- Analytics

- News and Tools

- Market News

- EUR/USD comes under pressure near 1.1560

EUR/USD comes under pressure near 1.1560

- EUR/USD loses momentum and recedes to the 1.1560 region.

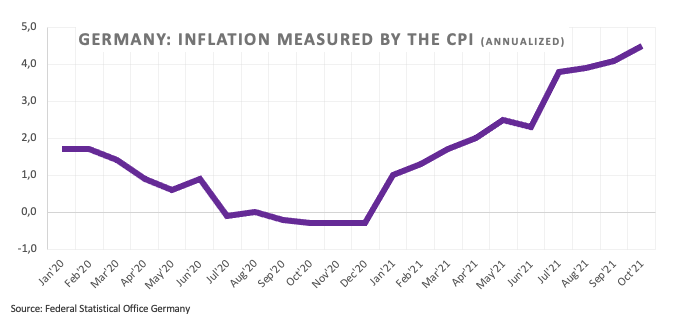

- German October final CPI came at 0.5% MoM, 4.5% YoY.

- US inflation figures take centre stage later in the NA session.

The single currency leaves behind the recent upside and prompts EUR/USD to drop to 2-day lows near 1.1560 on Wednesday.

EUR/USD now looks to the US docket

EUR/USD trades on the defensive for the first time after three consecutive daily advances, faltering once again in the 1.1600 neighbourhood as bullish attempts lack conviction for the time being.

The greenback, in the meantime, manages to regain some upside traction on the back of the improvement in US yield across the curve, partially reversing at the same time the recent moderate decline.

In the data space, earlier results showed the final October inflation figures in Germany, where the CPI rose 0.5% MoM and 4.5% vs. October 2020.

Still around inflation, market participants are expected to closely follow the release of US inflation figures measured by the CPI and the Core CPI for the month of October and due later in the NA session. In addition, the usual weekly Claims are due as well as Wholesale Inventories figures.

What to look for around EUR

Gains in EUR/USD remains so far limited by levels just past 1.1600 the figure. In the meantime, spot continues to look to the risk appetite trends for direction as well as dollar dynamics, while the loss of momentum in the economic recovery in the region - as per some weakness observed in key fundamentals - is also seen pouring cold water over investors’ optimism and tempering bullish attempts in the European currency. Further out, the single currency should remain under scrutiny amidst the implicit debate between investors’ expectations of a probable lift-off sooner than anticipated and the ECB’s so far steady hand, all amidst the persevering elevated inflation in the region and prospects that it could extend further than previously estimated.

Key events in the euro area this week: German final CPI (Wednesday) - EMU Industrial Production (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Sustainability of the pick-up in inflation figures. Pick-up in the political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary on the rule of law. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is down 0.21% at 1.1568 and faces the next up barrier at 1.1616 (monthly high Nov.4) followed by 1.1675 (55-day SMA) and finally 1.1692 (monthly high Oct.28). On the other hand, a break below 1.1513 (2021 low Nov.5) would target 1.1495 (monthly high Mar.9 2020) en route to 1.1422 (monthly high Jun.10 2020).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.