- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Looking vulnerable around the FOMC minutes, 0.7170s eyed

AUD/USD Price Analysis: Looking vulnerable around the FOMC minutes, 0.7170s eyed

- AUD/USD is on the verge of a downside continuation towards daily lows.

- DXY has headed for a test of 97 the figure again.

- FOMC minutes are coming up and could be the final catalyst of the week.

The US data dump ahead of the long weekend and Thanksgiving Holidays in North America has seen the US dollar mark fresh 16-month cycles highs on Wednesday. The dollar index DXY has rallied to a high 96.937.

Investors have started to price the prospect that the Federal Reserve will begin hiking rates in mid-2022, in stark contrast to the European Central Bank which is expected to remain more dovish as covid risks loom.

This is what makes today's FOMC minutes critical, albeit they come at a time as US traders will be looking to square positions ahead of the holidays, so it could go either way. Volatility or little trading activity until after the weekend and depending on the outcome.

Fed officials have contributed to the more hawkish view on US interest rates of late as the central bank faces stubbornly high inflation. The minutes will be scrutinised for signs of a faster pace of tapering and sooner timings of lift-off. Anything that points towards this should keep the US dollar underpinned into the close. This leaves high beta currencies, such as the Aussie vulnerable.

The following illustrates the daily lows and the prospects of a drop into here from an hourly perspective:

AUD/USD daily chart

The price is not far off from the prior daily lows in the 0.7170s, just some 15 pips at the time of writing and an hour ahead of the minutes.

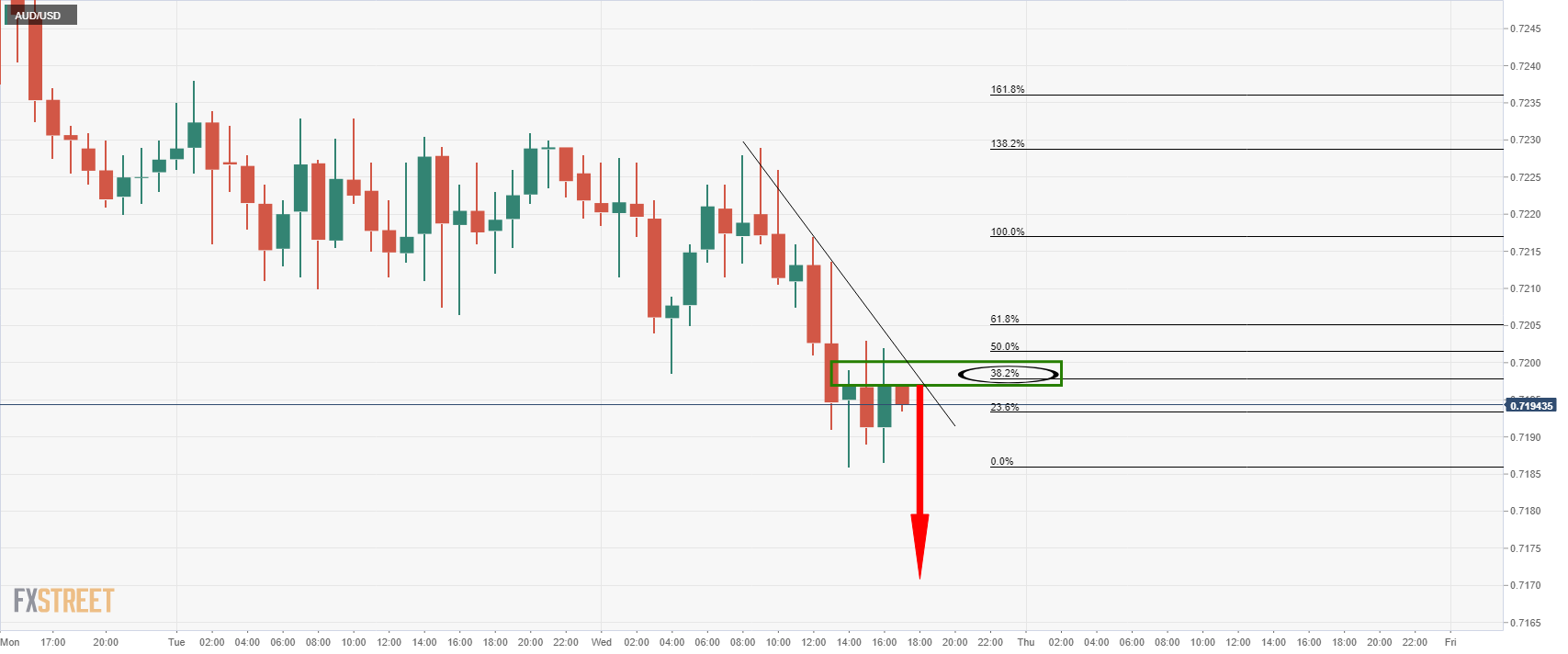

AUD/USD H1 chart

The price has already corrected to a 38.2% Fibonacci retracement level where it meets dynamic resistance and has stalled in the correction. This leaves scope for a downside extension from here.

If the US dollar can squeeze out the last remaining bears on the day and score fresh highs on the minutes into the 97's, then the above scenario in AUD/USD has a high probability of playing out.

DXY M15 chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.