- Analytics

- News and Tools

- Market News

- Silver Price Analysis: XAG/USD clings to gains below mid-$23.00s, bearish potential intact

Silver Price Analysis: XAG/USD clings to gains below mid-$23.00s, bearish potential intact

- Silver edged higher on Monday and recovered a part of the previous session’s heavy losses.

- The bias seems tilted in favour of bearish traders and supports prospects for further losses.

- A sustained move beyond the $24.00 mark is needed to negate the near-term bearish outlook.

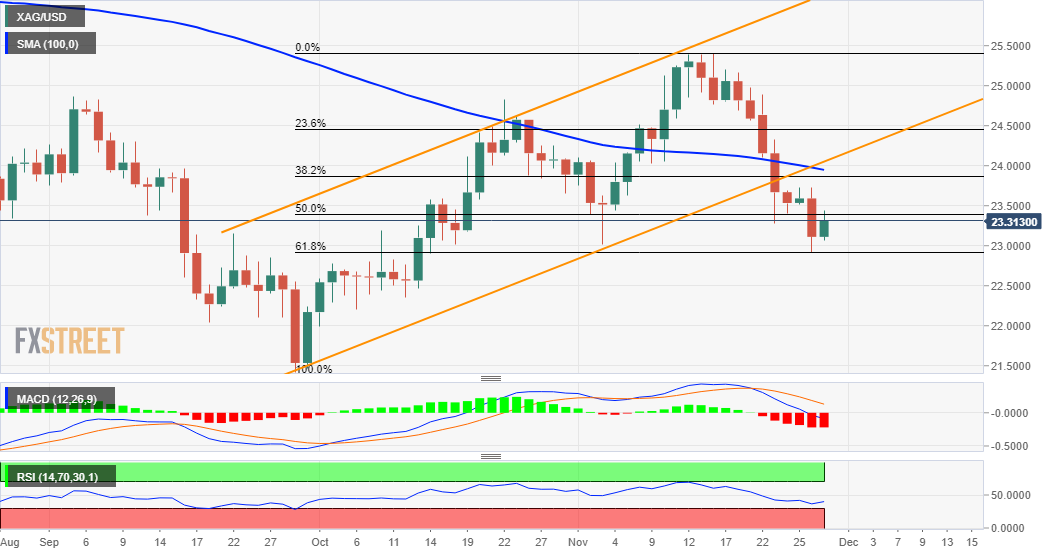

Silver regained positive traction on the first day of a new week and recovered a major part of Friday's slide to sub-$23.00 levels, or the lowest level since October 14. The white metal maintained its bid tone through the first half of the European session and was last seen trading just below mid-$23.00s, up nearly 1% for the day.

Looking at the broader picture, the recent sharp retracement slide from the vicinity of mid-$25.00s stalled near support marked by the 61.8% Fibonacci level of the $21.42-$25.41 strong move up. This should now act as a key pivotal point for short-term traders, which if broken decisively should pave the way for further near-term losses.

Given last week's sustained break below the 100-day SMA and an ascending channel confluence support, the bias seems tilted firmly in favour of bearish traders. The negative outlook for the XAG/USD is reinforced by bearish technical indicators on the daily chart, which are still far from being in the oversold territory.

Hence, any subsequent positive move towards the $23.70-75 region might still be seen as a selling opportunity and remain capped near the $24.00 confluence breakpoint. The latter coincides with the 38.2% Fibo. level, which if cleared could shift the bias in favour of bulls and push the XAG/USD to the $24.45-50 region (23.6% Fibo. level).

On the flip side, the $23.10-$23.00 area might now protect the immediate downside. A convincing break below will reaffirm the bearish bias and turn the XAG/USD vulnerable. The next relevant support is pegged near the $22.70-65 region, below which the commodity could eventually drop to test the $22.30-25 support en-route the $22.00 mark.

Silver daily chart

Technical levels to watch

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.