- Analytics

- News and Tools

- Market News

- AUD/USD buckles as RBA Lowe signals no rate rise for 2022

AUD/USD buckles as RBA Lowe signals no rate rise for 2022

- RBA's Lowe gives markets something to think twice about.

- AUD/USD struggles to find demand following Lowe's dovish commentary.

AUD/USD is being pressured as we progress through the Asian session as traders dial back their rate hike bets following comments from the Reserve Bank of Australi's governor, Phillip Lowe. At the time of writing, AUD/USD is giving back some territory around 0.7360 and 0.7368 the high for the day but remains up around 0.20%.

At the start of the session, AUD/USD was perky in the 0.7340s with the US dollar shedding some of the gains it has picked up in the New York session. Along came the RBA minutes. Despite their dovishness, suggesting rate hikes will not come until wages and jobs have met the RBA's target, likey not until 2024, markets moved in contrary to the rhetoric. The Aussie pairs rallied as if the opposite was said in the minutes and rates remained firmly bid with the 2-year jumping towards the highs of 0.488%.

Nevertheless, Lowe has spoken. He has stated that the economy would have to turn out very differently for the board to consider hiking rates next year. Consequently, Aussie pairs are now meeting headwinds.

Key comments from Lowe

Latest data, forecasts do not warrant a rate rise in 2022.

Still plausible first increase in the cash rate will not be before 2024.

Could be case for hike before 2024 if inflation rises faster than expected.

Underlying inflation at 2.5% mid-point would not warrant a rate rise.

Need to see underlying inflation well within 2–3% range, confident it will stay there.

A sharp rise in underlying inflation would have different policy implications to a slow drift up.

Yet to see a broad-based pickup in wages growth in Australia.

Our business liaison suggests most retain a strong cost control mindset.

Energy prices in Australia trending lower due to wind, solar capacity.

Likely global inflation pressures will moderate over next 18 months as demand/supply adjusts.

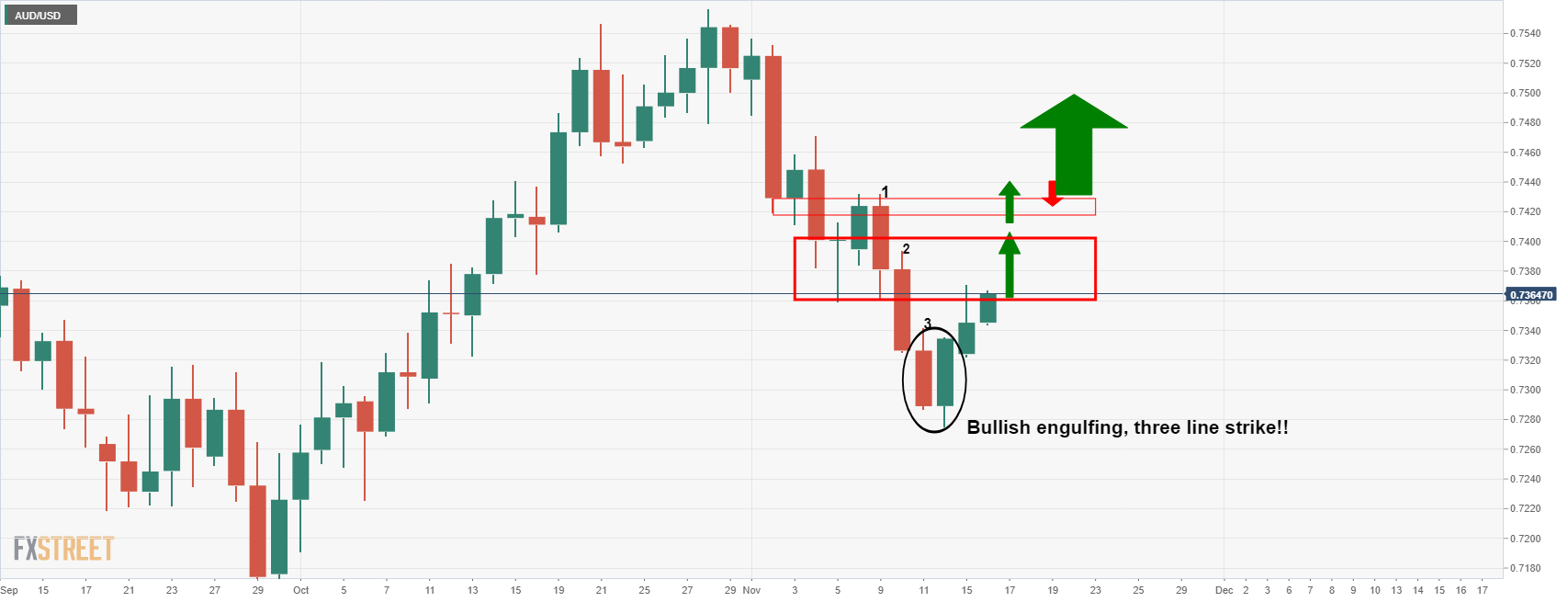

AUD/USD technical analysis

However, as always, there are two sides to the coin. On the one hand, we have a bullish outlook as follows:

On the other hand, we have the bearish:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.