- Analytics

- News and Tools

- Market News

- NZD/USD takes breather from parabolic rally, but plenty to be bullish for

NZD/USD takes breather from parabolic rally, but plenty to be bullish for

- NZD/USD bulls are moving in on critical hourly resistance.

- There are bullish fundamentals at play, but the rally is overextended, relative to historic price action.

NZD/USD has fallen from the highs of the experiential rally that .started on Oct 13 as the greenback started to tail off before the more recent catalyst in New Zealand's inflation data. At the time of writing, NZD/USD is trading at 0.7150 and flat ahead of the Tokyo open and fix that could kick start some price action in Asia today.

''The Kiwi is around 80bps higher than it was 24hrs ago, having benefited from a combination of USD weakness and its own credentials, with good performance seen on most crosses,'' analysts at ANZ Bank noted.

Earlier in the week, New Zealand's Consumer Price Index (CPI) was reported to have risen 2.2% in the third quarter, beating expectations and surging at the fastest pace in over a decade driven by housing-related costs and other supply constraints, data released on Monday showed.

Statistics New Zealand said in a statement. CPI rose 2.2% in the quarter ending September from a rise of 1.3% in the second quarter, the biggest quarterly movement since a 2.3% rise in the December 2010 quarter. Annual inflation surged 4.9% compared to a rise of 3.3% in the previous quarter, also the biggest annual movement in more than a decade.

The data beat analysts' expectations in a Reuters poll and forecasts of the Reserve Bank of New Zealand (RBNZ), both of which put the quarterly inflation rise at 1.4%, lifting annual inflation to 4.1%.

''While the reaction seems delayed and had been haphazard, the sharp move higher in short-end interest rates looks to now be impacting. Yesterday we changed our OCR call; we now expect six more hikes – one at each meeting between now and August, taking the OCR to 2%,'' analysts at ANZ Bank said, adding:

''Perhaps more importantly, we have also lifted our inflation forecasts. In an environment of still well-anchored inflation expectations, that speaks to the RBNZ being ahead of the pack and cyclically higher rates, which should benefit the NZD.''

