- Analytics

- News and Tools

- Market News

- Breaking: RBNZ hikes as expected by 25bps, NZD/USD undecided

Breaking: RBNZ hikes as expected by 25bps, NZD/USD undecided

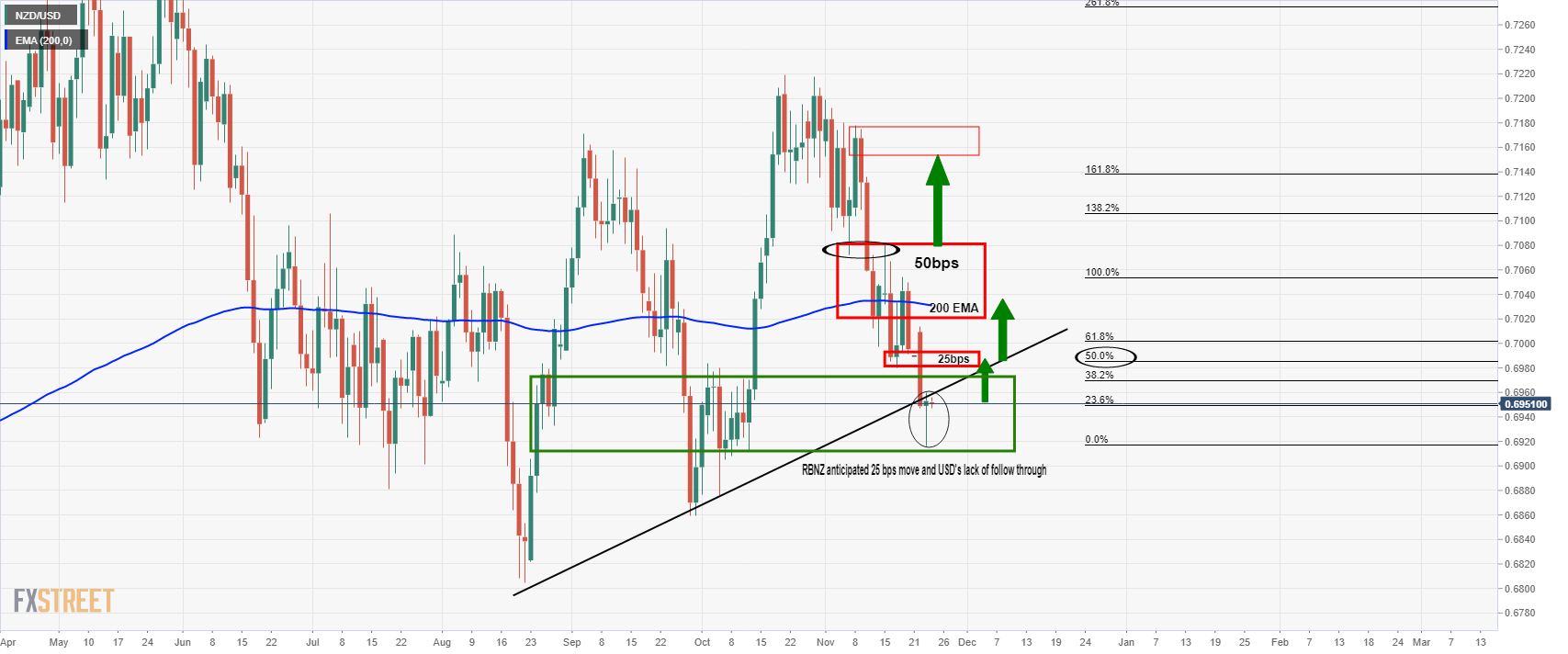

The RBNZ has hiked the OCR by 25bps and sees headline inflation above 5% in the near term with the projections showing the cash rate rising to 2% by end of 2022.

Key takeaways from the statement

The statement also said that it would be appropriate to continue reducing stimulus.

Further removal of monetary stimulus is expected and that committee reached a consensus on the policy decision.

The committee also assessed risks to their price stability and maximum sustainable employment objectives as being broadly balanced over the medium term.

RBNZ projections for the path ahead

- Official cash rate at 0.94% in March 2022 (previously 0.86%).

- This moves to 2.14% in December 2022 (vs the prior 1.62%)

- Then 2.3% in March 2023 (prior 1.77%)

- Then 2.61% in December 2024.

These are not the kind of projections the bulls were hoping for and hence the kiwi is lower. Bulls were looking for rate hikes in the region of clips of between 50 and 25bps towards a 3% target.

However, the RBNZ does see that annual Consumer Price Index at 3.3% by December 2022 (against a prior outlook of 2.2%.

Before the RBNZ statement

However, in the technical preview, it was stated that the downside risks were as follows:

RBNZ dovish outcome

''The risk to the downside comes on a uber hawkish set of Fed minutes coupled with a dovish hike from the RBNZ. A dovish hike could consist of concern over covid contagion, geopolitical risks, the guidance of incremental 25bps hikes, contingent on various factors. All of the above would catch an already heavily long positioning in the kiwi market offside. 0.6950 is a line in the sand in this regard and a break will open risk to a restest of the 0.6880s and then 0.68 the figure.''

After the RBNZ statement

The bird is a touch lower on the 15 min chart, losing 0.15% on the day so far.

Markets now await the press conference for further clues.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.