- Analytics

- News and Tools

- Market News

- EUR/USD sits tight ahead of the Fed, but bears ready to clean-up

EUR/USD sits tight ahead of the Fed, but bears ready to clean-up

- EUR/USD sits around 1.1580 resistance ahead of the Fed.

- Bears eye 1.1520 demand area and then a break below 1.1500 in coming sessions.

EUR/USD is sitting around 1.1580 ahead of the Federal Reserve interest rate decision at the top of the hour. The pair has changed hands between a low of 1.1562 and a high of 1.1598 so far on Wednesday following a slew of economic positives from the US in the early New York trade.

The greenback has edged higher on Wednesday, holding near recent peaks versus the euro as well as the yen. Traders are in anticipation today of an expected announcement on the unwinding of the Fed's pandemic-era stimulus. If there is going to be any surprises outside of a ''no-taper'', it will be most likely from the Fed's Chairman, Jerome Powell, in topics surrounding inflationary pressures and timings of lift-off. Before he speaks, the Fed's policy statement, which will likely kick-off the tapering of its $120 billion-a-month asset purchase program, is due at 2 p.m. Eastern time (1800 GMT), followed by the news conference with Powell.

What's priced in?

''At this point, the Fed has managed expectations perfectly in terms of preparing the markets for what is likely to be speed tapering,'' analysts at Brown Brothers Harriman. ''Most Fed officials seems to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed. The most likely path for tapering has already been flagged by the Fed, which would reduce asset purchases by $15 bln per month ($10 bln UST and $5 bln MBS) starting this month so that QE effectively ends mid-2022.''

Around tapering, flexibility will be something that markets will respond to as well as timings for rate hike lift-off. Any signal that Powell is open to responding with rate hikes to inflation, if the case for it being transitory keeps weakening, would reinforce the supportive US dollar backdrop.

''We don't expect any definitive new "liftoff" signal, and we expect "elevated" inflation will continue to be seen as "largely reflecting transitory factors," but the chair will likely emphasize how tapering will lead to flexibility in responding if the economy evolves in a way that deviates significantly from expectations,'' analysts at TD Securities explained.

ECB dials down hawkish sentiment

The Fed announcement follows meetings of the Reserve Bank of Australia on Tuesday and the ECB last Wednesday, both of which pushed back against market pricing of tighter policy. European Central Bank Christine Lagarde said an interest rate rise in 2022 was very unlikely because inflation was too low, sending government bond yields lower. But the euro barely budged.

She noted that “In our forward guidance on interest rates, we have clearly articulated the three conditions that need to be satisfied before rates will start to rise. Despite the current inflation surge, the outlook for inflation over the medium term remains subdued, and thus these three conditions are very unlikely to be satisfied next year.”

Of note, the swaps market is pricing in 7 bp of tightening over the next twelve months, down from 11 bp yesterday and over 20 bp right after Thursday’s decision. As such, Lagarde’s efforts seem to be working.

EUR/USD technical analysis

While the macro side of the trade is somewhat uncertain with respect to how markets will respond to the semi-unknown, the technical picture for EUR/USD is more heavily tilted to the downside as follows:

EUR/USD Price Analysis: Bears seeking a break below 1.15 the figure

As per the prior analysis above, the price action has followed suit:

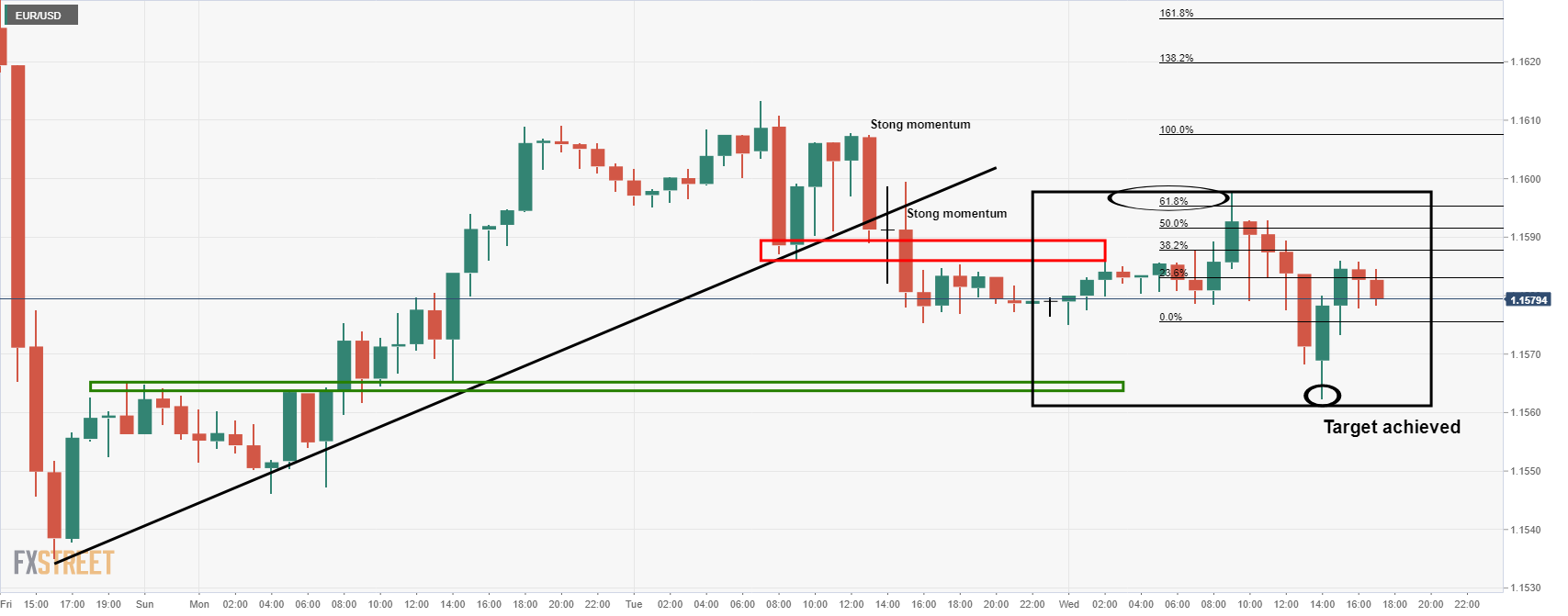

EUR/USD prior analysis, H1 chart

EUR/USD live market update

The price picked up some extra liquidity in a touch of the 61.8% Fibo prior to reaching the target as illustrated above.

However, the bears may not be done yet and a break of 1.15 the figure is still very much to play for. Ahead of the Fed, where we could expect some price swings, either way, the hourly chart is still offering prospects of a downside continuation as follows:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.