- Analytics

- News and Tools

- Market News

- GBP/JPY Price Analysis: Bulls pressing against critical breakout territories

GBP/JPY Price Analysis: Bulls pressing against critical breakout territories

- GBP/JPY imbalances in view from lower to longer time frame perspectives.

- Bulls seeking a breakout out of longer-term dynamic resistance.

There is little to be said on the shorter-term time frames for GBP/JPY as the cross gyrates with no clear directional bias as the price rounds-off the downtrend and teases with a change of trajectory:

GBP/JPY H1 chart

The price is wedged between dynamic support and resistance in the near term and trapped between horizontal support and resistance as well. The real meat on the bone will come from a break of these horizontal areas that would be expected to equate into a fresh trend, above or below the 50-EMA, one way or the other.

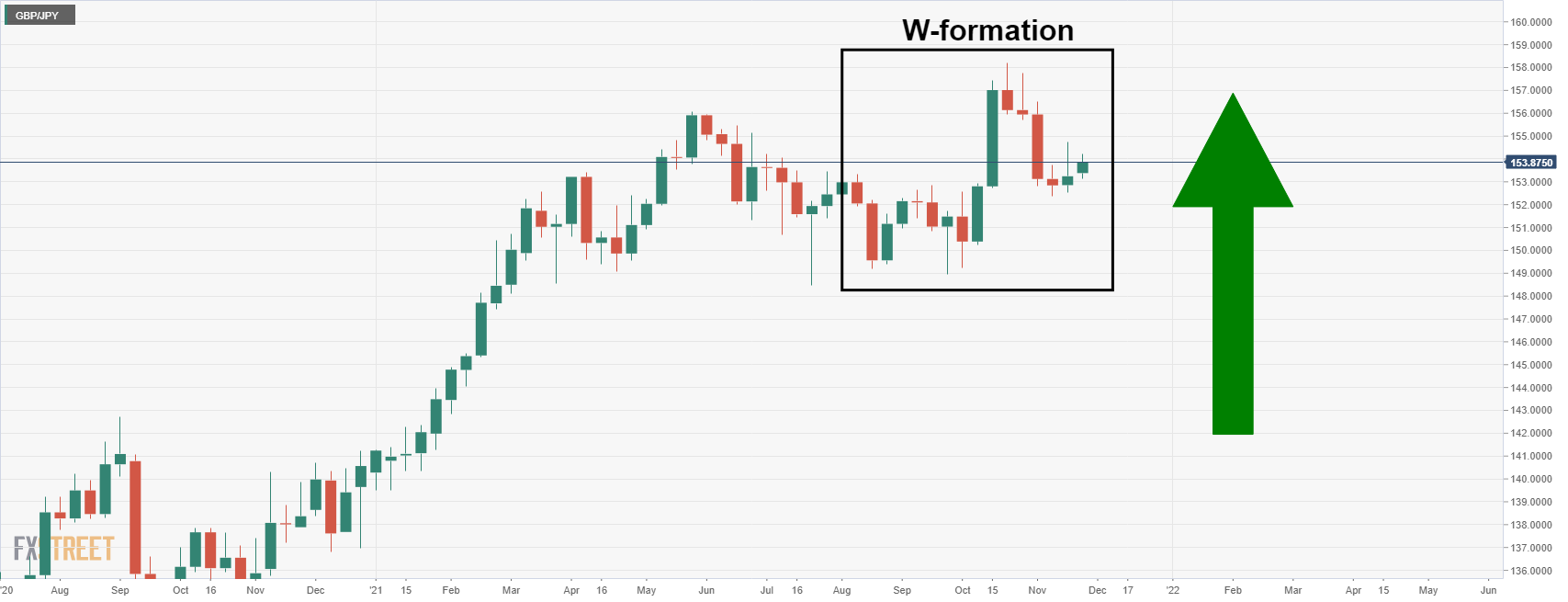

GBP/JPY weekly W-formation

This brings us to the longer-term charts to give us some context. As illustrated, the price is in an overall uptrend. It has just completeda test of the neckline of the W-formation within the dominant uptrend which leaves the upside bias a favoured outcome.

