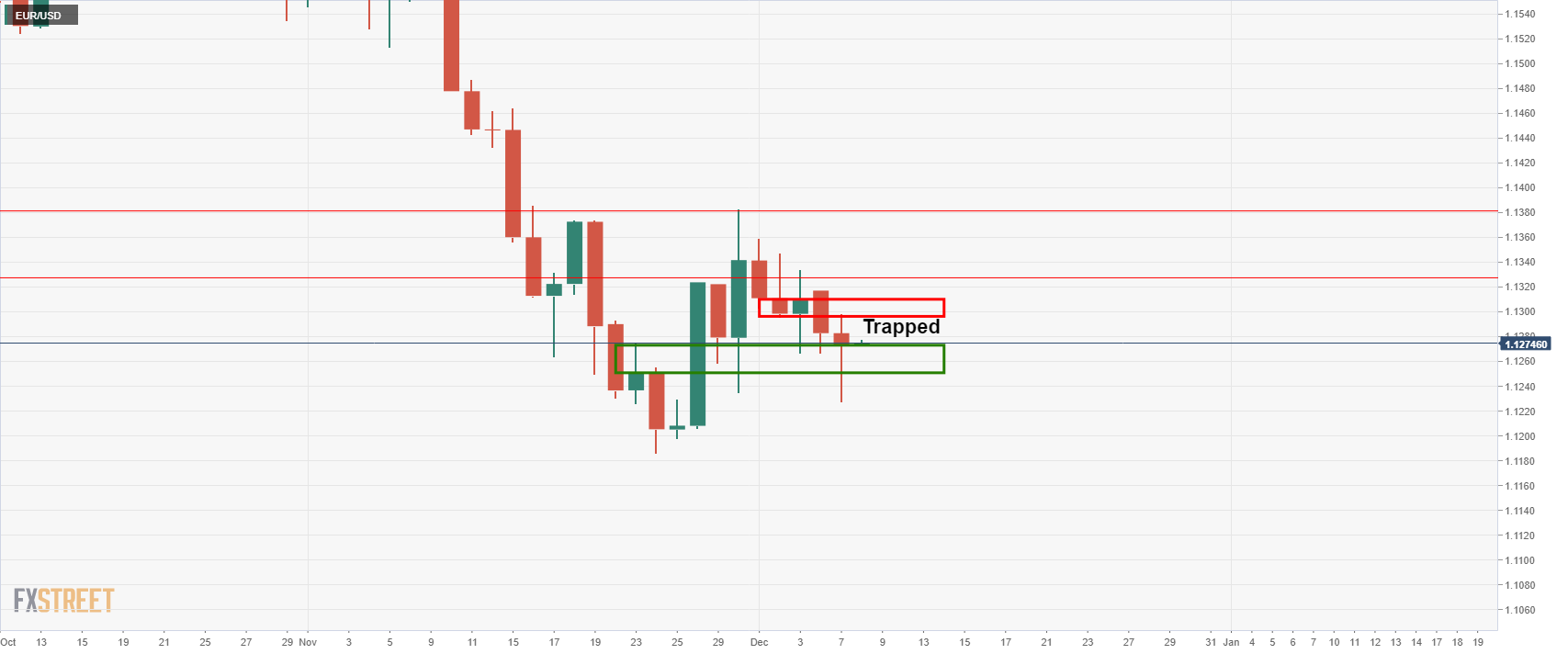

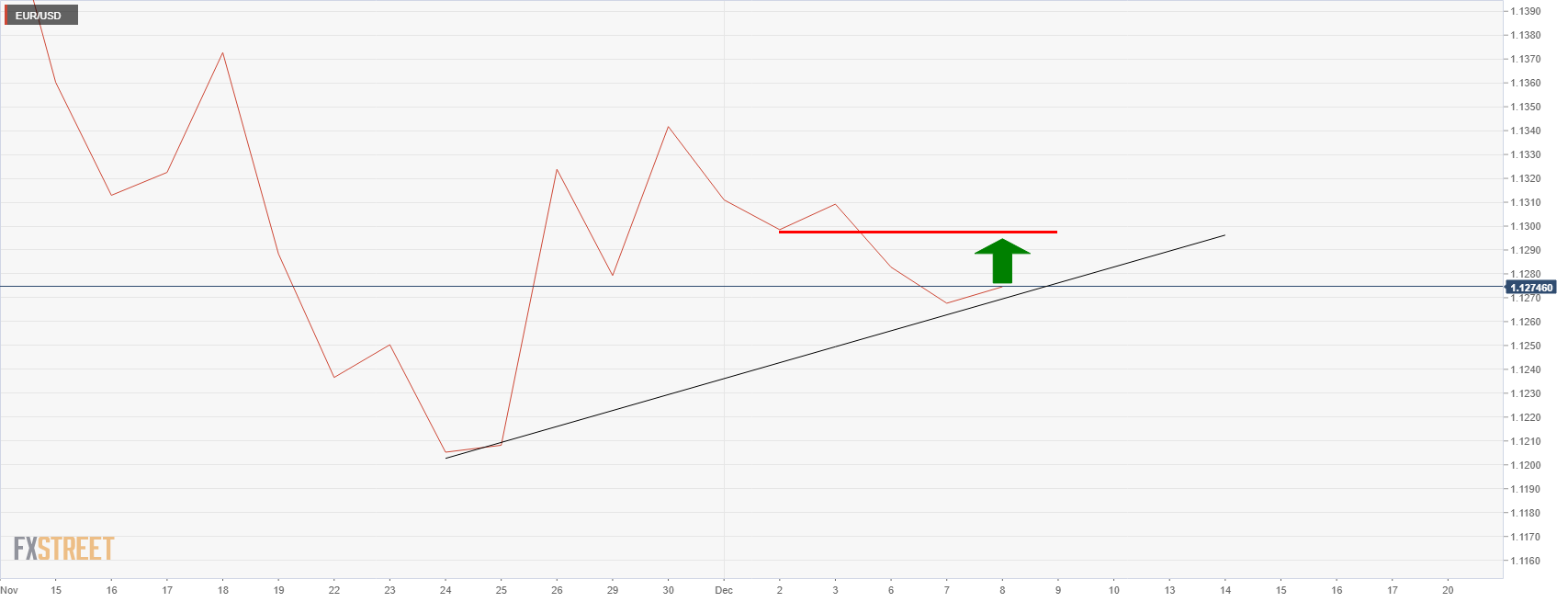

From a daily perspective, the price is trapped between support and resistance with 1.1300 the upside target, as per the following line chart's analysis:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.