- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bears could be looking to dip the toe in daily resistance

Gold Price Forecast: Bears could be looking to dip the toe in daily resistance

- Gold is holding in a bullish territory in the open.

- Bears are n the lookout for a downside correction for the days ahead.

- XAU/USD capitalizes on inflation fears, buyers look to retain control.

The US dollar was mixed against the G10 Friday and gold recorded its biggest weekly gain in more than six months, following last week's inflation report in the US. XAU/USD rallied to $1,868 as the greenback fell from its 95.265 highs on the back of concerns among consumers. The November University of Michigan Consumer Sentiment survey surprised with a slump to a 10-year low as consumers fret over rising prices.

The spectre of higher entrenched inflation saw investor demand surge and the breakout in the yellow has also attracted new buyers as global markets search for inflation hedges. The sentiment is likely to stick around for the foreseeable future. the Bureau of Labor Statistics announced that consumer prices in the United States rose 6.2% over the past year. However, this is not a uniquely US phenomenon.

Eurostat, the statistical agency of the European Union, has released a flash estimate for annual inflation in the euro area and like the US report, this estimate showed inflation surging beyond what has been considered the norm. The data has come in at 4.1% in a preliminary estimate based on incomplete data. While it was considerably lower than the US rate. In fact, the world's four largest economies - the US (highest in 30 years), China, Japan (highest in more than 40-years) and Germany - have all reported record inflation numbers for October. Economists, politicians, Central Bank leaders had been insisting that the current inflation is temporary, but the markets think now, and that is bullish for gold.

One of the worst inflation calls ever by the Fed

We have already started to see policymakers back off from the transitory mantra but there is still a lot of work to do on the labour recovery, so there needs to be a fine balance in the communication in the past pandemic recovery. However, there are economists out there who are far more concerned. Mohamed El-Erian, for instance, a chief economic adviser at Allianz SE, says this will go down in history as one of the worst inflation calls ever by the Federal Reserve. He doesn't think inflation will come down anytime soon and the concern is that the time between ending the paper and interest rate hikes is not going to be significant and that they will have to raise rates much faster, tapping on the breaks at the wrong time. In this regard, for the week ahead, the bond markets and US yields are going to matter for the gold price.

Gold technical analysis

-

Gold Chart of the Week: More to come from the bulls for the week ahead?

The above link is a contrarian view of the current trajectory of the price in anticipation of a healthy bearish correction.

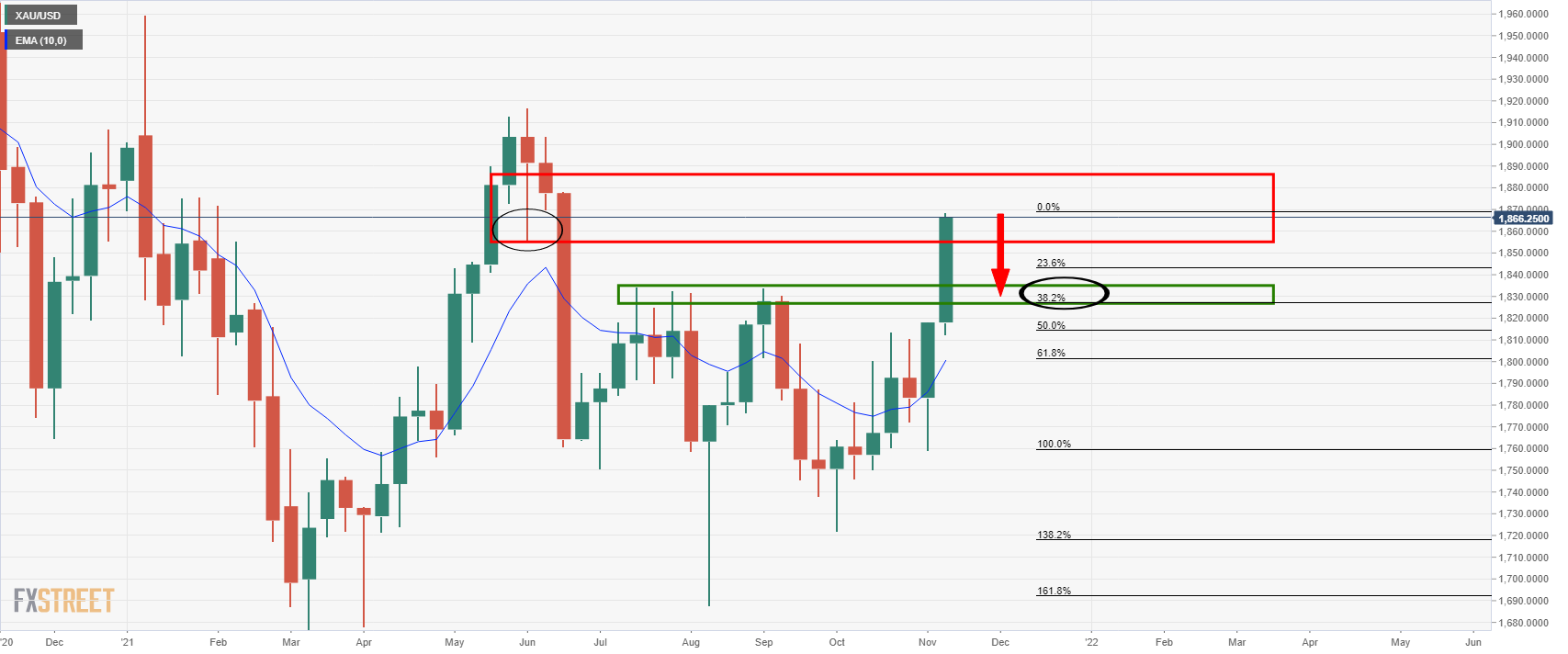

In this daily chart, it is illustrated that the price is reaching a critical level of resistance and a pullback could be expected towards the prior daily highs where a 38.2% Fibonacci retracement can be found near the $1,830s.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.