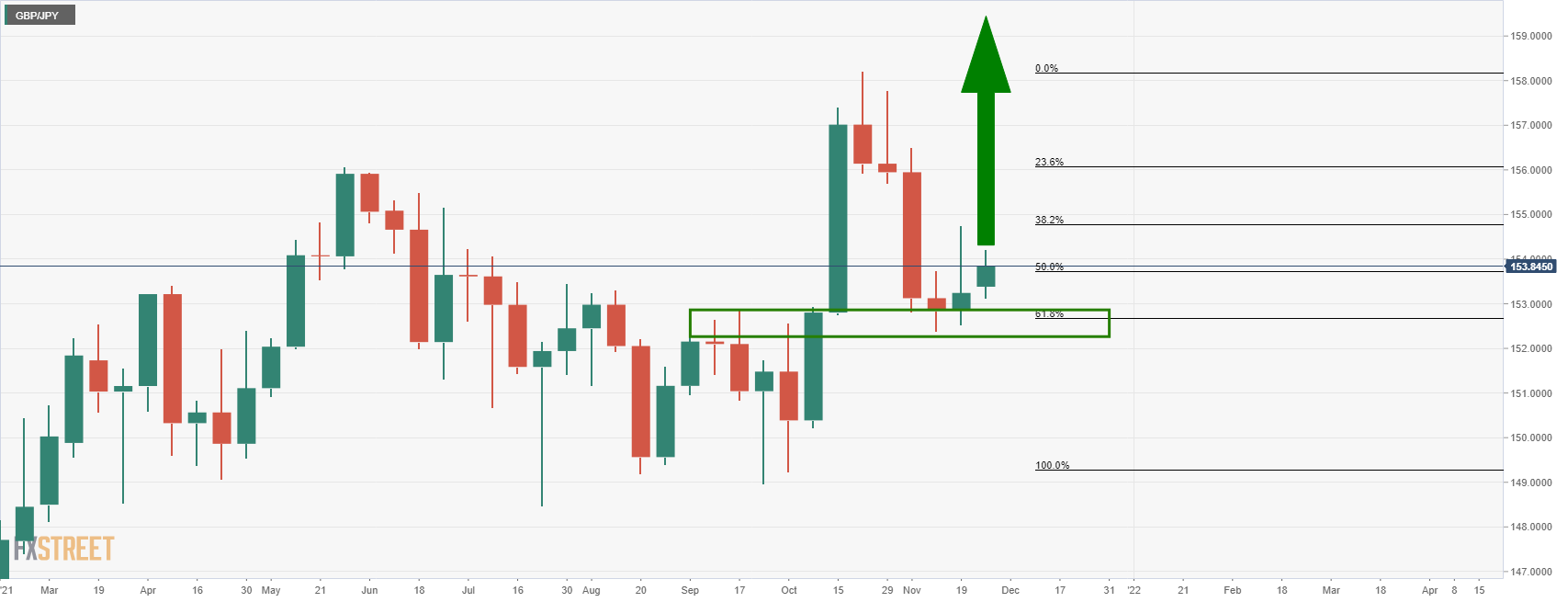

GBPJPY weekly bullish outlook

The price fell sharply to the nose of the W-formation in a 61.8% Fibonacci retracement. This means there is little volume between here and the 156.20's for which bulls will look to exploit. We can also see this clearly n the hourly chart:

This leaves the bias to the upside while the price pushes against the longer-term trendline resistance.

GBP/JPY weekly bearish alternative

However, that is not to say that the bears are out of the game. Given the 38.2% Fibonacci retracement that we have seen already, subsequent attempts to sell into the strength as bears fade the bullish commitments could lead to a sharp sell-off. The imbalance between the 150.15 and 152.70s could be mitigated by the bears as well. However, the path of least resistance does currently appear to be to the upside.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.