- Analytics

- News and Tools

- Market News

- EUR/USD drops to fresh lows around 1.1220, looks to key data, FOMC

EUR/USD drops to fresh lows around 1.1220, looks to key data, FOMC

- EUR/USD loses the grip and clinches new lows at 1.1220.

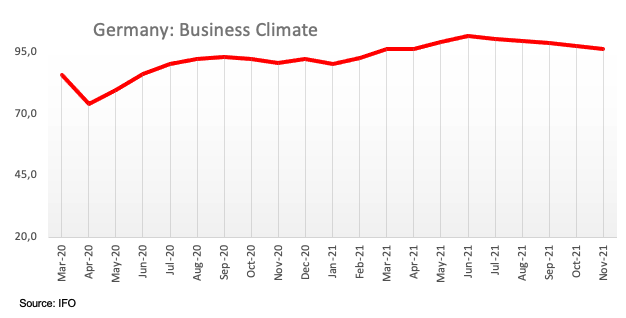

- German Business Climate surprised to the downside in November.

- US PCE, FOMC Minutes take centre stage later in the NA session.

The single currency remains under pressure and depreciates further, motivating EUR/USD to clock new cycle lows around 1.1220 on Wednesday.

EUR/USD looks to domestic, US data and the FOMC Minutes

EUR/USD stays depressed and regains the downside following Tuesday’s moderate advance to levels past 1.1270 on Wednesday. It is worth recalling that above-expectations flash PMIs in the euro area underpinned the daily corrective upside in spot earlier in the week.

The better note in the greenback keeps the pair under scrutiny and close to the area of fresh 16-month lows near 1.1220 recorded on the previous session. Higher US yields, particularly boosted after J.Powell was re-appointed to the Fed, continued to bolster the upside momentum in the dollar, while the persistent Fed-ECB policy divergence adds to the downtrend in spot.

Later in the session, the German Business Climate tracked by the IFO survey is due while the focus of attention is later expected to shift to the US docket, where inflation figures measured by the PCE, usual weekly Claims and the release of the FOMC Minutes are all scheduled.

What to look for around EUR

EUR/USD seems to have found some decent contention near the 1.1200 yardstick so far this week. The pair continues to suffer the ECB-Fed policy divergence, while the sharp increase in COVID-19 cases in Europe also adds to the deteriorated outlook for the single currency in the last part of the year. Also weighing on the pair, the loss of momentum in the economic recovery in the euro area - as per some weakness observed in key fundamentals – is also seen pouring cold water over investors’ optimism on the economic recovery.

Key events in the euro area this week: German IFO (Wednesday) – German GfK Consumer Confidence, German Final Q3 GDP, ECB Accounts, ECB’s Lagarde (Thursday) – ECB’s Lagarde (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Increasing likelihood that elevated inflation could last longer. Pick-up in the political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary on the rule of law. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is losing 0.22% at 1.1223 and faces the next up barrier at 1.1374 (low Nov.18) followed by 1.1464 (weekly high Nov.15) and finally 1.1609 (weekly high Nov.9). On the other hand, a break below 1.1220 (2021 low Nov.24) would target 1.1185 (monthly low Jul.1 2020) en route to 1.1168 (low Jun.19 2020).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.