- Analytics

- News and Tools

- Market News

- USD/TRY records a new all-time high near 13.90, recedes afterwards

USD/TRY records a new all-time high near 13.90, recedes afterwards

- USD/TRY fades an initial spike to the vicinity of 13.9000.

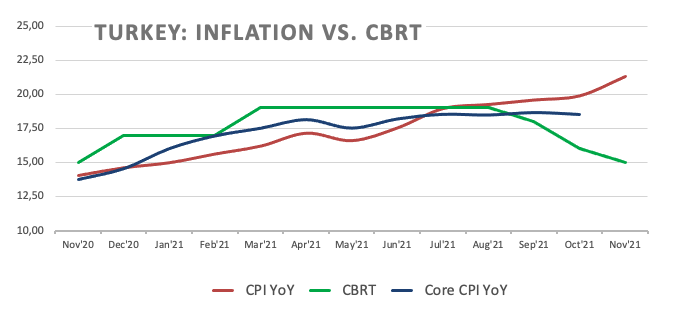

- Turkey’s inflation rose more than expected in November.

- The CBRT intervened once again in the FX markets.

USD/TRY advances further and records a new all-time high in the vicinity of 13.90 on Friday.

USD//TRY looks to CBRT, intervention

Following the record tops, the Turkish central bank (CBRT) announced it directly intervened in the FX markets, always citing the “unhealthy price formations in exchange rates” as some sort of justification. Following the CBRT move, spot dropped to the 13.30 region as the lira (apparently) regained attraction.

The lira, in the meantime, continues to suffer the lack of credibility in the CBRT, which keeps undermining the prospects for the currency in the longer run. That’s not even considering the persistent interference of politics in the design of the monetary policy by the CBRT.

In addition, inflation figures in Turkey showed the CPI rose more than expected in November, this time 21.31% YoY and 3.51%, surpassing initial forecasts. Additionally, Producer Prices rose 9.99% inter-month and 54.62% over the last twelve months.

USD/TRY key levels

So far, the pair is losing 0.11% at 13.6106 and a drop below 12.3585 (low Dec.1) would open the door to 11.5451 (low November 24) and finally 11.4583 (20-day SMA). On the other hand, the next up barrier lines up at 13.8746 (all-time high Dec.1) followed by 14.0000 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.