- Analytics

- News and Tools

- Market News

- Gold Price Analysis: Bears in charge as US dollar firms

Gold Price Analysis: Bears in charge as US dollar firms

- Gold is under pressure as the US dollar continues to move higher.

- DXY was in a few pints away from the 97 figure on Wednesday as hawks circle above the Fed.

The price of gold on Wednesday was pressured by a surging US dollar and higher volatility on the day. The greenback is in favour as hawkish best ramp up surrounding the Federal Reserve. XAU/USD is down -0.12% at the time of writing and up from the lows of $1,778.61 as the US dollar consolidates into the Thanksgiving holidays and close on Wall Street.

ECB/Fed divergence underpinning the US dollar

On the day, the greenback printed a fresh 16-month high against the euro and the DXY marked territory just shy of 97 the figure. Investors are pricing up the prospect of the Federal Reserve hiking rates in mid-2022 and tapering at a faster pace, potentially commencing such an adjustment as soon as the December meeting. By contrast, the European Central Bank is concerned about covid and growth more so and remains in the dovish camp.

Fed officials sounding more hawkish

Fed officials have been sound far more hawkish of late due to stubbornly high inflation and in today's trade, San Francisco Fed President Mary Daly changed her tune. "If things continue to do what they've been doing, then I would completely support an accelerated pace of tapering," Daly said during an interview with Yahoo Finance published on Wednesday.

daly now advocates for a faster pace of tapering, echoing the rhetoric of Fed Vice Chair Richard Clarida. The vice-chair said last week that the December 14-15 meeting would be an appropriate time to have such a discussion.

The Fed minutes underscored the hawkishness at the Fed today as well. Participants judged prices may take longer to ease and some participants said faster taper could be warranted.

Germany in a thorn in EZs side

Additionally, playing into the hands of the US dollar and weighing on the precious metal, the single currency is under pressure due to newly released covid data in Germany. The reports show that more than 70,000 new coronavirus cases have been reached, by far the biggest one-day increase on record, with some areas yet to report.

This, coupled with economic prints on the day that show German business morale has deteriorated for the fifth month running in November is bound to weigh on the euro. In turn, this could underpin US dollar strength and see the DXY above 97 and underpinned for the foreseeable future.

Mixed outlook for gold

Meanwhile, analysts at TD Securities explained that gold is vulnerable to a deeper consolidation. ''Precious metals prices continue to melt following the Fed Chair's renomination.''

''However, given TD Securities' forecast of slowing growth and inflation next year, market pricing for Fed hikes may ultimately prove too hawkish,'' the analysts added.

Gold technical analysis

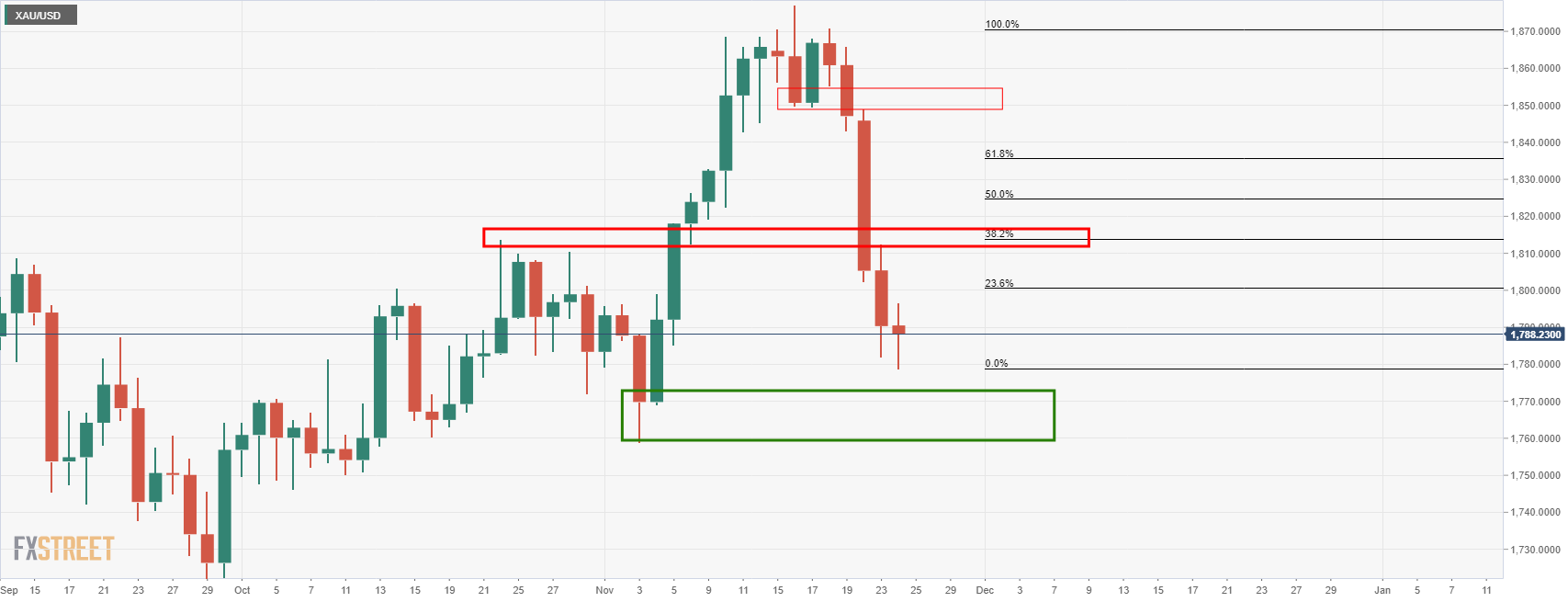

From a daily perspective, gold is in no man's land. The price is stalling but is yet to reach the level of support as illustrated above. However, given the current rejection from the day's lows, there are prospects of consolidation and that could lead to a move higher. Bulls would be looking for a meaningful correction and that brings in the 38.2% Fibonacci retracement near $1,1810. This aligns with old highs for the month of October.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.