- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Bears to target 1.2600 on break of dynamic support

USD/CAD Price Analysis: Bears to target 1.2600 on break of dynamic support

- DXY is lacking momentum on the lower time frames, forming a daily doji on the day.

- The uptrend in USD/CAD is coming under pressure with the price stalling on the bid.

USD/CAD is underperforming as it consolidated the prior three days of consecutive gains. The greenback is stalling on the bid also as measured by the DXY and is starting to form a topping candle. The following top-down analysis illustrates the potential for a significant correction on both the US dollar index and USD/CAD for the coming sessions.

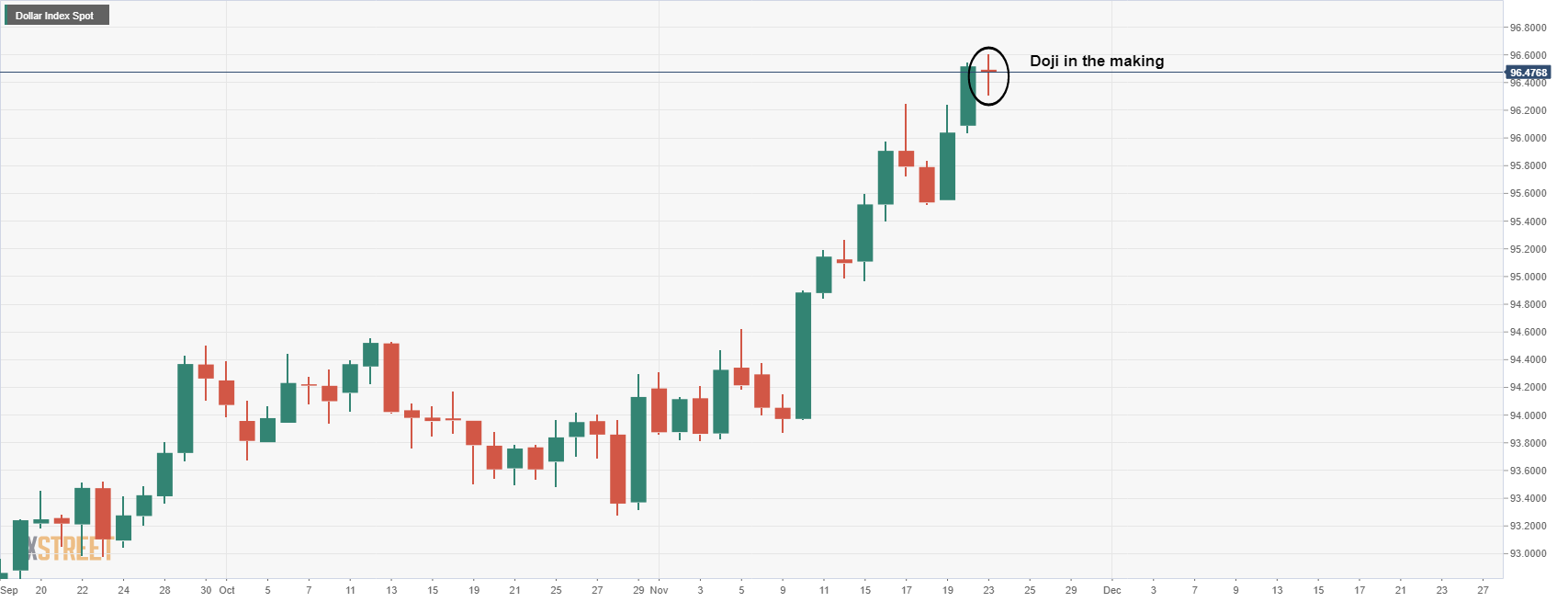

DXY daily chart, spinning top

The spinning top or doji is a topping candle stick formation. However, this will only be confirmed as a high probability topping pattern if the next one to two candles are heavily bearish. The trend is strong in the greenback as per the prior engulfing candles in the series of the daily candles. Therefore, this may just be a pause ahead of the Federal Open Market Committee minutes on Wednesday.

