- Analytics

- News and Tools

- Market News

- Silver under pressure as Fed's Powell confirms hawish bias despite covid threats

Silver under pressure as Fed's Powell confirms hawish bias despite covid threats

- Silber bulls are stepping in as the greenback gives back territory to the stubborn euro.

- Eurozone data arrived hot and put the ECB's dovishness into question.

- if the ECB is seen to align with the Fed, euro can rally and the dollar will be pressured, helping commodities recover.

The price of silver was a touch lower on the day despite a strong rally in the US dollar. Equities sold off and bond yields lifted as Fed Chair Jerome Powell indicated the Fed might consider accelerating the taper of bond purchases as inflation persists. At the time of writing, the white metal is down some 0.33% after falling from a high of $23.312 to a low of $22.6935.

The greenback did not manage to stay on top for long as the eurozone data came in hot. This enabled the euro to correct a strong sell-off considering the European Central Bank may not be able to ignore the risks of higher inflation for longer. Inflation in Europe hit a record in November with the headline inflation up 4.9% YoY and core inflation up 2.6% YoY. At this point, the ECB continue to insist the current high rate of inflation will not persist. On the same day, there was better news on the Unemployment Rate in Germany as well. The Unemployment rate fell in Germany by 0.1% to 5.3% in November as claims decreased by 34k. This data was slightly better than expected but ''Germany’s labour market still has some way to go to fully recover'', analysts at ANZ Bank argued.

Meanwhile, this morning the Fed Reserve Chair Jerome Powell conceded that it is time to talk about a fast rate of tapering. he noted that inflation can no longer be considered “transitory” as the risks of persistently higher inflation have grown.

''Despite the market uncertainty caused by the emergence of the Omicron variant of COVID, Powell indicated it may be time to further curb the rate of bond purchases,'' analysts at ANZ Bank explained.

''While this form of monetary policy tightening had previously been announced, Powell now says the bond purchase programme may need to end sooner than previously signalled. He stated that the economy is very strong and inflationary pressures are strong therefore it is appropriate to consider wrapping up the taper of asset purchases a few months early, and this will be discussed at the next Fed meeting.''

The analysts argued that this indicates the bond purchase programme may be wrapped up by March 2022 with the final purchases occurring in February.''

Consequently, the DXy shot higher to test the 96.65 territories. The euro, however, was above to battle back in a 61.8% Fibonacci retracement and this weighed don the greenback that fell back to test 96 the figure towards the close on Wall Street.

Meanwhile, analysts at TD Securities explained that the selling flow from China Smart Money funds has continued to weigh on silver, with the group substantially growing their short during the commodity carnage in last Friday's session.

''Interestingly, the recently added Shanghai gold length has remained resilient to the technical failure, but Shanghai silver traders' growing short fits with our view of a more vulnerable fundamental outlook for the white metal, despite the resiliency thus far observed in price action.''

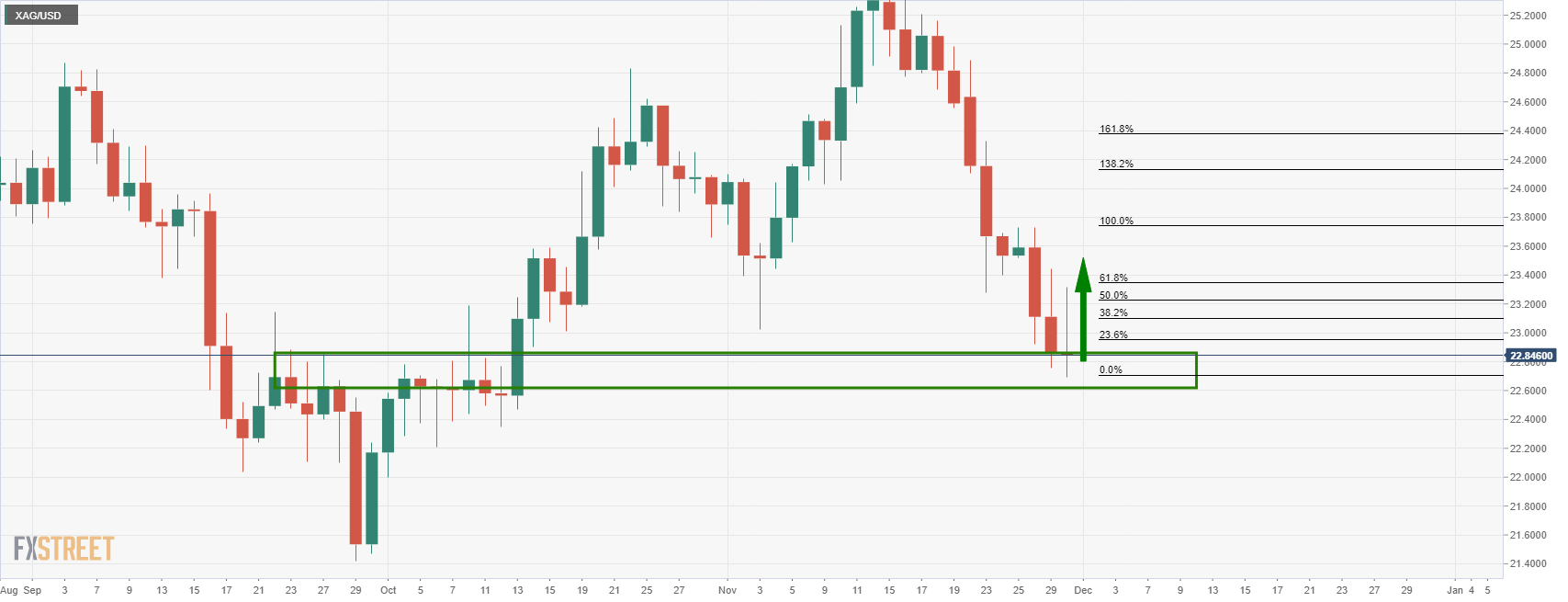

Silver technical analysis

As the dust settles, the bulls will be looking for a correction, potentially as far as a test of the 61.8% golden ratio and into the prior support structure near $23.60. A break of the current support, however, opens risk to a run into the $21.50 regions.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.