NZD/USD technical analysis

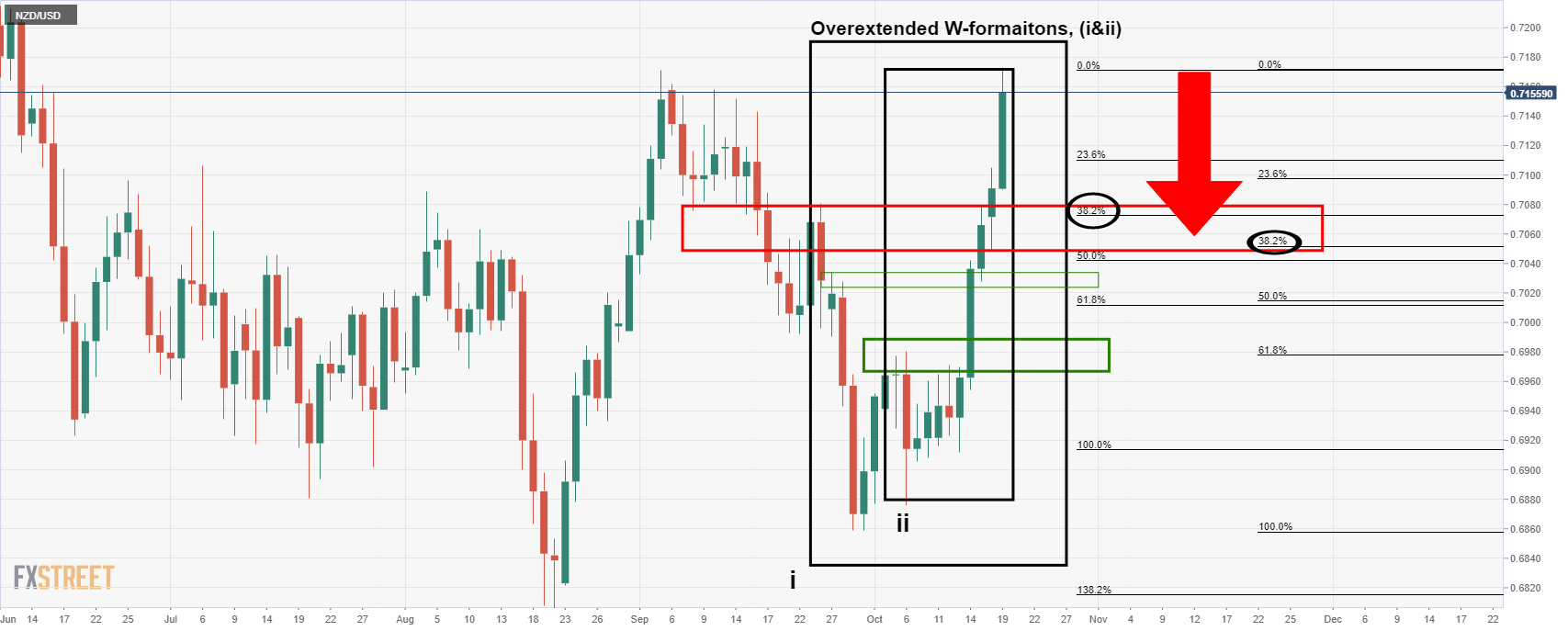

- NZD/USD Price Analysis: Countertrend traders to eye 0.7050

''The 38.2% Fibonacci channel between Wi and Wii offers a target area between 0.7080 and 0.7050 as the closest round numbers, the latter being aligned to the weekly counter trendline.''

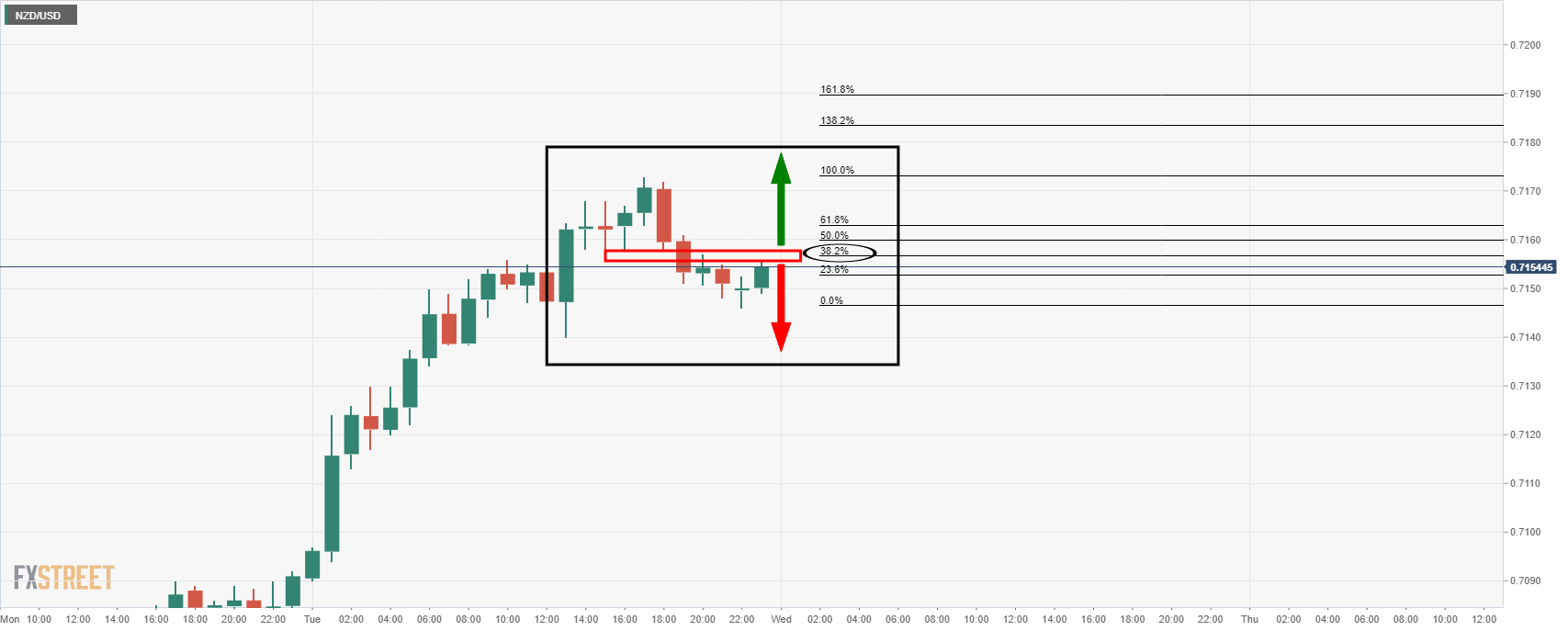

From an hourly perspective, however, the price is moving in on the M-formation as follows:

The price is making a 38.2% retracement to the neckline that would be expected to hold. This could lead to a downside 1-hour bearish impulse in the sessions ahead. If it breaks the neckline, then there will be prospects of some consolidation and a potential upside continuation from the newly formed bullish structure in coming sessions.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.