Meanwhile, however, the commodity bloc currencies and high beta yen remain pressured although the Canadian dollar is holding up the best on an hourly basis according to the hourly Currency Strength Index, CSI. This leads to the prospects of a significant correction in USD/CAD as follows:

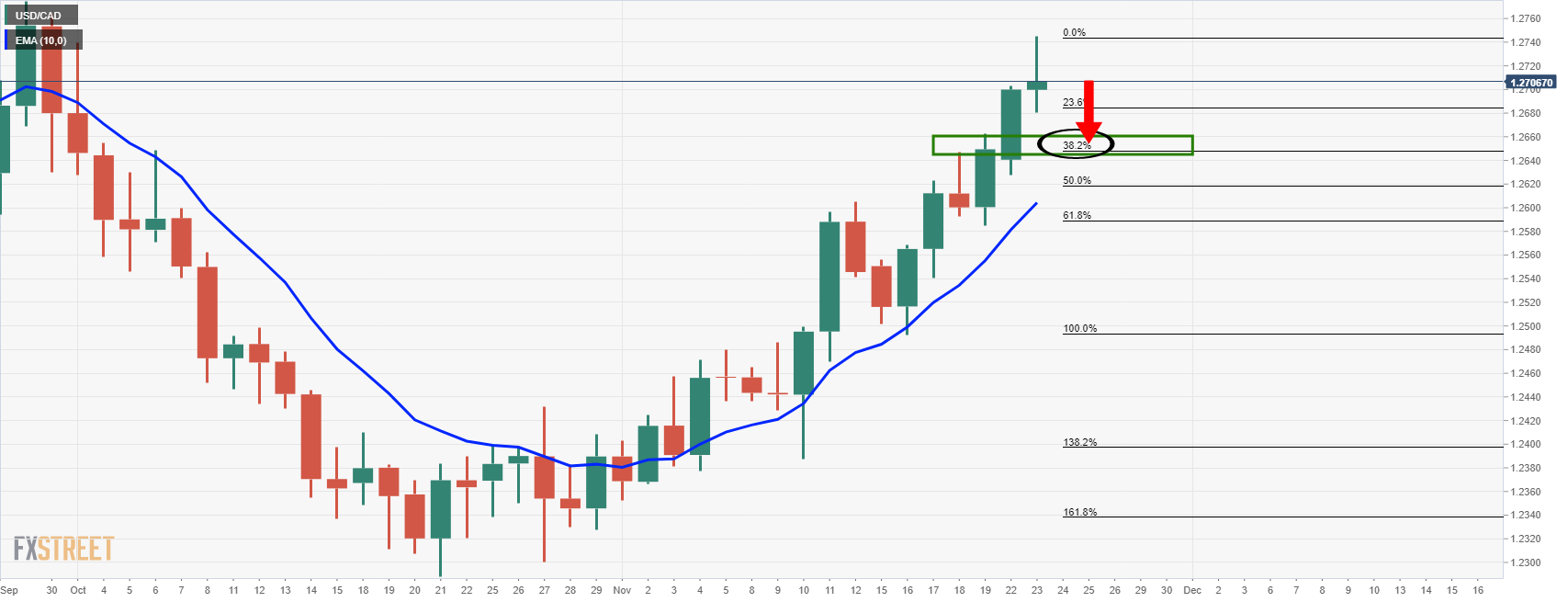

USD/CAD daily chart

From a daily perspective, the price could be on the verge of a 38.2% Fibonacci correction towards 1.2650. From an intraday perspective, traders can look to the hourly chart for confirmation of the downside bias.

USD/CAD H1 charts

Here we can see that the price fell sharply in the New York open. Bulls have failed to commit and the bears are piling in again. The support of 1.2700 is under pressure and a break there will open prospects of a downside continuation towards the daily target.

USD/CAD dynamic support scenario

Looking closer, however, 1.2680 guards a break of the dynamic trendline support. A break of this would equate to prospects of a much deeper correction, potentially all the way to the 200-EMA situated currently near the mid-Nov highs as a target around 100 pips lower at 1.2600 the figure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.