- Analytics

- News and Tools

- Market News

- EUR/USD bulls come up for their least breath?

EUR/USD bulls come up for their least breath?

- EUR/USD holds within familiar ranges following the Fed taper announcement.

- Fed statement inline with expectations, yet transitory language a touch more hawkish.

- All eyes on Powell's presser, the Fed Dec meeting, US data and how hawkish the ECB will be.

EUR/USD was trading around 1.1600 throughout the Federal Reserve event on Wednesday. The outcome was more or less in line with the market's expectations but the Fed has acknowledged in a tweak in its statement that inflation might not be as transitory as expected.

Nevertheless, the price made a fresh high during the chairman's presser, touching 1.1616 at the time of writing as Powell attempts to dial down inflation risks. The range, so far today, has been between 1.1562 and 1.1616.

Fed statement takeaways

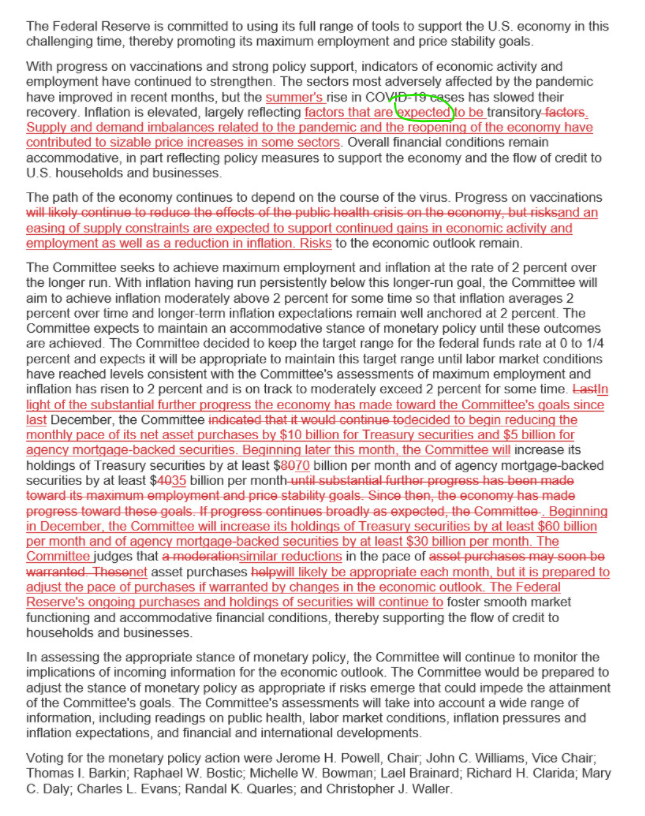

A taper announcement was made, something that was well telegraphed in prior Fed communications. In the statement, it maintained the transitory language but changed the wording, from ''reflecting transitory factors'' to, ''factors that are expected to be transitory'':

- Tapering starting November, with monthly reductions of $15 bln.

- Prepared to adjust taper pace ‘as warranted’.

- Interest rate decision actual: 0.25% vs 0.25% previous; est 0.25%.

Fed's chair, Powell's presser

Powell is emphasising that the US is not at maximum employment and he has tried to water down the market's take on the tweak to the 'transitory' verbiage in the statement. The US dollar was sent on the backfoot following his reasoning but overall, the markets are steady and will very quickly move to a focus on US data with the Nonfarm Payrolls just around the corner.

EUR/USD H1 chart

From a technical standpoint, the downside is still vulnerable so long as the price stays within the confines of recent ranges as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.