- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Bulls await US Nonfarm Payrolls, eye 1.30s

USD/CAD Price Analysis: Bulls await US Nonfarm Payrolls, eye 1.30s

- USD/CAD is making tracks to the upside with the 1.30s are in sight.

- The month and weekly targets are clear and Fridays Nonfarm payrolls could be the deciding factor.

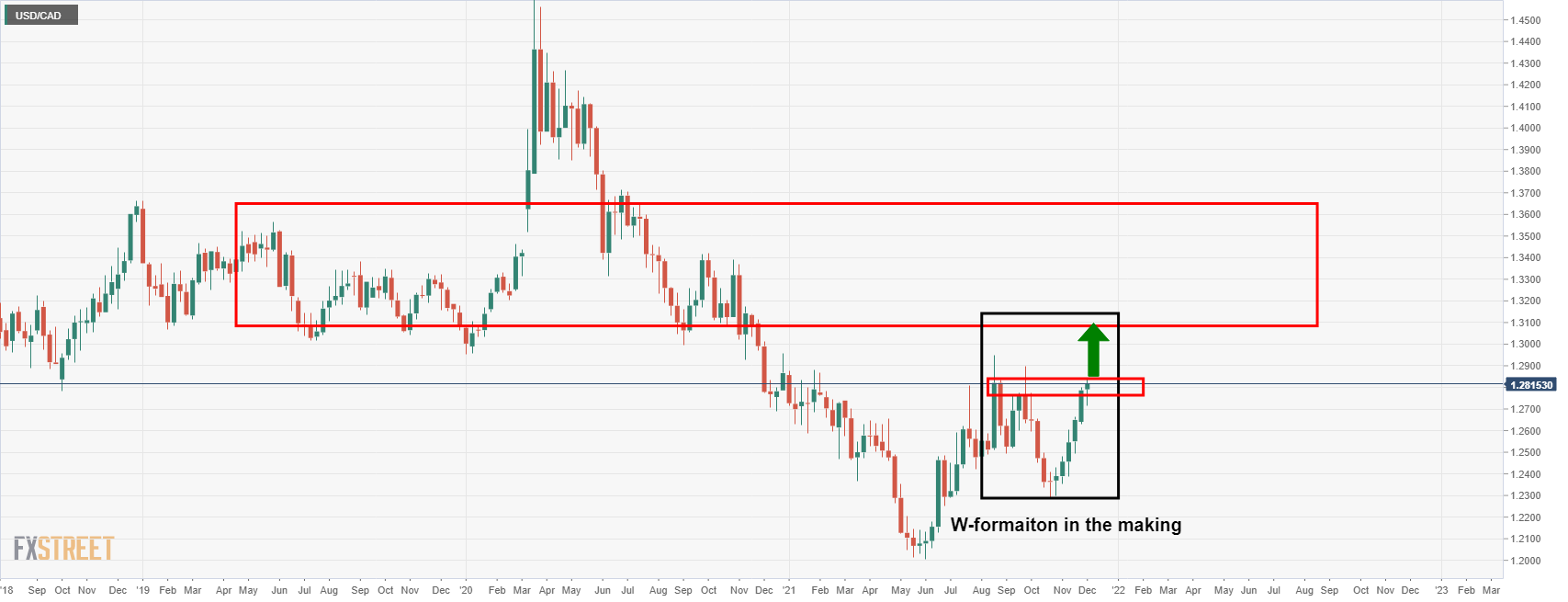

USD/CAD is on the move and the bulls are in control from a longer-term perspective. The following illustrates the prospects of a run all the way into test the 1,30's in the coming days. However, US Nonfarm Payrolls will be critical in this regard.

The greenback earlier gained after US data showing initial claims for state unemployment benefits rose 28,000 to a seasonally adjusted 222,000 for the week ended Nov. 27, lower than the forecast of 240,000. Today, Payrolls probably surged again, according to analysts at TD Securities.

''A strong trend continues to be signaled by surveys and claims, but our forecast also reflects the latest Homebase data—with a decline in the Homebase series more than accounted for by seasonality. Along with our +650k forecast for payrolls, we forecast a 0.2pt decline in the unemployment rate and a 0.4%m/m (5.0% y/y) rise in hourly earnings.''

USD/CAD monthly chart

The bulls are in charge and there is overhead resistance that could be tested in the coming days near 1.2995.

USD/CAD weekly chart

The weekly outlook has the price on the verge of making a W-formation. There needs to be some more upside, however. The bulls can target the key monthly resistance at 1.3050 once 1.30 is cleared. On the flip side, the W-formation would be expected to attract bears in to test the neck line near 1.2770.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.