- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bounces off $1,780 support on Thanksgiving Day

Gold Price Forecast: XAU/USD bounces off $1,780 support on Thanksgiving Day

- Gold grinds higher around intraday top following a bounce off three-week low.

- Sluggish market conditions trigger corrective pullback from the near-term key support level.

- Yields failed to cheer hawkish Fed Minutes, inflation data on Wednesday.

Gold (XAU/USD) snaps a five-day downtrend while printing 0.25% intraday gains around $1,792 during early Thursday.

The yellow metal dropped to the lowest level since November 04 the previous day before bouncing off $1,778. While a pullback in the US Treasury yields could be linked to the gold’s rebound, strong technical support around $1,780 also played its role to trigger the corrective pullback. That said, the recovery moves remain lackluster during Asia as the US markets are off due to the Thanksgiving Day holiday and there are no major releases from elsewhere.

The US 10-year Treasury dropped 2.2 basis points (bps) to 1.64% after refreshing monthly high the previous day even as the Federal Open Market Committee (FOMC) Minutes said, “Some participants said faster taper could be warranted.” Further, Federal Reserve Bank of San Francisco President and FOMC member Mary Daly who sees, per Reuters, the case for speeding up the QE taper and expects rate hikes at end of 2022 also portrayed hawkish bias at the Fed.

Additionally, a 30-year high print of the Fed’s preferred inflation gauge, namely the US Personal Consumption Expenditures - Price Index, also should have favored the yields. The stated inflation indicator jumped to 5.0% YoY in October, surpassing 4.6% expected figures and 4.4% prior.

The reason for the bond buyers to keep the reins could be linked to the recently sluggish US inflation expectations, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data. The stated gauge reversed the previous day’s bounce off a three-week low on Wednesday to print a 2.61% level.

While the inflation woes are likely not to have any fresh catalysts today, gold traders may keep eyes on the latest covid woes, which if escalated can pull the commodity back to the key support. . After Austria and the Netherlands, record-high cases in Germany triggered multiple warnings to recall the lockdowns from the region.

“Coronavirus infections broke records in parts of Europe on Wednesday, with the continent once again the epicenter of a pandemic that has prompted new curbs on movement and seen health experts push to widen the use of booster vaccination shots,” said Reuters.

Technical analysis

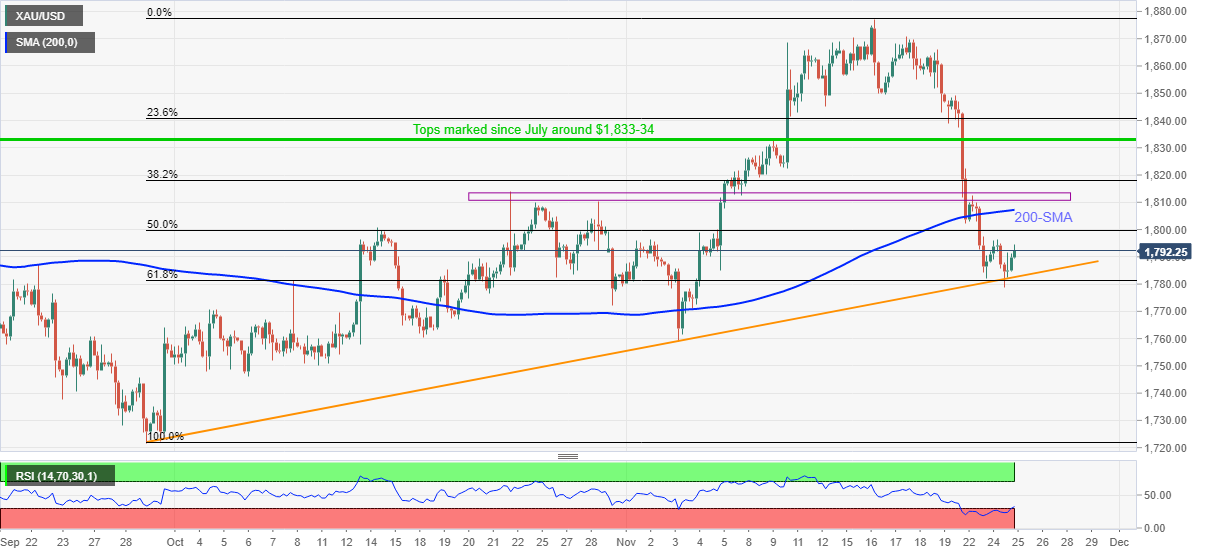

A clear downside break of a one-month-old horizontal area and 200-SMA weighed on the gold prices during the early week.

However, oversold RSI conditions favor a corrective pullback from a two-month-long ascending support line and 61.8% Fibonacci retracement (Fibo.) of September-November upside, near $1,780.

The recovery moves remain elusive until crossing the 200-SMA and the aforementioned support-turned-resistance area, respectively near $1,806 and $1,810-13.

Should gold buyers dominate past $1,813, November 09 swing high around $1,833 will join the tops marked in July and September near $1,834 to offer a tough nut to crack. Following that, the mid-November swing low near $1,850 will be in focus.

Meanwhile, a clear downside past $1,780 will aim for the multiple lows near $1,759 before jostling with multiple supports near $1,748-47.

In a case where gold sellers conquer the $1,747 support, the odds of a slump targeting September’s low around $1,721 can’t be ruled out.

Gold: Four-hour chart

Trend: Further recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.