- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Bulls look to test 0.71 the figure

AUD/USD Price Analysis: Bulls look to test 0.71 the figure

- AUD/USD bears look to 0.68 the figure and bulls to 0.71 the figure.

- RBA event today will be key for the pair that is otherwise correcting in a semi-risk-on environment.

AUD/USD was a strong performer at the start of the week and benefitted from the risk-off unwind that occurred on the back of positive sentiment surrounding the covid headlines. These indicate the new variant is less severe.

Consequently, AUD/USD has taken on the mid-point of the 0.70 area and is now consolidating ahead of the Reserve Bank of Australia risk later today.

There is little chance of a continuation ahead of the event but every chance that volatility could arise around it. The following illustrates the bullish and bearish outcomes that could arise one way or the other from a technical perspective.

AUD/USD bullish prospects

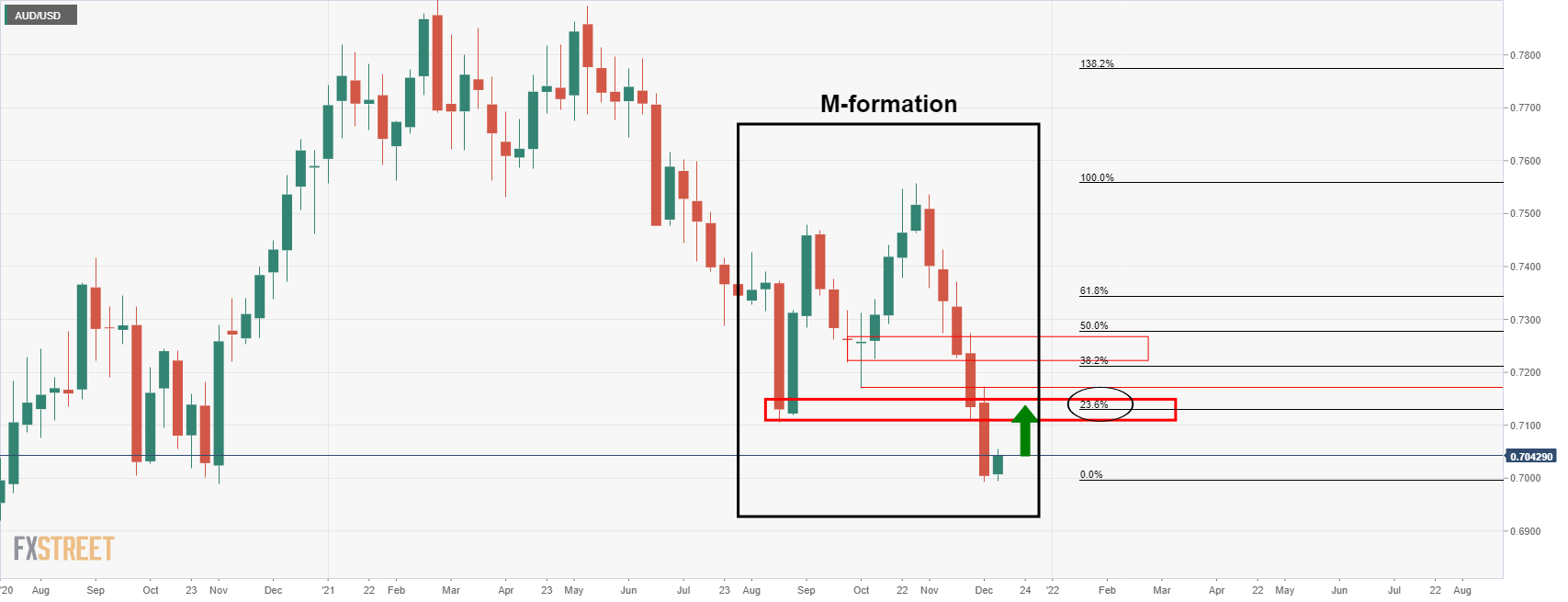

From a long term analysis, the M-formation, which is a bullish reversion pattern, has been illustrated as follows:

As seen, there is a structure between 0.7108/30 that the price could move into that has a confluence with the 23.6% Fibonacci retracement through 0.71 the figure near 0.7130.

From an hourly perspective, the price has met resistance at the 61.8% Fibo of the prior hourly bearish impulse. The price is now correcting that rally to the 38.2% Fibonacci level near the 21-EMA. The support is located between here and the 61.8% of the latest bullish impulse. If this were to hold, then there are prospects of a continuation to the next layer of resistance near 0.7070. On a break of there, then there is space all the way to 0.71 the figure.

AUD/USD bearish outlook

If the downside is not over, then the hourly chart's trajectory from a bearish perspective is layered with support as illustrated above. 0.7030 and 0.7010 could be levels of support that guard a breakout and a downside extension on the daily time frame:

0.68 the figure could be targetted with 0.6780's acting as support below there.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.