- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bears moving on for the kill ahead of NFP

Gold Price Forecast: Bears moving on for the kill ahead of NFP

- Gold is on the defensive from a critical level of resistance on the daily chart.

- All eyes will now turn to the US jobs market as the US dollar seeks to regain its title on the forex leader board.

The price of gold was ending the day higher by 1.25% after travelling from a low of $1,769.64 to a high of $1,798.95 despite a front footed greenback as investors bought the post-Federal Reserve USD dip. The greenback recovered some 0.5% on Thursday as measured by the US dollar index, the DXY. The index rallied from a low of 93.825 to a high of 94.473.

The US dollar rebounded on Thursday from a dip after the US Federal Reserve repeated it saw high inflation as transitory and announced on Wednesday a $15 billion monthly cut to its $120 billion in monthly purchases of Treasuries and mortgage-backed securities. The knife was later buried when Chairman Jerome Powell said he was in no rush to hike borrowing costs leading to an additional sell-off in the greenback.

However, as fast as traders were to let go of the greenback, they were just as quick to buy back into the prospects of faster timings of a rate hike from the Fed following a series of strong data this week ahead of FrduaysNonfar Payrolls event.

Nonfarm Payrolls in focus

''We expect employment and wage gains to slow in the year ahead as the boosts from fiscal stimulus and reopening fade and the participation rate rises, but, more immediately, momentum appears to be up again as the drag from Delta fades.,'' analysts at TD Securities explained.

''We forecast up 550k in total for payrolls in October, with private payrolls up 600k. We forecast up 0.5% m/m for hourly earnings, with the 12-month change rising to 5.0% from 4.6%.''

The prospects of maximum employment in the comings months should keep the US dollar elevated and real yields less negative as a headwind for the gold price.

However, the analysts at TD Securities also acknowledged that ''the Fed reiterated that its tools cannot help ease the temporary supply constraints that have ultimately driven inflation higher.'' This, they say, is a dovish message ''relative to market expectations for Fed hikes, which still remains far too hawkish, but which may also be distorted by the recent positioning washout across Treasuries.''

''Nonetheless, the yield curve steepening does reflect that market pricing has started to acknowledge that the Fed may let inflation run hot for a bit longer. In this context, while the breadth of traders short positions is not extreme by any means, position sizing is bloated considering the number of participants short, which leaves the hawks vulnerable to a squeeze.''

''Going forward, the market will continue to gauge whether the Fed holds strong enough cards to bluff, which leaves a larger focus on economic data. In this respect, we expect some immediate strength resulting from the fading Delta wave, but that the fiscal drag will turn sufficiently contractionary to delay the prospect of rate hikes.''

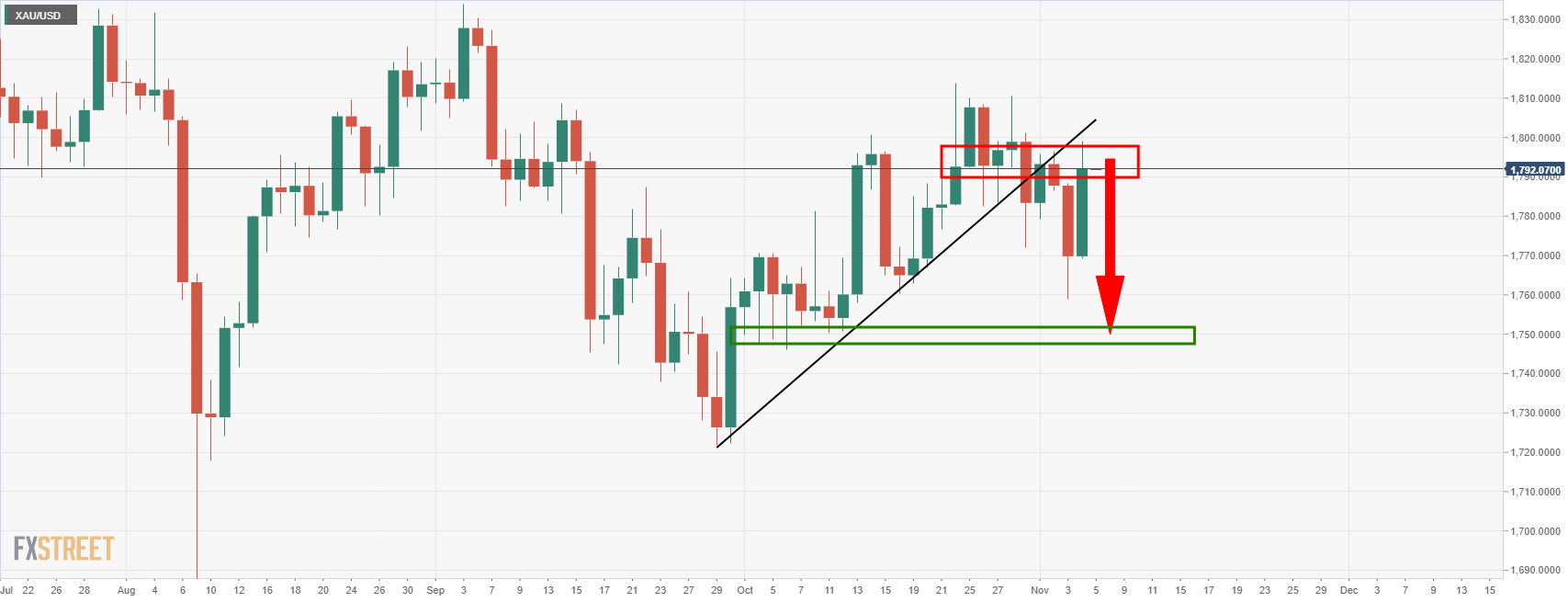

Gold technical analysis

The price is wedged back into a consolidation area on the daily chart and offers little clue as to where the market might be headed next.

However, should the resistance hold, then the path of least resistance is likely to the downside.

meanwhile, from a 4-hour perspective also, the market could well have picked up enough liquidity on the break of the counter trendline and filling buy stops for which could result in a downside move into the $1,750s for the forthcoming session.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.