- Analytics

- News and Tools

- Market News

- Silver bulls face a wall of resistance

Silver bulls face a wall of resistance

- Silver bulls are in control but are facing a wall of resistance.

- The US dollar is moving into support near 93.50 and yields could pick up as a headwind for precious metals.

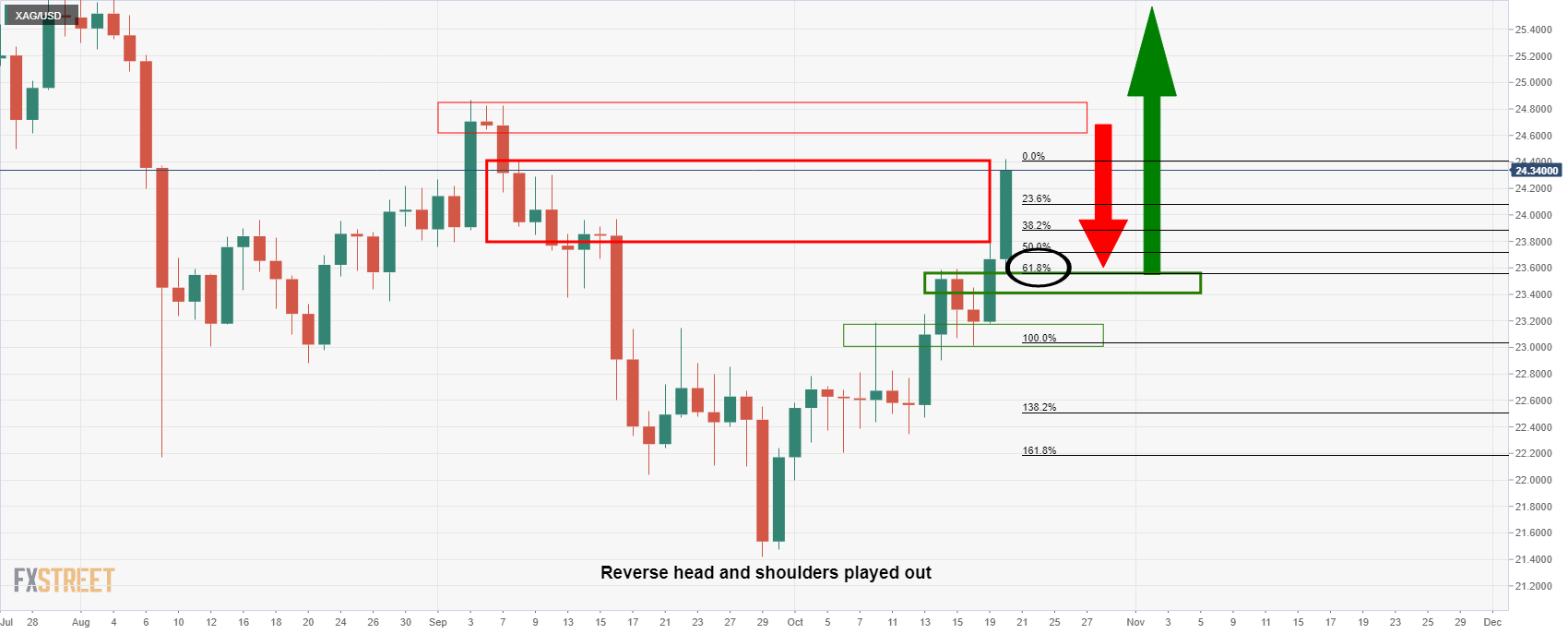

Silver has continued with its northerly projection, testing deeper into daily resistance territory. At the time of writing, XAG/USD is trading 2.8% higher on the day so far and has travelled from a low of $23.57 to a high of $24.42. Meanwhile, the greenback has suffered a sell-off from 93.879 to a low of 93.541 as measured against a basket of currencies in the DXY index.

Also boosting precious metals, US benchmark 10-year Treasury yields pulled back after hitting a five-month peak earlier in the session. The 10-year yield fell from a high of 1.673% to a low of 1.621%. However, they are now steadied and could be on the verge of another surge to the upside from a technical perspective as the yield spikes from the 21-50 hour SMMA cloud and building demand at counter-trendline support following a break of the hourly flag resistance:

Should the US yields break higher and take the US dollar for a ride to the upside as well, this could prove a major headwind for silver for the end of the week's sessions, as illustrated below in the technical analysis. Meanwhile, investors are starting to consider where the Federal Reserve is reacting too little too late to the threat of inflation.

In the global supply crunch, inflation issues make precious metals attractive as a hedge. However, analysts at TD Securities have argued that the ''market pricing for Fed hikes remains far too hawkish, as it fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response.''

''The market is increasingly pricing in a policy mistake which is unlikely to take place, considering that central banks are likely to look past these disruptions as their reaction functions have been historically more correlated to growth than inflation,'' the analysts said.

Silver technical analysis

The price of silver has rallied into resistance and a pullback to restest the old resistance as new support could be expected at this juncture, especially o the US dollar bounces back into action. There is a 61.8% Fibonacci retracement level that aligns with the old resistance anear 23.60.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.