- Analytics

- News and Tools

- Market News

- US Dollar Index prints new 2021 high at 95.00

US Dollar Index prints new 2021 high at 95.00

- DXY adds small gains and records new YTD peaks.

- US multi-decade high inflation remains in centre stage.

- US bonds market will be closed on Thursday.

The greenback, when gauged by the US Dollar Index (DXY), extends the recent sharp advance and clinches new cycle highs around 95.00 on Thursday.

US Dollar Index boosted by higher CPI

The index continues to digest Wednesday’s sharp advance and moves to fresh tops around the 95.00 area, where some initial resistance seems to have turned up for the time being.

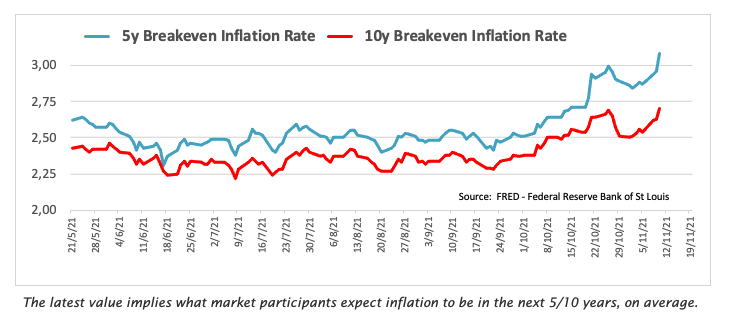

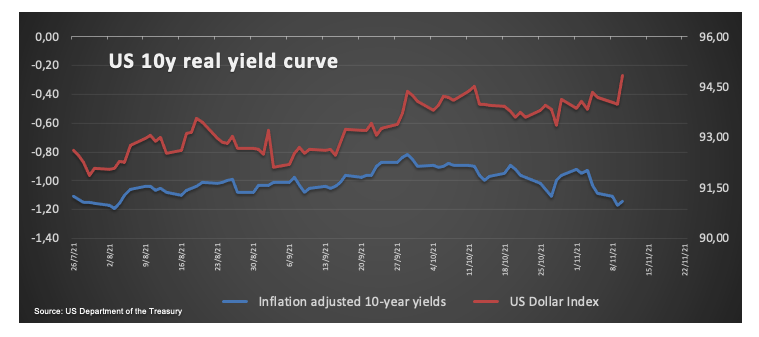

The post-CPI jump in the dollar was sustained by the rebound in US yields along the curve and the moderate corrective upside in TIPS break-evens. It is worth recalling that US headline CPI rose to a 30-year high at 6.2% in October vs. the same month of 2020, while consumer prices excluding food and energy costs (Core CPI) advanced at an annualized 4.6%.

Of course, speculations of a potential move by the Federal Reserve on the Fed Funds Rates earlier than anticipated have already kicked in and emerge as another driver sustaining the upside momentum in the buck.

There are no data releases in the US data space, while the US debt market will also be closed due to the Veterans Day holiday.

What to look for around USD

The index jumped to new cycle highs around the 95.00 level, area last visited in the summer of the coronavirus pandemic. The sudden change of heart in the dollar remains underpinned by rising yields and the firmer perception that the elevated inflation will be among us longer than anticipated, all this morphing into already rising speculations of probable interest rate hikes as soon as in 2022.

Key events in the US this week: Flash November Consumer Sentiment (Friday).

Eminent issues on the back boiler: US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. Debt ceiling debate. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is gaining 0.12% at 94.98 and a break above 95.00 (2021 high Nov.11) would open the door to 95.71 (monthly low Jun.10 2020) and then 97.80 (high Jun.30 2020). On the flip side, the next down barrier emerges at 93.87 (weekly low November 9) seconded by 93.53 (55-day SMA) and finally 93.27 (monthly low October 28).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.