- Analytics

- News and Tools

- Market News

- AUD/NZD Price Analysis: The big day has arrived for this cross

AUD/NZD Price Analysis: The big day has arrived for this cross

- AUD/NZD outlook into the RBNZ event is bullish on a 25BP hike.

- Traders are fully pricing in a 25bp hike, although 50bp is the biggest risk.

The RBNZ meets today and analysts are overwhelmingly expecting a 25bp hike rather than 50bp. This is where the risk is for the cross. A 50bp increase will see the kiwi fly considering the market has clipped it wings on the basis that a hike has been well telegraphed for a long time

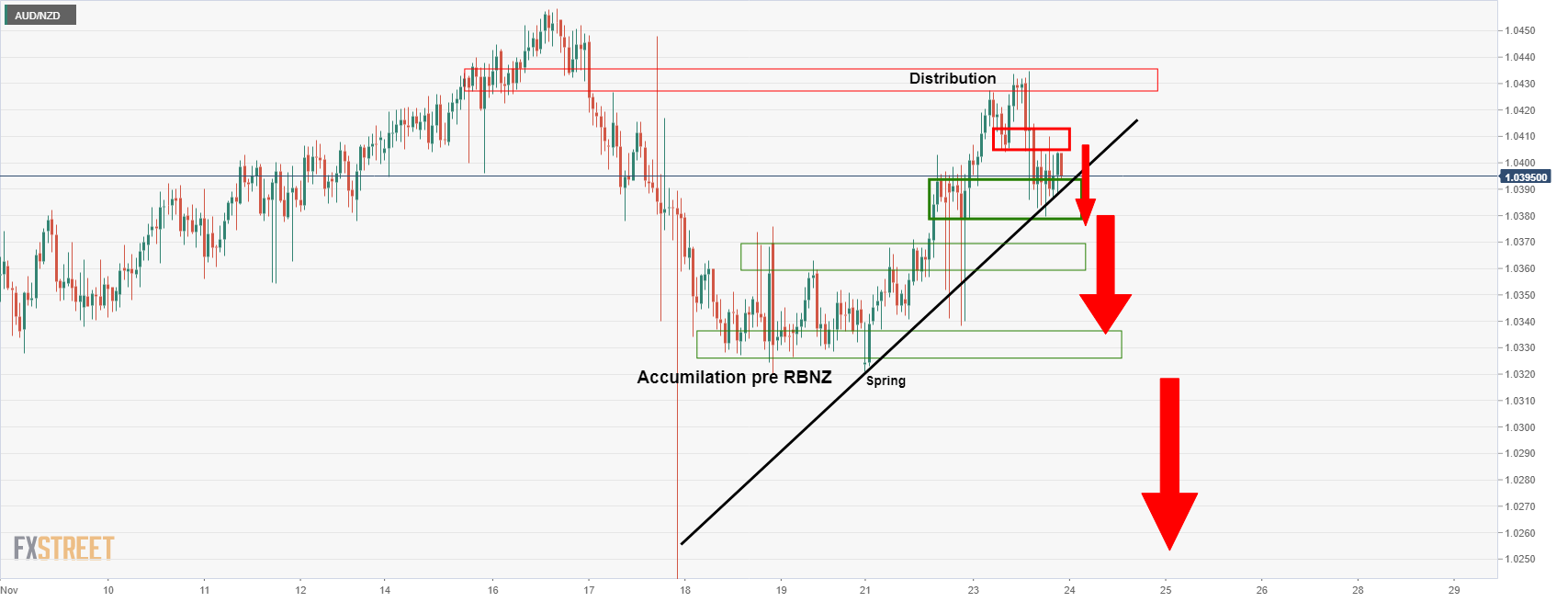

This brings us to the charts:

AUD/NZD daily chart

For the near term, this is the potential outlook for today's main event. Given the market will not be surprised that the RBNZ hikes, a move higher would not be unrealistic, especially as traders factor in the path of central banks in general. The RBNZ’s OCR track will be key in determining how far the kiwi could fall.

If there is a tendency towards an endpoint near 3% but dovish rhetoric, in so much that 25 bp OCR rate hikes will possibly be all we will get from the RBNZ between now and then, this leaves plenty of room for the RBA to catch up. Thus, there could be more value in the Aussie moving forward should a 2023 rate hike remain a possibility if inflation, wages and growth surprise to the upside.

In the event that there is a 50bp hike, there will be the toss-up between how detrimental this might be for the economy vs what this will mean to a market that is already long of NZD. The knee jerk will undoubtedly see a bid in the kiwi, especially as markets are nervous going into the meeting and waiting on the sidelines, waiting to pile in on such an outcome.

AUD/NZD H1 chart

The price would be expected to extend distribution that has started to take place ahead of the meeting. A break of the dynamic support would open the risk of a knee-jerk run on 1.0380 and then 1.0320 stops.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.