- Analytics

- News and Tools

- Market News

- AUD/USD meanders close to 0.7400 ahead of US inflation, Fed speak, Aussie jobs

AUD/USD meanders close to 0.7400 ahead of US inflation, Fed speak, Aussie jobs

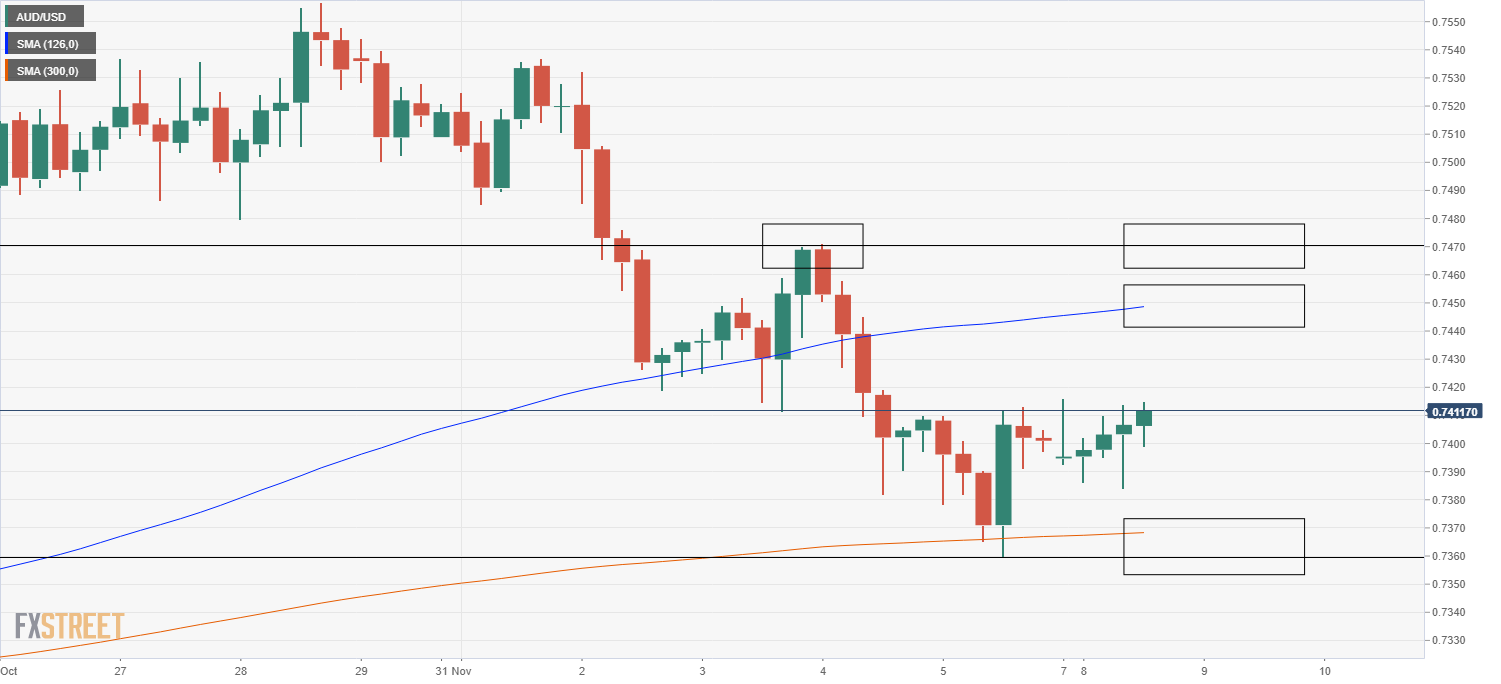

AUD/USD continues to meander close to the 0.7400 level, a level around which is has gently pivoted since the US dollar weakened in response to last Friday’s US labour market report (despite that report being stronger than expected across most metrics). In recent trade, it has pushed to fresh daily highs just above 0.7410, but isn't showing much conviction as of yet. The key levels that technicians will be watching this week are the 50-day moving average (DMA) at 0.7445 and last Wednesday’s high at 0.7470 to the upside and the 21DMA and last week’s low in the 0.7360 region to the downside. Chinese trade data overnight was mixed; exports beat expectations, but imports missed and, thus, given that China is a big export destination for Australian goods, this is a net negative for AUD. Analysts read the weaker than expected import data as further signs that Chinese growth momentum continues to weaken.

This Week

Last week was a hectic one, with the RBA and Fed both deciding on monetary policy and the end result being a sharp fall for the pair as a dovish RBA Governor Philip Lowe pushed back more aggressively against market pricing for rate hikes in 2022 than his Fed counterpart Jerome Powell. In the absence of key central bank events and the US labour market report, this week should be a calmer affair, though there are plenty of Fed policymakers speaking publically this (including a number throughout Monday’s US session) and US inflation data is set for release on Tuesday (the Producer Price Inflation report) and Wednesday (the Consumer Price Inflation report).

Meanwhile, Thursday sees the release of both Australian and US jobs data; the former is the official labour market report for Australia for the month of October and is expected to show employment rising modestly as lockdowns were eased, while the latter is the US September JOLTs report, which should show that labour demand in the US remains incredibly strong. Ahead of Aussie jobs on Thursday, the release of the NAB October Business Confidence survey during Tuesday’s Asia Pacific session and then the release of the Westpac Consumer Confidence survey during Wednesday’s APac session may trigger some AUD volatility.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.