- Analytics

- News and Tools

- Market News

- NZD/JPY Price Analysis: Bears await patiently in the trees to pounce on the kiwi again

NZD/JPY Price Analysis: Bears await patiently in the trees to pounce on the kiwi again

- NZD/JPY bears remain on the lookout for an optimal entry to the downside to targeting 79 the figure.

- Corrections could be the first port of call as markets over into consolidation.

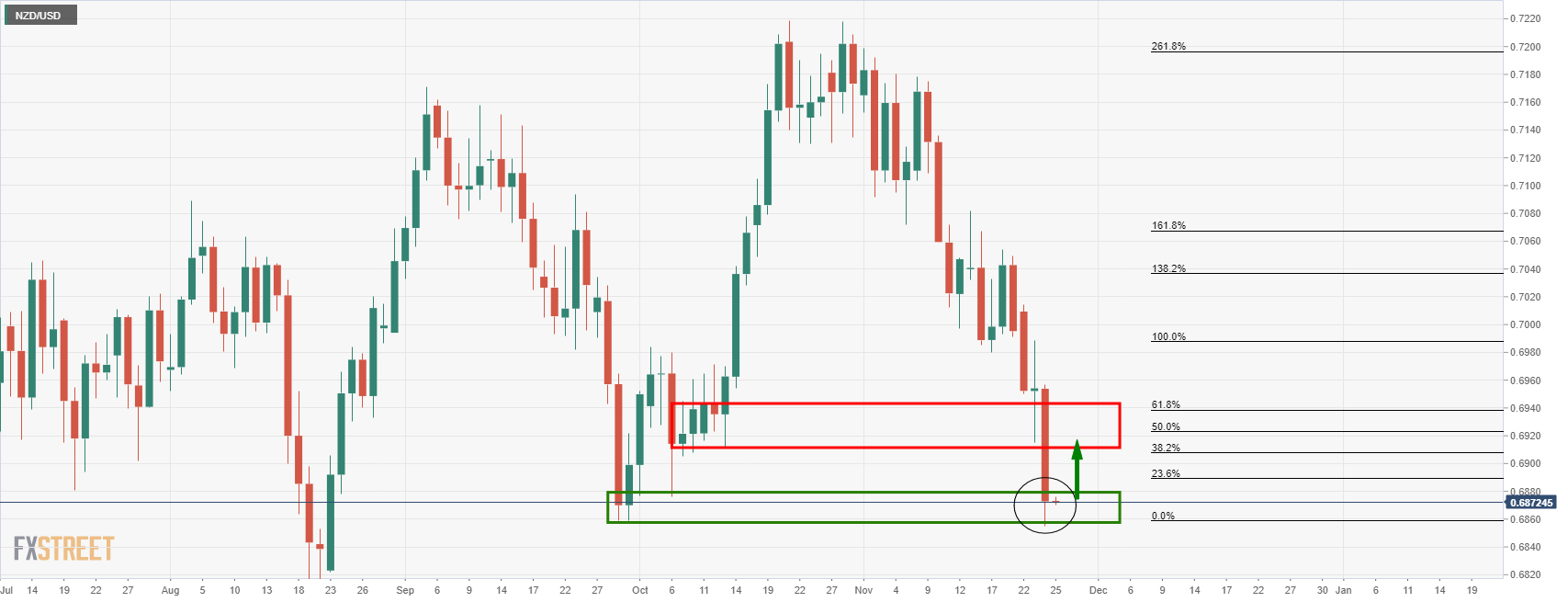

The bears were at it overnight and dishevelled the cross all the way towards a 61.85 Fibonacci retracement area on the daily chart. This was an outcome of the Reserve Bank of New Zealand meeting that disappointed the bulls that were in anticipation of a 50bs rate hike. Instead, the central bank delivered a 25bp hike and the kiwi subsequently collapsed.

The following was the prior analysis before the event that is followed by the aftermath and the prospects for a continuation to the downside in both NZDPY and NZD/USD, but not for a correction.

NZD/JPY daily chart, prior analysis

As illustrated, the price was on the cups of a continuation towards the horizontal support near 79 the figure.

There is still some way to go yet, but the foundations have been laid as the price well and truly breaks down the barriers of the 50% mean reversion area near 79.60. However, we now move into a quiet spell given the US holiday-thin markets.

A period of consolidation that could well lead to a positive correction in the kiwi would likely see the cross move in on the 79.80s being the old closes of the prior candles:

However, that is not to say the price cannot continue lower before such a considerable correction. But looking to the NZD/USD chart, the kiwi does look to be oversold and too in need of a correction:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.