- Analytics

- News and Tools

- Market News

- EUR/USD regains traction and re-visits the 1.1640 area

EUR/USD regains traction and re-visits the 1.1640 area

- EUR/USD fades Thursday’s downtick and regains the 1.1640 zone.

- The greenback resumes the downside on the back of lower yields.

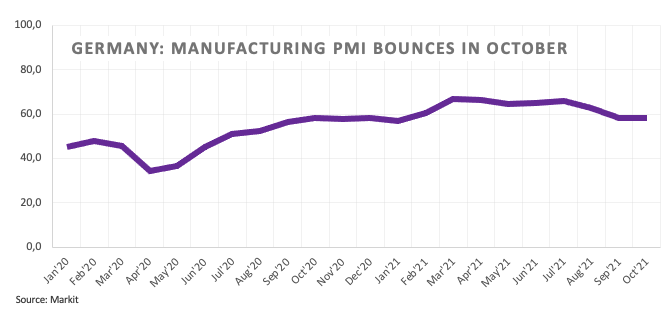

- EMU, Germany flash Manufacturing PMIs surprised to the upside.

The single currency quickly leaves behind Thursday’s downtick and motivates EUR/USD to retake the 1.1640 region at the end of the week.

EUR/USD propped up by data

EUR/USD regains upside traction and returns to the 1.1650 zone on Friday on the back of the resumption of the selling pressure in the greenback and the upbeat tone in the broad risk-linked universe.

In fact, lower US yields weigh once again on the buck and forces the US Dollar Index (DXY) to fade the bullish intentions recorded during the previous session.

Also supporting the firm note in the pair emerges the better-than-expected preliminary readings for the Manufacturing PMI in both Germany and the broader Euroland for the current month.

Data wise across the pond, Markit will publish the flash PMIs also for the month of October.

What to look for around EUR

EUR/USD advanced further and clinched fresh October peaks near 1.1670 earlier in the week. While the improvement in the sentiment surrounding the risk complex lent extra wings to the par, price action is expected to keep looking to dollar dynamics for the time being, where tapering chatter remains well in centre stage. In the meantime, the idea that elevated inflation could last longer coupled with the loss of momentum in the economic recovery in the region, as per some weakness observed in key fundamentals, are seen pouring cold water over investors’ optimism as well as bullish attempts in the European currency.

Key events in the euro area this week: Preliminary PMIs in the euro zone (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the region. Sustainability of the pick-up in inflation figures. Probable political effervescence around the EU Recovery Fund in light of the rising conflict between the EU, Poland and Hungary. ECB tapering speculations.

EUR/USD levels to watch

So far, spot is gaining 0.13% at 1.1638 and faces the next up barrier at 1.1669 (monthly high Oct.19) followed by 1.1709 (55-day SMA) and finally 1.1755 (weekly high Sep.22). On the other hand, a break below 1.1602 (20-day SMA) would target 1.1571 (low Oct.18) en route to 1.1524 (2021 low Oct.12).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.